CEX

Share

CEXs are platforms managed by centralized organizations that facilitate the trading of cryptocurrencies, offering high liquidity and user-friendly fiat on-ramps. Leaders like Binance, OKX, and Coinbase serve as the primary gateways for institutional and retail entry. In 2026, the industry focus is on Proof of Reserves (PoR), enhanced regulatory compliance, and hybrid models that offer self-custody options. This tag provides updates on exchange security, listings, and global market trends.

4213 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

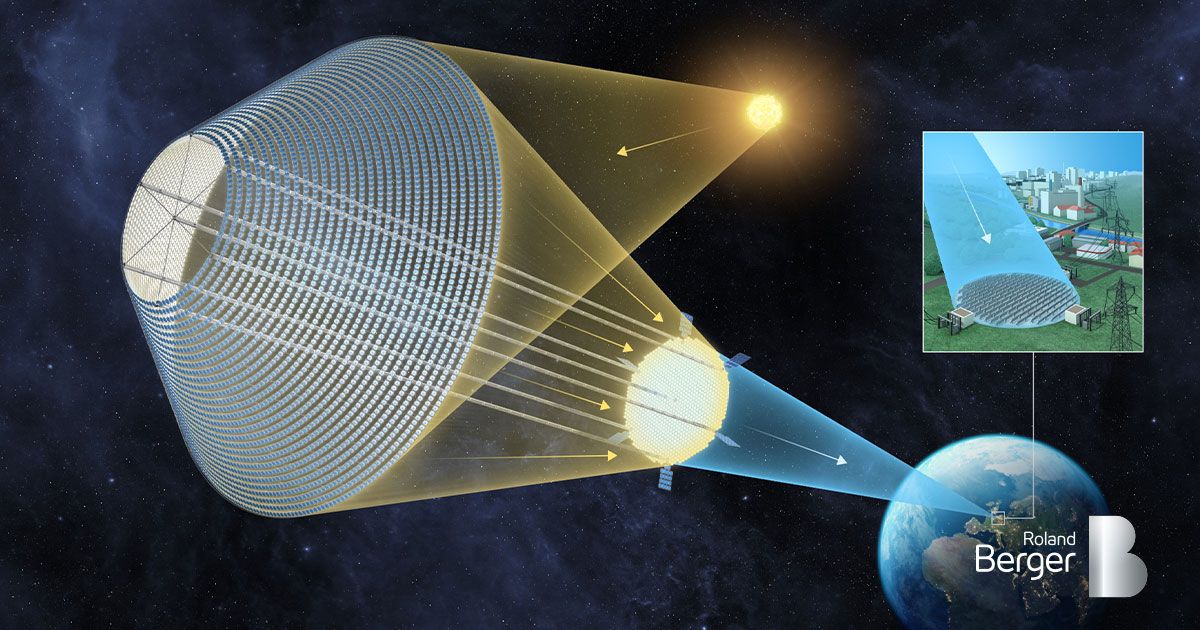

What If Your Electricity Came from Space?

Author: Hackernoon

2025/10/06

Share

Recommended by active authors

Latest Articles

Trump’s 'desperate' push to rename landmarks for himself is a 'growing problem': analysis

2026/02/07 05:30

Volatility to stay high on flows – MUFG

2026/02/07 05:29

US Stocks Close Higher in Stunning Rally: Major Indices Surge Over 1.9%

2026/02/07 05:25

Viyou.ai: Create Stunning AI Videos, Images, and Viral Content with Unlimited Freedom

2026/02/07 05:14

XRP Price Prediction: XRP Holds $1.25–$1.35 Demand While $2.00 Reclaim Remains the Trend Trigger

2026/02/07 04:10