Can SOL Price Recover Despite a 55% Q4 Correction?

The post Can SOL Price Recover Despite a 55% Q4 Correction? appeared first on Coinpedia Fintech News

The SOL price is currently navigating a high-stakes phase in late 2025 as strong on-chain fundamentals strictly collide with bearish market sentiment. While Solana continues to dominate usage metrics and attract institutional activity, its price action reflects broader macro caution rather than network weakness.

SOL Price and Solana’s On-Chain Performance Remain Robust

From a network perspective, Solana crypto continues to demonstrate exceptional performance. Over the past 90 days, Solana’s throughput has consistently hovered near 1,000 transactions per second, highlighting the chain’s ability to handle real-world scale.

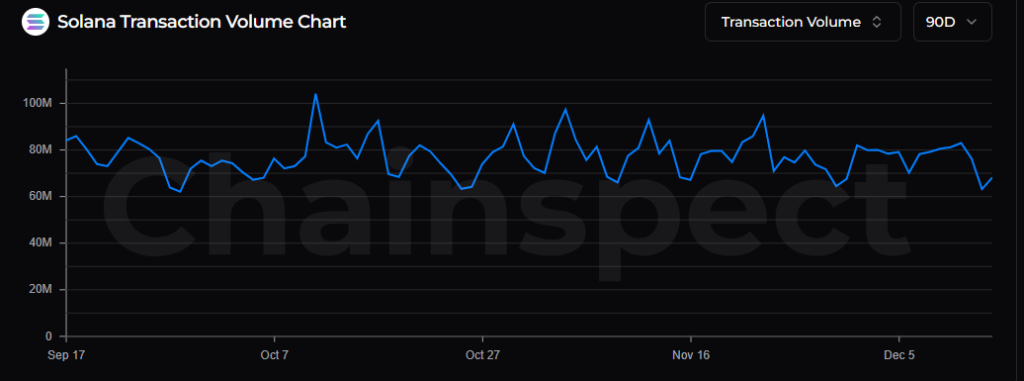

At the same time, daily transaction volumes fluctuating around 80 million indicate stable and sustained usage rather than speculative spikes.

This consistency reinforces Solana crypto’s positioning as one of the most actively used blockchains in the industry.

In fact, commentary from ecosystem president Lily Liu suggests that Solana has processed more activity throughout 2025 than the rest of crypto combined, by a wide margin. These metrics underscore why the SOL price is often evaluated differently from smaller networks.

Institutional Adoption Strengthens the SOL Price Narrative

Beyond raw activity, institutional interest continues to build. Recently, a JP Morgan tokenized a bond on Solana, marking another step toward real-world financial adoption. Also, strengthening Solana’s credibility as an institutional-grade settlement layer rather than a purely retail-driven chain.

Similarly, ETF inflows linked to Solana have continued to rise, signaling growing acceptance from traditional capital.

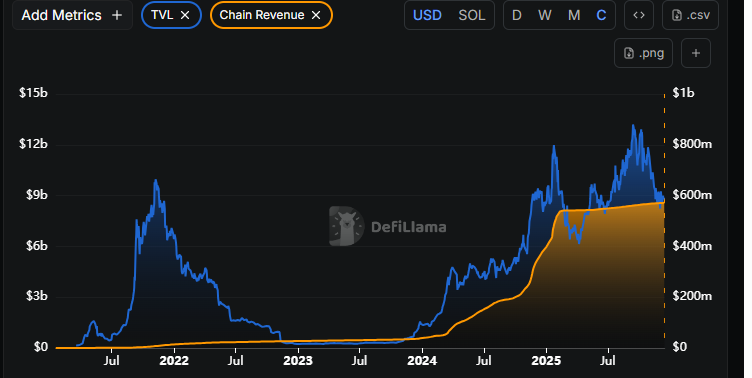

Likewise, its on-chain revenue offers further context. Solana’s cumulative chain revenue is approaching the $600 million mark, sitting near all-time highs. This figure reflects real economic activity generated by users, applications, and validators rather than short-lived hype.

However, the total value locked has declined. After peaking near $13.2 billion in mid-September, Solana’s TVL has fallen to roughly $9 billion. While this $4.2 billion drawdown appears large in absolute terms, percentage-wise it remains relatively contained given the broader bearish conditions across Q4 2025. As a result, TVL trends point to consolidation rather than big crash.

SOL Price Chart Shows Heavy Correction but Key Support Holds

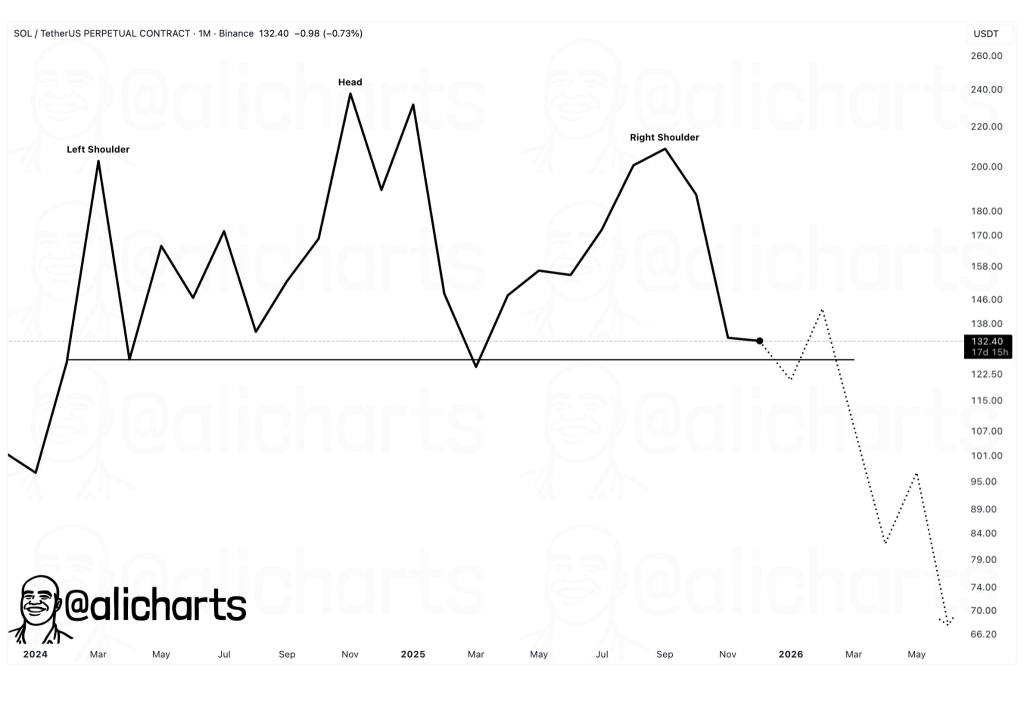

Despite these fundamentals, the Solana price chart tells a more cautious story. Since reaching an all-time high near $295, SOL has corrected roughly 55% during Q4. Market sentiment has clearly tilted bearish, overshadowing positive network data.

Technically, the SOL price continues to hold above the $120 support zone, which remains a critical area for bulls. However, if macro conditions deteriorate further, downside scenarios extend toward the $70 region.

Such a move would represent a nearly 75% decline from the peak, aligning with historical deep-cycle corrections rather than project-specific failure.

SOL Price Outlook Hinges on Sentiment vs Fundamentals

The divergence between Solana’s fundamentals and price action places SOL price at a pivotal juncture. On one hand, strong usage, rising revenue, ETF inflows, and institutional adoption argue against a prolonged collapse. On the other, macro uncertainty and technical damage continue to suppress bullish momentum.

As a result, near-term SOL price forecast scenarios remain sensitive to broader risk appetite rather than network health alone. Whether fundamentals can reclaim control over price direction will depend largely on how macro sentiment evolves in the coming months.

Ayrıca Şunları da Beğenebilirsiniz

The Channel Factories We’ve Been Waiting For

USDC Treasury mints 250 million new USDC on Solana