Top Old Altcoins Set to Dominance in the Next Altseason, Expert Predicts

As the cryptocurrency market prepares for what experts anticipate will be another dynamic altcoin cycle, industry leaders highlight that established digital currencies with ETF potential are likely to attract the lion’s share of fresh institutional investment. Insights from CoinQuant CEO Maen Ftouni suggest that older cryptocurrencies such as XRP and Cardano are poised to benefit due to their association with upcoming ETF approval processes. This forecast underscores how traditional finance and institutional players continue to shape the evolving landscape of blockchain investments, impacting both the strategic flow of capital and overall market dynamics.

- Market analysts predict older, ETF-related cryptocurrencies will attract significant capital during the next altcoin season.

- Institutional investors are likely to focus on “dinosaur” coins like XRP and Cardano due to their ETF prospects.

- Today’s crypto market is saturated with over 26 million tokens, raising concerns over demand and liquidity.

- Experts forecast short-lived surges in altcoin prices rather than a sustained altseason during the current cycle.

Older cryptocurrencies with pending or potential exchange-traded funds (ETFs) are expected to absorb much of the investment during the upcoming altcoin season, according to Maen Ftouni, CEO of CoinQuant, a provider of algorithmic trading tools. During a discussion at the Global Blockchain Congress 2025 in Dubai, Ftouni explained that institutional capital tends to flow toward well-established coins, often dubbed “dinosaur” cryptocurrencies, which include XRP and Cardano.

“Since the flow of funds is predominantly coming from traditional finance and ETFs at the moment, those investors are mainly eyeing these major tokens with a chance of eventually securing ETF approval, which explains the recent rise in these dinosaurs,” Ftouni noted.

This sentiment feeds into ongoing debates among market analysts regarding the structure and future trajectory of the crypto markets, especially as it relates to altcoin seasons — periods characterized by rapid appreciation in altcoin prices. The current market environment, marked by an overabundance of tokens, intensifies concerns about liquidity and demand mismatches.

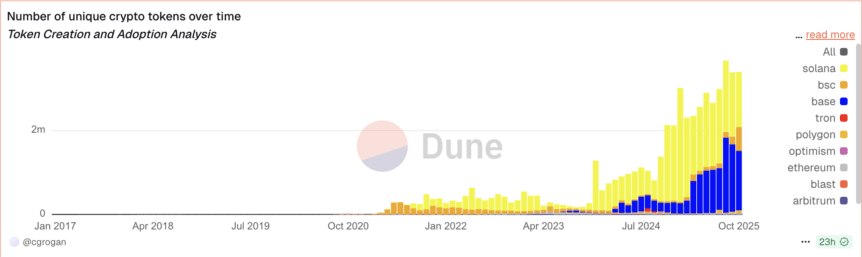

As of early 2025, the number of cryptocurrencies listed on CoinMarketCap has surpassed 26 million, more than doubling since the start of the year. This proliferation has led some experts, like economist and trader Alex Kruger, to caution that the oversaturation will likely hinder sustained market rallies.

The increasing count of crypto tokens. Source: Dune

The increasing count of crypto tokens. Source: Dune

Kruger recommended traders temper expectations, suggesting that instead of a prolonged altcoin rally, the market will experience short bursts of price increases focused on specific tokens. These rallies might last only a few weeks, reflecting a shift in market dynamics where only select assets see significant gains during these periods.

Published: Altcoin season 2025 is almost here… but the rules have changed

This article was originally published as Top Old Altcoins Set to Dominance in the Next Altseason, Expert Predicts on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Top 3 Alternatives To Ripple (XRP) and Solana (SOL) That Could Turn $250 Into $250K in 2025

MAGACOIN FINANCE Surpasses $14M With Whale Inflows