Schwab Reveals Crypto ETFs Are rivaling Bond ETFs in Popularity

- Approximately 45% of ETF investors plan to include crypto ETFs in their portfolios, matching interest in bond ETFs.

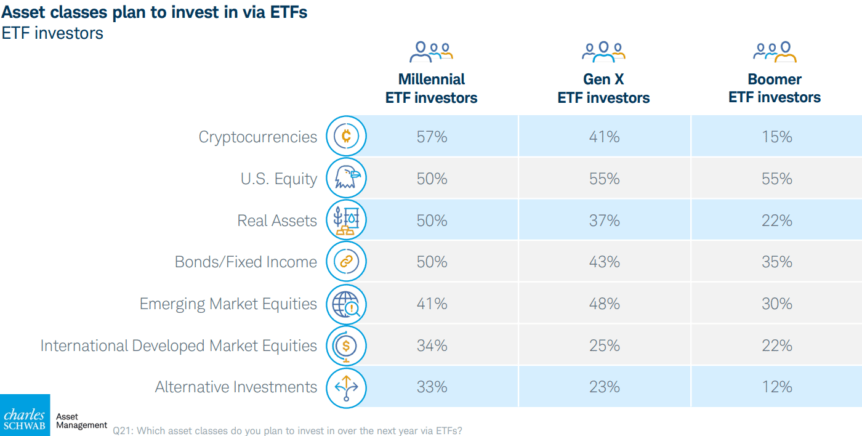

- Millennials show significantly higher enthusiasm for crypto ETFs, with 57% indicating plans to invest.

- Investors cite low costs and accessibility as primary reasons for adopting ETFs, including crypto-focused ones.

- The survey reveals a surprising shift: crypto ETFs are gaining interest equal to that of traditional bonds, despite their smaller assets under management.

- The investment landscape is rapidly transforming, with ETFs leading the way into new asset classes and strategies.

Interest in cryptocurrency exchange-traded funds (ETFs) is surging among retail investors, according to a recent report by Schwab Asset Management. Nearly half of ETF investors now intend to add crypto ETFs to their holdings, signaling a shift toward digital assets amid broader acceptance in mainstream markets. The report underscores growing confidence in blockchain-based investment vehicles as the crypto market continues to evolve.

In its “ETFs and Beyond” study, Schwab found that 52% of respondents plan to invest in US equities, while 45% expressed a similar interest in crypto ETFs—tied with US bonds for second place. Bloomberg’s senior ETF analyst Eric Balchunas noted that this was unexpected, considering the bond market’s size.

he said.

Source: Eric BalchunasThe survey polled 2,000 individual investors between ages 25 and 75, with half having recently bought or sold ETFs and holding at least $25,000 in investable assets. The findings reveal a modernization of investor attitudes—particularly among younger generations—toward digital assets and alternative strategies.

Millennials Lead in Crypto ETF Interest

The study showed that Millennials, born between 1981 and 1996, are especially eager to invest in crypto ETFs, with 57% planning to allocate funds into such assets. This contrasts with just 41% of Generation X respondents. Conversely, Baby Boomers displayed the least interest, with only 15% considering crypto ETFs for their portfolios.

Millennials show higher interest in crypto ETFs than other age groups. Source: Schwab Asset Management

Millennials show higher interest in crypto ETFs than other age groups. Source: Schwab Asset Management

Expert analysis highlights that overall investor sentiment remains optimistic about ETFs, with many planning to increase their usage, especially among younger investors keen on diversifying through digital assets and niche strategies.

Driving Forces Behind ETF Adoption

Key factors boosting ETF appeal include their low costs and ease of access. About 94% of respondents acknowledge that ETFs help reduce expenses in their portfolios, while half appreciate their ability to target specialized or alternative assets outside traditional markets.

David Botset, Schwab’s managing director, emphasized that the investment ecosystem is experiencing a swift transformation, with ETFs playing a central role.

he stated.

This shift indicates that retail investors are increasingly embracing blockchain innovations and digital assets, shaping the future of crypto regulation and markets. As ETFs continue to democratize access to cryptocurrencies, their influence on global investment patterns is set to grow, paving the way for further mainstream adoption of crypto and blockchain technologies.

This article was originally published as Schwab Reveals Crypto ETFs Are rivaling Bond ETFs in Popularity on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

REX Shares’ Solana staking ETF sees $10M inflows, AUM tops $289M for first time

Goedemorgen Bitcoin: Waarschuwing voor bubbel, koers herstelt