Market Dip Sparks Surge in Demand for the Best Crypto Presales to Buy Now

Bitcoin’s sharp drop to the $103K range recently rattled the market, triggering more than $1 billion in liquidations and sending traders into panic mode.

The sell-off pushed prices down from $109K before bouncing back slightly to $106K, reminding investors just how unpredictable this market can be.

Despite the short-term fear, Bitcoin’s broader trend still looks healthy. According to a recent chart shared by Coinvo on X, the market’s floor has continued to rise each year from $15K in 2022 to $75K this year.

Even during correction phases, the long-term structure continues to show higher lows and a steadily growing base of holders. The Fear and Greed Index has dropped to 25, according to CoinMarketCap, signaling extreme caution-the very condition that often precedes major rebounds.

Periods like this often mark turning points in investor behavior. When volatility spikes and Bitcoin cools off, capital tends to rotate into smaller, high-upside opportunities. That’s why, while some traders panic-sell, others start scouting early-stage projects with strong fundamentals and active communities.

These presales, often overlooked during market dips, have become breeding grounds for the next wave of breakout tokens.

Source – Cryptonews YouTube Channel

Best Crypto Presales to Buy Before the Next Market Surge

When Bitcoin stalls, attention naturally shifts toward smaller, high-upside projects, especially those that combine strong community energy with creative token models.

Among the many names circulating on crypto forums and YouTube, 3 presales are commanding attention for their innovation and momentum: Pepenode, Maxi Doge, and Bitcoin Hyper.

Each brings something unique to the table, from gamified mining to cultural branding to Bitcoin-scale infrastructure.

Pepenode: Turning Virtual Mining Into Real Earnings

Pepenode is a new meme coin that turns presale participation into an interactive experience.

Instead of simply buying tokens and waiting, users can join a virtual mining ecosystem. They acquire and upgrade digital nodes that simulate mining power, earning rewards in real time.

The presale incentivizes early involvement. Around 70% of tokens spent on nodes and upgrades are burned, creating scarcity. Referral rewards also encourage community growth. The platform is accessible, requiring no specialized hardware or technical expertise.

Built on Ethereum’s proof-of-stake network, Pepenode reduces energy consumption compared to traditional mining.

Technical audits provide added security, though risks remain, including price volatility and partial team anonymity.

Users can stake tokens, upgrade nodes, and compete on leaderboards, allowing them to actively participate in the ecosystem before the main token launch.

Early participants gain advantages, such as stronger nodes and boosted rewards, creating incentives to engage from day one.

Pepenode combines meme coin appeal with gamified utility. By giving users immediate ways to earn and participate, the project distinguishes itself from passive presales.

Participants can experience the ecosystem firsthand and potentially benefit from the platform’s interactive features and token mechanics.

Visit Pepenode

Maxi Doge: Where Meme Culture Meets Muscle

Even after the recent market crash, certain dog-themed meme coins have remained strong, showing that their narrative is resilient against market volatility. This strength has drawn investors’ attention to Maxi Doge, another dog-themed token with potential.

The project’s presale has already surpassed $3.6 million, with participation from both retail traders and crypto whales.

Unlike older meme tokens built purely on hype, Maxi Doge introduces real mechanics that appeal to active traders. The team plans to integrate staking, yield rewards, and a competitive environment that blends humor with on-chain functionality.

Its structure is clear. A portion of the supply funds marketing through the Maxi Fund, while allocations for development, liquidity, and staking ensure the token can sustain its economy after launch.

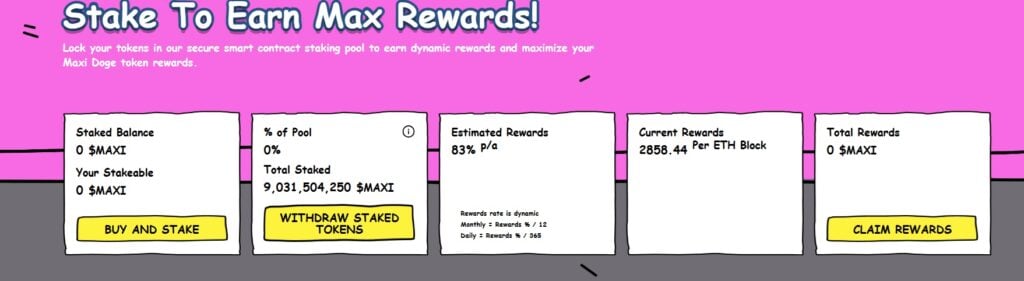

Early participants are already staking their tokens for up to 80% annual returns, with the rate adjusting as more holders join. More than 9 billion tokens have been staked so far, signaling trust in Maxi Doge’s reward model.

What separates this token from others is its identity. Maxi Doge blends meme humor with an attitude that mirrors real trading culture: bold, competitive, and risk-tolerant.

If Dogecoin defined the meme era’s beginning, Maxi Doge could represent its next evolution, bringing community-driven entertainment and practical engagement under one roof.

Visit Maxi Doge

Bitcoin Hyper: The Fastest Layer 2 on Bitcoin Hits $24 Million in ICO

Bitcoin Hyper has emerged as one of this year’s standout presales, recently reaching $24 million in its ICO. This milestone highlights growing investor confidence in the project as it positions itself as a leading Layer 2 solution for Bitcoin.

The project aims to enhance Bitcoin’s capabilities by combining its security with the speed and scalability of Solana’s infrastructure. Through the Solana Virtual Machine, Bitcoin Hyper can support DeFi platforms, gaming applications, and real-world asset use cases without compromising Bitcoin’s trustless foundation.

At the heart of the ecosystem is the HYPER Bridge, which locks Bitcoin on the main chain and issues wrapped BTC on the HYPER chain. This allows users to leverage their Bitcoin in decentralized applications while keeping it secure.

The HYPER token powers the system, providing utility for gas, governance, and staking, giving holders long-term incentives.

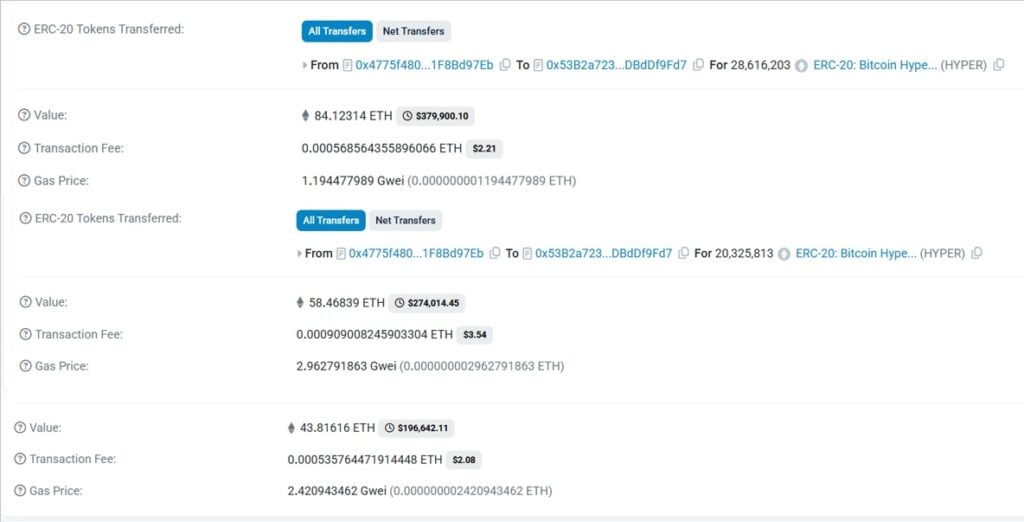

Investor activity remains strong, with on-chain data showing multiple six-figure purchases, including $379.9K, $274K, and $196.6K, driving the project toward its $24 million milestone.

By integrating scalability and real functionality, Bitcoin Hyper isn’t just layering Bitcoin; it’s expanding what the network can achieve, with strong ICO momentum and active whale participation positioning it as a leading force in Layer 2 development.

For those looking to join Pepenode, Maxi Doge, and Bitcoin Hyper presales, Best Wallet is recommended for safe and secure investment in the market, and through Best Wallet’s “Upcoming Tokens” portal, users can view presales, check project details, and secure tokens before launch.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Nexperia China asserted its independence after the Dutch government seized control over tech‑transfer concerns.

Japan’s Top 3 Banks Led By MUFG Unite to Unveil Local Stablecoin