The AI Revolution: From Crypto Trading to Content Authenticity

Key takeaways:

- AI is streamlining crypto trading with automated tools that analyze market trends and execute trades based on sentiment and technical data.

- The rise of AI-generated content has made it harder for readers and traders to distinguish between human insight and machine-written text.

- Tools like ZeroGPT help ensure transparency by detecting AI-generated material and supporting trustworthy reporting in digital finance.

Artificial intelligence is changing the way we trade, invest, and communicate online. In the crypto market, AI-powered tools are already analyzing blockchain data, forecasting price movements, and giving investors real-time insights that were once impossible to get manually. At the same time, AI models are writing articles, summarizing complex financial topics, and even covering the crypto market itself, sometimes faster than journalists can.

This growing overlap between AI in finance and content creation highlights a clear double-edged trend. While automation improves accuracy and speed, it also raises an important question: how can readers and traders tell whether the information they rely on was written by a human or a machine?

AI’s expanding role in crypto trading

AI is becoming the backbone of modern crypto trading strategies. Machine learning systems now scan markets 24/7, spotting short-term opportunities and automatically executing trades based on both technical signals and sentiment data from social media or news feeds.

Platforms that integrate predictive AI models are gaining traction among retail and institutional investors alike. Many of the top AI crypto coins are built around automation, decentralized data analytics, and fraud detection, showing how intelligent systems can bring structure and stability to an unpredictable market.

However, as AI takes on more of the analytical workload, the challenge is not only about accuracy but also authenticity. The same technology that generates forecasts can also produce market commentary or news content that looks reliable but isn’t human-made. AI often outputs information that isn’t completely accurate, and sometimes it’s just flat-out wrong. This growing blur between expert insight and algorithmic output has made content verification more important than ever.

The battle for authenticity

In an online ecosystem filled with AI-written text, trust has become a measurable factor. Investors and readers now have to ask whether what they are reading was written by an analyst or a chatbot.

The implications go well beyond journalism. In finance, even subtle misinformation generated by AI could sway market sentiment, influence retail traders, or distort public opinion around cryptocurrencies. As a result, ensuring that information is human-written and verifiable has become critical for platforms that value integrity and transparency.

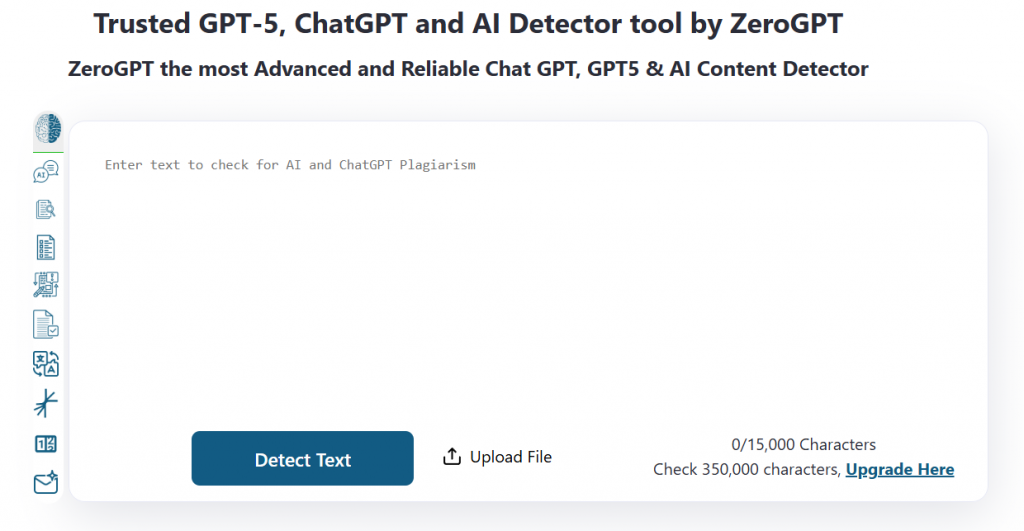

That is where AI checker tools like ZeroGPT come into play, helping separate genuine human analysis from chatbots.

Verifying the human touch

ZeroGPT is one of the leading AI/GPT detectors available today, known for its accuracy and reliability. Its detection system can identify text written by ChatGPT, GPT-4, GPT-5, and other large language models.

But ZeroGPT is more than just a detector. It includes a suite of tools such as an AI Paraphraser, Grammar Checker, Summarizer, and Translator, all designed to help writers, editors, and researchers maintain clarity and credibility while still using AI productively.

For crypto-focused media and data platforms, ZeroGPT offers an added layer of transparency. It helps ensure that articles, forecasts, and analytical reports on Bitcoin, Ethereum, or emerging tokens remain trustworthy as AI becomes a bigger part of the content pipeline.

Final thoughts

AI and blockchain share a common foundation: trust through verification. Blockchain verifies transactions on a public ledger, while AI detectors verify authorship and authenticity. Together, they are shaping a digital environment where technology strengthens trust instead of undermining it.

As AI continues to redefine both finance and content creation, tools like ZeroGPT remind us that technology’s value is not only about what it creates but also about how accountable it remains to the truth.

You May Also Like

Solana Price Prediction: Analysts See $250 Target But Rollblock Draws Attention For Bigger 30x Return

XRP Crashes 15% In A Week But Spot ETF Launches Mean $2.70 Could Come Soon