In May, the Web3 industry welcomed a number of major events. Regulatory and judicial progress continued to advance, with Ethereum Pectra mainnet upgrade, Kraken confirming the next round of FTX compensation distribution, and the Federal Reserve FOMC announcing interest rate decisions becoming the focus of the month.In May, the Web3 industry welcomed a number of major events. Regulatory and judicial progress continued to advance, with Ethereum Pectra mainnet upgrade, Kraken confirming the next round of FTX compensation distribution, and the Federal Reserve FOMC announcing interest rate decisions becoming the focus of the month.

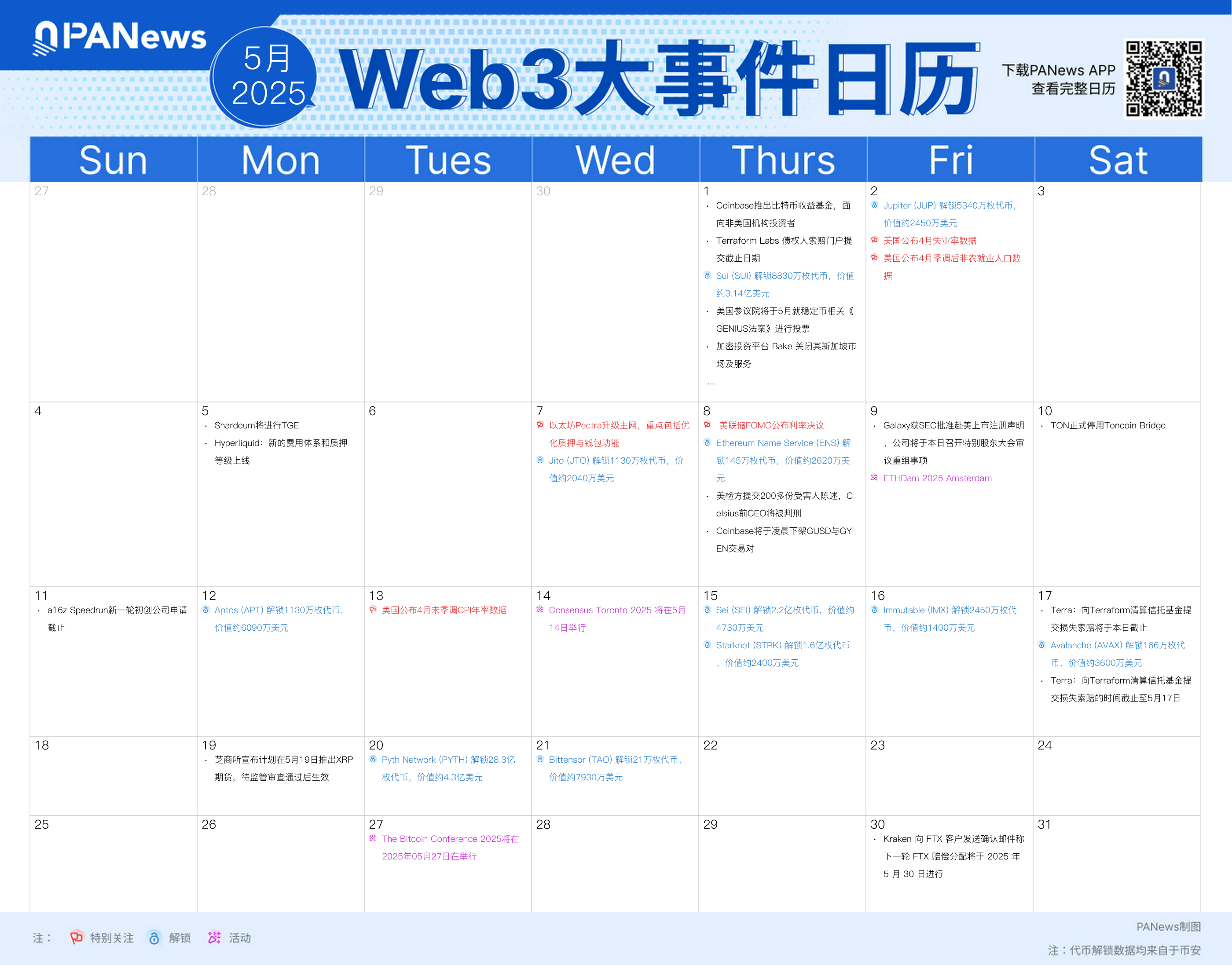

PA Chart | One chart to understand the major Web3 events worth paying attention to in May

2025/05/01 10:20

In May, the Web3 industry welcomed a number of major events. Regulatory and judicial progress continued to advance, with Ethereum Pectra mainnet upgrade, Kraken confirming the next round of FTX compensation distribution, and the Federal Reserve FOMC announcing interest rate decisions becoming the focus of the month. At the same time, major events such as Consensus Toronto 2025 and Bitcoin Conference 2025 were launched one after another. In terms of projects, the unlocking of multiple tokens such as Sui, Jito, and Aptos may bring market fluctuations, which deserves continued attention.

PANews has compiled a calendar of major Web3 events in May, providing you with a glimpse of the highlights of this month.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Share Insights

You May Also Like

The Channel Factories We’ve Been Waiting For

The post The Channel Factories We’ve Been Waiting For appeared on BitcoinEthereumNews.com. Visions of future technology are often prescient about the broad strokes while flubbing the details. The tablets in “2001: A Space Odyssey” do indeed look like iPads, but you never see the astronauts paying for subscriptions or wasting hours on Candy Crush. Channel factories are one vision that arose early in the history of the Lightning Network to address some challenges that Lightning has faced from the beginning. Despite having grown to become Bitcoin’s most successful layer-2 scaling solution, with instant and low-fee payments, Lightning’s scale is limited by its reliance on payment channels. Although Lightning shifts most transactions off-chain, each payment channel still requires an on-chain transaction to open and (usually) another to close. As adoption grows, pressure on the blockchain grows with it. The need for a more scalable approach to managing channels is clear. Channel factories were supposed to meet this need, but where are they? In 2025, subnetworks are emerging that revive the impetus of channel factories with some new details that vastly increase their potential. They are natively interoperable with Lightning and achieve greater scale by allowing a group of participants to open a shared multisig UTXO and create multiple bilateral channels, which reduces the number of on-chain transactions and improves capital efficiency. Achieving greater scale by reducing complexity, Ark and Spark perform the same function as traditional channel factories with new designs and additional capabilities based on shared UTXOs. Channel Factories 101 Channel factories have been around since the inception of Lightning. A factory is a multiparty contract where multiple users (not just two, as in a Dryja-Poon channel) cooperatively lock funds in a single multisig UTXO. They can open, close and update channels off-chain without updating the blockchain for each operation. Only when participants leave or the factory dissolves is an on-chain transaction…

Share

2025/09/18 00:09

Share

Bloomberg ETF Analyst: There are currently 155 crypto ETP applications tracking 35 different digital assets

PANews reported on October 22nd that Bloomberg ETF analyst Eric Balchunas tweeted that there are currently 155 crypto ETP applications tracking 35 different digital assets. This number could increase to 200 in the next 12 months.

Share

2025/10/22 07:30

Share

Wise recruits a stablecoin product manager to assess digital asset opportunities and threats

PANews reported on October 22nd that Ledger Insights reported that cross-border payments company Wise is making its first foray into the stablecoin space, recruiting a digital asset product manager with experience in building stablecoin wallets or payment solutions. Wise claims stablecoins can both improve settlement efficiency and create competitive pressure for emerging rivals. The company projects cross-border payment volume of £145 billion in 2024, with an average fee rate of 0.58%, corresponding to £840 million in cross-border revenue. The report indicates that it will be difficult for stablecoins to significantly outperform Wise in terms of cost, and that global banking relationships remain crucial for stablecoin deposits and withdrawals. Wise may also provide related services to stablecoin payment companies.

Share

2025/10/22 07:44

Share