Gerald Edelman's Radical Ideas About Mind, Memory, and Machines

:::info Author:

Jeffrey L. Krichmar, Department of Cognitive Sciences, Department of Computer Science, University of California, Irvine Irvine, CA 92697-5100 (jkrichma@uci.edu).

:::

Table of Links

Abstract and 1. Introduction

- Background and History

- Roadmap to a Conscious Artifact

- Hidden Gems

- Final Thoughts, Acknowledgments, and References

ABSTRACT

In 2006, during a meeting of a working group of scientists in La Jolla, California at The Neurosciences Institute (NSI), Gerald Edelman described a roadmap towards the creation of a Conscious Artifact. As far as I know, this roadmap was not published. However, it did shape my thinking and that of many others in the years since that meeting. This short paper, which is based on my notes taken during the meeting, describes the key steps in this roadmap. I believe it is as groundbreaking today as it was more than 15 years ago.

1 Introduction

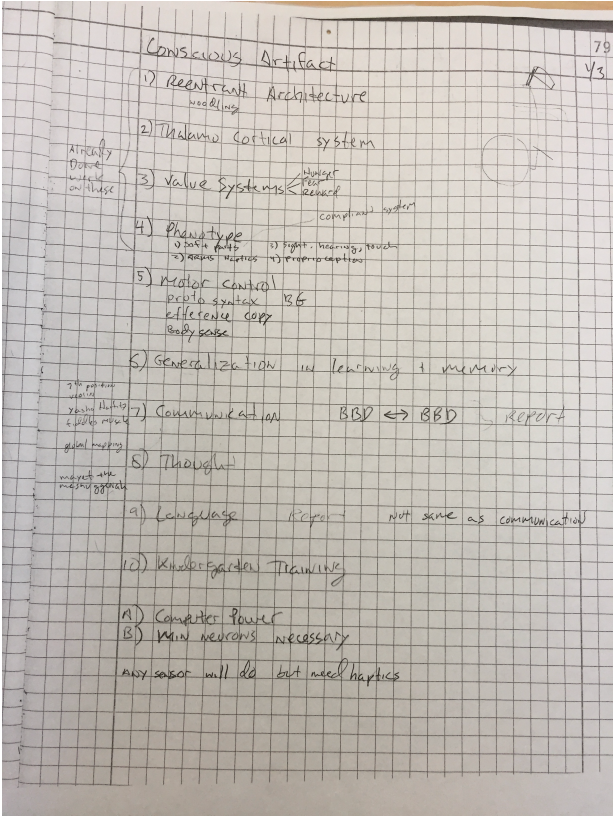

In February of 2020, I participated in the "On Consciousness" podcast with Bernie Baars and David Edelman. We talked about my work at The Neurosciences Institute (NSI) in La Jolla, California on the Darwin series of Brain-Based Devices, as well as my current research in neurorobotics. Unsurprisingly, the conversation turned to consciousness. I happened to mention that a page from my old lab notebook, which is pinned to a bulletin board in my office at UC Irvine, outlines a roadmap towards the creation of a Conscious Artifact. The key steps in this roadmap were laid out by Gerald Edelman, who was the director of the NSI at the time I was a research fellow there.

\ Several months later, alert listener Grant Castillou contacted me about the podcast. In his email he wrote, "I have read many of Dr. Edelman’s works, but never come across anything like this before". At that time, my university was in lockdown due to the COVID-19 pandemic and I did not have access to my office. Recently, though, I was in my office and found the roadmap (see Figure 1). This brief paper describes the roadmap and my recollections of the event and the thinking behind it more than 15 years ago.

2 Background and History

It is necessary to provide some background on what led to this event. Of course, it was a long time ago, so I may not have all the facts and dates exactly right. It is well known that memory is labile; time and the accumulation of experience can lead to false memories. Keeping that caveat in mind, what follows is my best recollection of the event and what was proposed.

\ Although the date in the upper right corner of my notebook looks like January 3rd, I think this is either a misprint or my bad handwriting. I believe the event was shortly after the Society for the Study of Artificial Intelligence and Simulation of Behaviour (AISB) meeting held in Bristol UK in April of 2006. I participated in the GC5: Architecture of Brain and Mind symposium and also attended the symposium on Integrative Approaches to Machine Consciousness.

\ When I returned to the NSI, I was asked to give a briefing on the meeting at the Institute’s Fellows’ Symposium. I described what I saw and, in particular, the current state of machine consciousness and artificial intelligence.

\ Later that day, we had our weekly "Build A Brain" meeting. The "Build A Brain" group comprised an eclectic mix of theoreticians, engineers, and neuroscientists. Every week we would discuss the progress on our brain-based devices and

\

\

\ how we could test theories of neuroscience using those simulations. Although Gerald Edelman had given much thought to the topic of consciousness, up until that point he had not wanted to construct a conscious machine. In fact, he either did not think it was possible or thought it was not a worthwhile endeavor.

\ However, at this particular meeting, I think my report on AISB’06 compelled him to state, "I think the time has come to build a conscious artifact." My notes from that meeting are shown in Figure 1. After the meeting, Eugene Izhikevich, who was also present, told me to save this page because it might be important. So, I made an extra copy of the page for myself, and it eventually followed me to UC Irvine, where it now occupies a corner of my bulletin board.

\ The rest of this paper describes, to the best of my recollection, my interpretation of this roadmap toward a Conscious Artifact.

\

:::info This paper is available on arxiv under CC BY 4.0 license.

:::

\

You May Also Like

Unprecedented Surge: Gold Price Hits Astounding New Record High

Little Pepe Token News as DeepSnitch AI Raises $463K in Record-Breaking Time