Oracle

Share

Oracles are essential infrastructure components that feed real-time, off-chain data (such as price feeds, weather, or sports results) into blockchain smart contracts. Without decentralized oracles like Chainlink and Pyth, DeFi could not function. In 2026, oracles have evolved to support verifiable randomness and cross-chain data synchronization. This tag covers the technical evolution of data availability, tamper-proof price feeds, and the critical role oracles play in ensuring the deterministic execution of complex decentralized applications.

5189 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Who Starts Where In Baku

Author: BitcoinEthereumNews

2025/09/21

Share

Recommended by active authors

Latest Articles

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

2026/02/06 17:24

The $1 Billion Liquidation: Bitcoin’s Brutal Moves

2026/02/06 17:18

PA Daily News | Bitcoin plunges 15.48% in a single day, marking the largest drop since the FTX crash; MSTR reports a net loss of $12.4 billion in Q4 2025.

2026/02/06 17:15

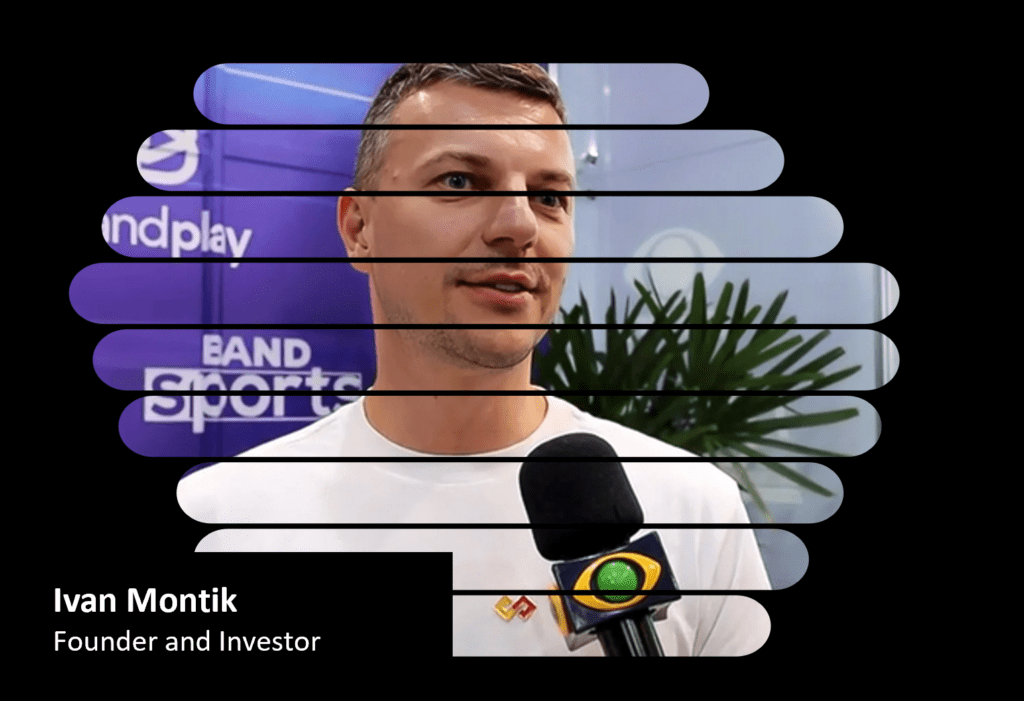

THE WIRECARD SMOKING GUN: SoftSwiss Founder Ivan Montik Unmasked in Munich Court as Judge Flattens PSP Denials

2026/02/06 17:04

What Triggered the Latest Bitcoin and Altcoin Crash?

2026/02/06 16:45