German VDMA cautions U.S. tariff expansion will impact over 50% of machine exports

VDMA, the German association of engineering companies, cautioned that the December expansion of U.S. tariffs could hit over 50% of German and European machinery exports. The federation of 3,600 plant and machinery engineering firms said the percentage of exports affected surged from 40% in August’s expansion to 56%.

VDMA President Bertram Kawlath called on the EU to renegotiate the tariff deal with the U.S. as soon as possible to protect its industries from economic setback. He said the high punitive tariffs on U.S. exports will affect nearly all branches of mechanical engineering.

Thilo Brodtmann, VDMA’s managing director, stressed that the earlier 15% duties agreement between the U.S. and Europe is hardly worth more than the paper it was written on if the USA continues to widen tariffs on steel and aluminum.

One spokesperson also noted that, under the latest tariff amendments, the association’s companies would need to report the content and value of different kinds of steel in their machinery (or its origin) to U.S. customs.

Brodtmann says companies under VDMA are despairing

The VDMA managing director said that companies under the federation are despairing in light of the steel portion disclosure requirements. He pointed out that it is difficult for the companies to know the value of steel or its origin. Brodtmann further disclosed that U.S. customs will automatically apply the maximum tariff for Russia, 200%, if no origin can be provided.

The VDMA spokesperson also observed that this new development will significantly increase the effort and paperwork required for the involved companies. The companies will have no long-term reliability since the tariff list is updated every four months.

VDMA also pointed out that German machine builders are becoming extremely confused by the latest amendment to U.S. tariffs. The list already includes 406 items covering 165 products from typical construction and agricultural machinery engineering companies. The federation asserted that the idea of steel and aluminum derivative products can go very far downstream, dismissing hopes that the upcoming update could reduce the number of items.

Europe’s Krone pauses U.S. exports

European machinery firm Krone recently paused U.S. exports, citing alarming hidden tariffs on over 400 products, including combine harvesters, knitting needles, and hair driers. President Donald Trump’s administration is taxing nearly 407 specific products ranging from railway and bridge structures to cooker hoods.

Bernard Krone, the company’s fourth-generation chairman, said the new tariffs fall outside the EU deal and came as a big shock because the U.S. is the region’s second-largest market, worth over $130 million (£97 million) annually. Meanwhile, VDMA’s head of foreign trade, Oliver Richtberg, said that some companies have stopped exporting to the U.S. because the bureaucratic hurdles are so high.

The Krone chair believes the EU-U.S. deal struck in July is imperfect, but it offered predictability until the steel derivative list was released in August. He noted that with over 18,000 parts in Krone’s super farming machines, the list was shocking, and no one explained whether the tariffs depended on the price of raw steel, origin, or weight.

U.S. logistics and freight company Flexport also pointed out that getting the paperwork wrong could prove costly. The company believes it is unfair that U.S. customs authorities should apply maximum tariffs to steel derivative products on the hit list with incorrect paperwork. The U.S. customs authorities may also withhold refunds until the paperwork is in order.

However, after weeks of speaking with lawyers and U.S. officials on both sides of the Atlantic, Chairman Krone said he remains uncertain about the paperwork required by U.S. customs authorities. He added that his company will eventually resume U.S. exports with a test container of smaller machines rather than risk shipping its costlier machines.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.

You May Also Like

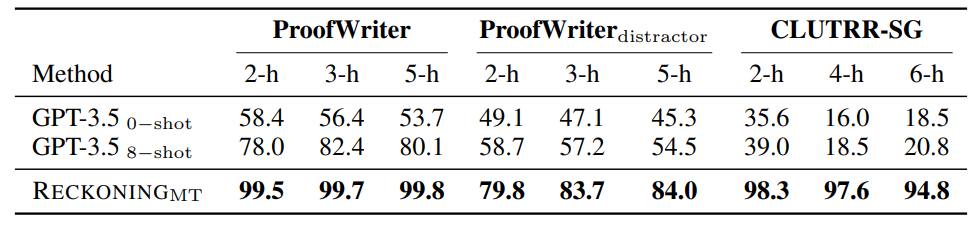

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification

The Strength of Dynamic Encoding: RECKONING Outperforms Zero-Shot GPT-3.5 in Distractor Robustness