These 5 Nigerian fintechs achieved significant milestones in 2025

As we wrap up 2025 across the tech space, Technext decided to conduct a review of the Nigerian fintech ecosystem.

With that, this article seeks to chronicle outstanding milestones attained by Nigerian fintech startups during the year 2025.

For our methodology, we initially identified the top 20 fintechs in Nigeria in 2025 and tracked their activities throughout the year. While it was a tough pick, we arrived at the top 5 using. the. volume of the noted metrics and the perceived impact on Nigerians.

To add, we spoke to some founders and stakeholders. from the highllighted fintech startups to provided insights on what these milestones mean to their operations and what to expect. in the coming year, 2026.

1. Moniepoint

For Moniepoint, 2025 has been the year of accelerated growth built on the trust it has earned in the last 4 years.

Early in the year, the company processed over 1 billion transactions processed monthly. The number demonstrated rapid growth from the 800 million figure in October 2024, the month it raised $110M Series C funding and achieved a unicorn status.

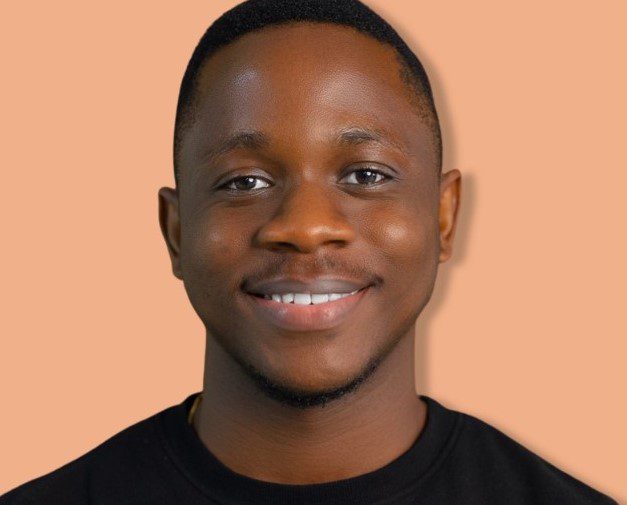

Speaking with Technext on the milestone, Edidiong Uwemakpan, Vice President, Corporate Affairs, Moniepoint Inc, explained that the company has grown in the number of businesses it serves, which is reflected in its numbers. She added that Monipoint’s goal “is to ensure that we maintain that level of reliability as we get into the new year.”

If the exchange rate has been fair, the fintech’s monthly roundup would be much similar to what Safaricom’s M-Pesa does monthly.

, Edidiong Uwemakpan, Vice President, Corporate Affairs, Moniepoint Inc

, Edidiong Uwemakpan, Vice President, Corporate Affairs, Moniepoint Inc

Edidiong mentioned that when businesses adopt Moniebook, it will help the company to “reliably serve them better, help them record their sales better and provide efficient bookkeeping and inventory management.”

With a surge in transactions facilitated per month and other milestones, Moniepoint is focused on growing its customer base, revenue and credit product in 2026.

“We’re giving to a lot more businesses around Nigeria, because we believe that’s the one way that Nigeria’s economy can really grow. If we have more people taking credits, expanding their business, and just boosting production as a whole,” Edidiong added.

Further proof of how the fintech company is its use of digital payment to drive financial inclusion. A recent report indicates that 7 in 10 fuel stations now use Moniepoint’s POS terminals.

You can read the full report here.

MILESTONES IN 2025 1. Now processing about 1 billion transactions in a month, worth N1 trillion. 2. Now serving 7 million businesses per month and 10 million active customers every month. 3. 7 in 10 POS nationwide use the Moniepoint POS terminal. 4. 20% or revenue comes from Credit offering. 5. Raised $90 million in a Series C funding round, pushing its valuation above $1 billion. 6. Launched Moniebook to help businesses manage daily operations.

2. Kuda Nigeria

In its Q1 2025 results, announced in July 2025, Kuda Nigeria recorded a milestone in its history.

The fintech company saw 300 million transactions worth N14.3 trillion ($9.3 billion) across its retail and business banking arms that quarter. In breakdown, retail banking accounted for N8.5 trillion ($5.5 billion), while business users processed N5.8 trillion ($3.7 billion).

Kuda bank imposes charges of N50 on deposits above N10,000 or above

Kuda bank imposes charges of N50 on deposits above N10,000 or above

While its cross-border payment offering had earlier failed, the company relaunched the cross-border remittance with a multi-currency wallet that allows Kuda users outside Nigeria to send money directly to Nigerian bank accounts. The company earlier paused its remittance offering to strengthen its product in-house with Kuda’s core banking application.

In the same period, Kuda saw its paid transfers surpass free transfers for the first time. For free transfers, the fintech company processed almost N1 trillion in transfers, while it facilitated N3 trillion on non-free transfers.

In addition to its key milestone in Q1 2025, Kuda Nigeria saw rapid customer base expansion and successful funding rounds. As of mid-2024, the company reported 7.5 million users.

MILESTONES IN 2025

1. Processed over 300 million transactions worth N14.3 trillion in Q1 2025

2. Witnessed steady growth in transactions on the app.

3. Recorded more paid transfers than free transfers.

4. Relaunched cross-border remittance with a multi-currency wallet

3. Middleman

Earlier in the year, TechNext spotlighted 10 Nigerian startups to watch out for in 2025. And, Middleman made the list. So, it is no surprise the startup has done so much so far.

From an increase in user base to the launch of Middleman AI and the Version 2 (V2) rollout, the fintech company has witnessed tremendous growth in 2025. Its most popular offering, ‘Remit by Middleman’, is a channel for e-commerce entrepreneurs who import from China and pay their suppliers in RMB – Renminbi (China’s currency),

Speaking with Technext, Adeola Owosho, Co-founder of Middleman, noted that a shift from payments to doing more was a major game changer for Middleman in 2025.

“We soon learned that our customers wanted more than just payments. They wanted an end-to-end procurement platform that offers more in terms of factory checks, customisations, consolidation, packing, shipping and so on,” he said.

Adeola Owosho, Co-founder at Middleman

Adeola Owosho, Co-founder at Middleman

At that point, the company upped the game by building an end-to-end stack. It also launched an AI sourcing assistant that provides customers with a more intelligent system on Chinese marketplaces.

Another milestone, according to Adeola, is that its procurement service raised the company’s gross margin from 2% to around 7%. “We’ve seen tremendous growth this month, and we’re pretty excited about our future,” he added.

Going into 2026, Middleman pictures an increased growth. “Next year is going to see us doubling down on our procurement service, building our agent network and also moving our procurement service fully in-app so that our users can have a more seamless experience,” Adeola said.

MILESTONES IN 2025

1. Rebranded and Launched procurement service.

2. Now processed almost ₦2 billion ($1.38 million) in total transactions.

3. Launch of Middleman AI with API integration

4. Crossed N2 billion in Gross Merchandise Volume (GMV)

5. Getting backed by Google

6. Now serving 12,000 users.

4. LemFi

The Nigerian-based Fintech company has had its hands full in 2025, including a lineup of new product launches and partnerships.

The startup kicked off the year with a $53 million Series B fundraise in January, bringing its total funding to over $86 million. It deepened its operation outside the shores of Africa, expanding to India, China, Pakistan, Brazil, and Mexico. With its acquisition and expansion in 2025, LemFi now operates in Europe, North America, Africa, and Asia.

In another notable partnership, LemFi collaborated with GCash to offer instant transfers for millions of Filipinos. The move saw LemFi connect the Filipino diaspora in North America and Europe to a trusted local financial tool.

LemFi processes $1 billion monthly, up from $2 billion in 2023, driven by $160 million monthly in its Asian corridor, which grew by 30 % month‑on‑month in its first year.

To wrap up 2025, the fintech company launched a “Global Accounts” product for Nigerians, enabling users to operate real USD and GBP accounts directly within the LemFi app and receive international payments.

MILESTONES IN 2025

1. Expanded to Egypt and Europe.

2. Secured $53 million in a Series funding round.

3. Acquired Pillar, a UK Credit Card Issuer.

4. Secured 14 U.S. State Money Transmitter Licenses (MTLs).

5. Now in 27 send-from markets and 20 send-to countries.

5. Palmpay

In 2025, Palmpay continued its driving force by topping its user base, which surpassed over 15 million in Q1. The fintech company has crossed 35 million subscribers, with each user doing about 50 transactions monthly.

The fintech company also announced a N4 billion interest payout to users of its PalmPay Wealth Product, signalling the increased trust and usage rate among customers.

PalmPay

PalmPay

In March 2025, the company also launched Debit Cards, extending its digital banking ecosystem beyond the mobile app. Four months later, Palmpay received notable recognition, making CNBC’s top global fintechs for the second year in a row.

As the fintech company heads into its 7th year in 2026, it will be looking to increase its numbers and fuel its expansion plans into more African countries.

MILESTONES IN 2025

1. Crossed 40 million users while daily transaction volumes surpassed 15 million in Q1 2025.

2. Completed the first live transaction with Wema Bank on the Nigeria Inter-bank Settlement System (NIBSS) National Payment Stack (NPS).

4. Named in CNBC and Statista's "Top 300 Global Fintech Companies" list for the second consecutive year.

5. Launched physical debit cards in partnership with Verve and AfriGo.

Honestly, if we were to select the top 10 Nigerian fintechs, we wouldn’t have exhausted the initial list. With respect to other fintechs, the above have excelled to merit the slot.

Ayrıca Şunları da Beğenebilirsiniz

Crucial Insights: Two Fed Interest Rate Cuts on the Horizon?

US Senators Introduce SAFE Crypto Act to Target Rising Crypto Scams