PlayAI Goes Live on Mainnet as Kaito Community Round Pushes Funding to $6.3M

The post PlayAI Goes Live on Mainnet as Kaito Community Round Pushes Funding to $6.3M appeared first on Coinpedia Fintech News

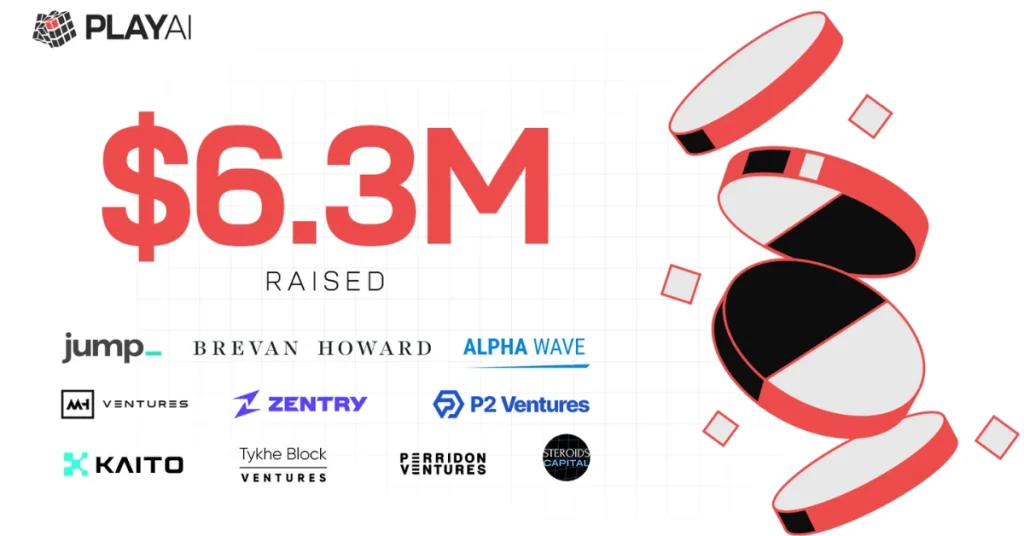

Following new strategic funding and the upcoming mainnet launch, PlayAI has now raised $6.3 million, accelerating its mission to make AI-powered automation native to the blockchain.

Dubai, UAE – [16 October 2025] – PlayAI, the programmable automation layer for AI and crypto, announces the forthcoming launch of its mainnet alongside a new $2 million community public sale conducted in collaboration with Kaito, bringing the company’s total funding to $6.3 million. The latest round also saw participation from Polygon Ventures, reinforcing investor conviction in PlayAI’s vision to make on-chain automation accessible to anyone.

The combined milestone strengthens the project’s resources and momentum following its previously announced $4.3 million seed round, which was backed by Jump Crypto, Brevan Howard, Polygon Ventures, Alphawave, and MH Ventures among others.

With mainnet going live the week of Oct. 13, 2025, PlayAI will introduce a subscription model that converts its growing beta traction into a durable, creator-first business, enabling users to deploy and monetize on-chain AI workflows at scale.

Ramees, Founder and CEO of PlayAI, said:

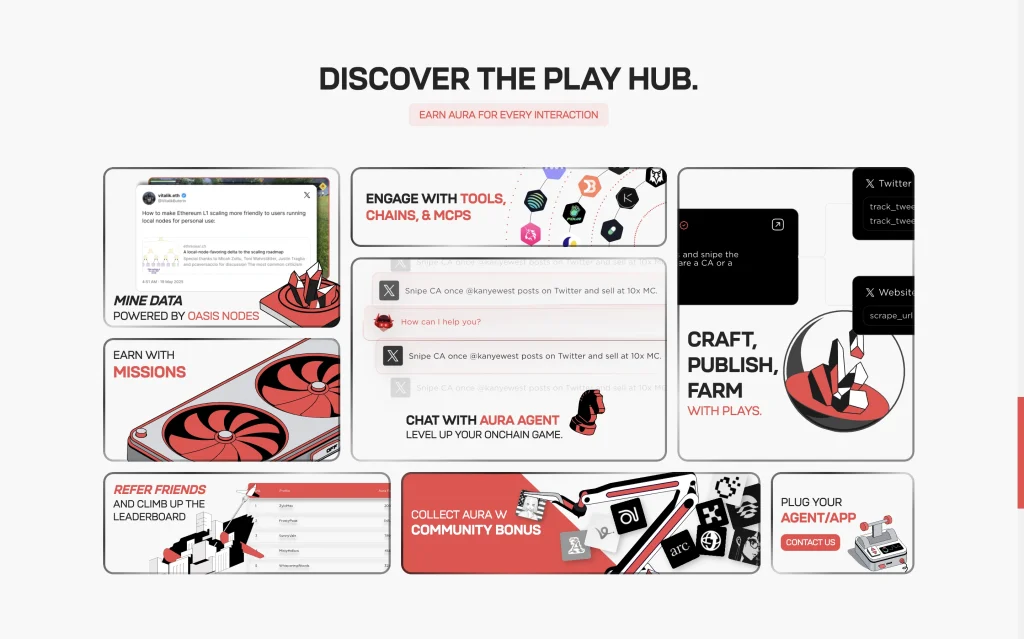

Positioned as the “Zapier of on-chain AI,” PlayAI lets anyone — without writing code — compose powerful automations that connect wallets, APIs, Model Context Protocols (MCPs), agents, and Web2/Web3 tools across major networks like EVM chains, Solana, Polygon, and BNB Chain. During beta, the platform processed over three million testnet transactions, attracted 2.25 million+ signups, and created 210,000+ smart wallets. It also grew to 170,000+ monthly active users, a 250,000+ community, and launched 50+ workflows, while onboarding more than 100 agents and MCPs.

Mainnet formalized this orchestration layer, making it simple to build, deploy and commercialize AI-driven crypto workflows with a single prompt through PlayStudio’s no-code canvas and PlayHub’s unified command center. With its Data Markets initiative, which incentivizes community members to contribute and curate datasets that enhance workflow performance and facilitate seamless multichain compatibility, the PlayAI ecosystem bridges the fragmented tools of Web3, transforming them into living, composable systems.

The $2 million raised in partnership with Kaito supports PlayAI’s thesis that agent economies will be built from the ground up by communities who both use and own the workflows they rely on. Participation in the sale revealed a broad base of retail users and builders eager to automate across various decentralized finance (DeFi), trading, gaming, and creator economy use cases.

Sandeep Nailwal, co-founder and CEO of Polygon Labs, said:

Creators can publish workflows that others can one-click deploy, subscribe to, or extend, while Data Markets reward the ongoing curation that improves results over time. The upcoming PLAI token utilities are being designed to align value accrual between the PlayAI network and the workflows built on top of it. This will create a future in which individual workflow tokens, creator subscriptions, and data rewards work together to reinforce adoption and drive long-term growth.

You May Also Like

What the U.S. shutdown tells us about market resilience

Ripple News: Trump’s CFTC Nominee Has History on XRP’s Side, Here’s Why