PANews reported on November 6th that Wintermute published an article on its X platform stating: "Liquidity drives the cryptocurrency cycle, but inflows have now stalled. Since the beginning of 2024, the size of stablecoins, ETFs, and the digital asset treasury has increased from $180 billion to $560 billion, but the growth momentum has slowed. Funds are rotating internally rather than entering new markets, leading to a rapid fading of gains and a continued narrowing of market breadth. When any of these three inflow channels accelerates again, liquidity will flow back into the digital asset space. Until then, cryptocurrencies will remain in a self-funding phase."PANews reported on November 6th that Wintermute published an article on its X platform stating: "Liquidity drives the cryptocurrency cycle, but inflows have now stalled. Since the beginning of 2024, the size of stablecoins, ETFs, and the digital asset treasury has increased from $180 billion to $560 billion, but the growth momentum has slowed. Funds are rotating internally rather than entering new markets, leading to a rapid fading of gains and a continued narrowing of market breadth. When any of these three inflow channels accelerates again, liquidity will flow back into the digital asset space. Until then, cryptocurrencies will remain in a self-funding phase."

Wintermute: Liquidity drives cryptocurrency cycles, but inflows have now stopped.

PANews reported on November 6th that Wintermute published an article on its X platform stating: "Liquidity drives the cryptocurrency cycle, but inflows have now stalled. Since the beginning of 2024, the size of stablecoins, ETFs, and the digital asset treasury has increased from $180 billion to $560 billion, but the growth momentum has slowed. Funds are rotating internally rather than entering new markets, leading to a rapid fading of gains and a continued narrowing of market breadth. When any of these three inflow channels accelerates again, liquidity will flow back into the digital asset space. Until then, cryptocurrencies will remain in a self-funding phase."

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

Tech Influence on Markets: A Deeper Impact Than the Dot-Com Era

The S&P 500, heavily weighted in technology, is exerting a formidable force on stock markets, surpassing its influence during the dot-com bubble. As volatility surrounds artificial intelligence stocks, this has also trickled down to U.S.Continue Reading:Tech Influence on Markets: A Deeper Impact Than the Dot-Com Era

Share

Coinstats2025/11/07 05:25

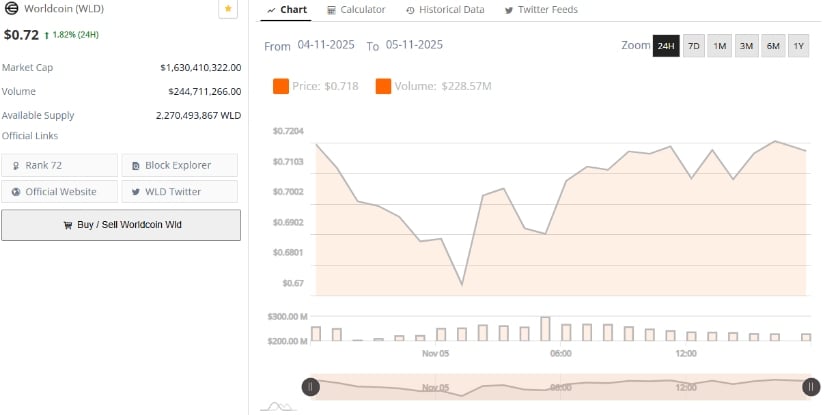

Worldcoin Price Prediction: WLD Tests $0.70 Support as Downtrend Extends

The current Worldcoin Price Prediction outlook centers on whether the token can stabilize near its recent support region, following a prolonged downtrend that has continued to apply pressure across the daily chart.

Share

Brave Newcoin2025/11/07 05:18

Bitcoin 2027 Target $200K vs Ozak AI Target $1.50 from $4.46M – Why $0.014 Entry Delivers 94x More Than BTC’s $107K Entry

Ozak AI ($OZ) is an AI-powered crypto project that combines predictive AI with a DePIN (decentralized physical infrastructure network) layer. This piece compares Bitcoin’s (BTC) established market profile and a hypothetical $200,000 2027 target to Ozak AI’s current presale at $0.014 and its stated $1.50 target, highlighting presale stats, verified partnerships, core features, and the

Share

Coinstats2025/11/07 05:15