Fed Rate Uncertainty Grips Crypto Market Ahead of Powell’s Speech

As per recent reports, the Fed FOMC meeting has put the crypto market on high alert. After weeks of uncertainty caused by the U.S. government shutdown, investors are waiting for clues from Federal Reserve Chair Jerome Powell. His words could decide whether Bitcoin keeps rising or pauses after its record run.

Market Overview

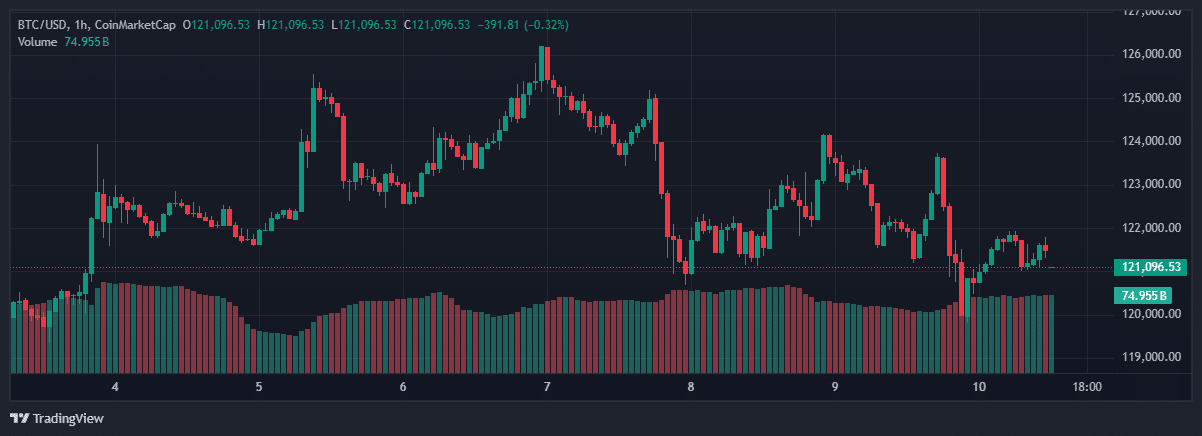

The connection between the Fed FOMC meeting and crypto continues to strengthen as global trends steer investor behavior. Bitcoin’s climb to a record $125,245 marks one of its biggest runs this year, driven by hopes that the Fed may soon ease interest rates.

Even so, signs of uncertainty linger. The 10-year U.S. Treasury yield has dipped to 4.108%, and the U.S. Dollar Index (DXY) has softened to 97.56, showing that many investors are playing it safe.

Source: Coinmarketcap

Source: Coinmarketcap

Market analysts say the next big move depends on Jerome Powell’s tone. If he hints at rate cuts, crypto could see another wave of buying. But if he sounds cautious, traders may start taking profits before volatility hits again.

Read More: BTC, ETH, XRP Slide as Fed Speech Looms Over Markets

What the Fed Said Last Time

The September FOMC minutes revealed signs of slowing economic momentum. U.S. private payrolls fell by 32,000 jobs in September, according to ADP, while inflation rose only 0.2%. These trends added pressure on policymakers to consider easing monetary policy.

The minutes stated,

Nearly all participants expected a 25 basis point rate cut, and about half projected another one in October. Those expectations have now built momentum ahead of the next Fed FOMC meeting crypto update.

Key Events to Watch

Powell’s upcoming speech at the Community Bank Conference will be his first since the shutdown. Economists expect it to shed light on the pressure smaller lenders face and how that might shape the Fed’s next move.

Traders are also eyeing the dot plot and forward guidance. If most officials support more rate cuts, it could boost crypto sentiment. As one strategist noted, “Fed signals will steer crypto’s next move,” with tone likely mattering more than the decision itself.

Market Insight

According to the market update, Bitcoin’s latest surge came alongside a drop in Treasury yields and a weaker U.S. dollar. Analysts say these macro shifts often push investors toward digital assets as a hedge against tightening liquidity. The same dynamic is now at play ahead of the Fed’s next move, keeping traders on edge as they look for fresh direction.

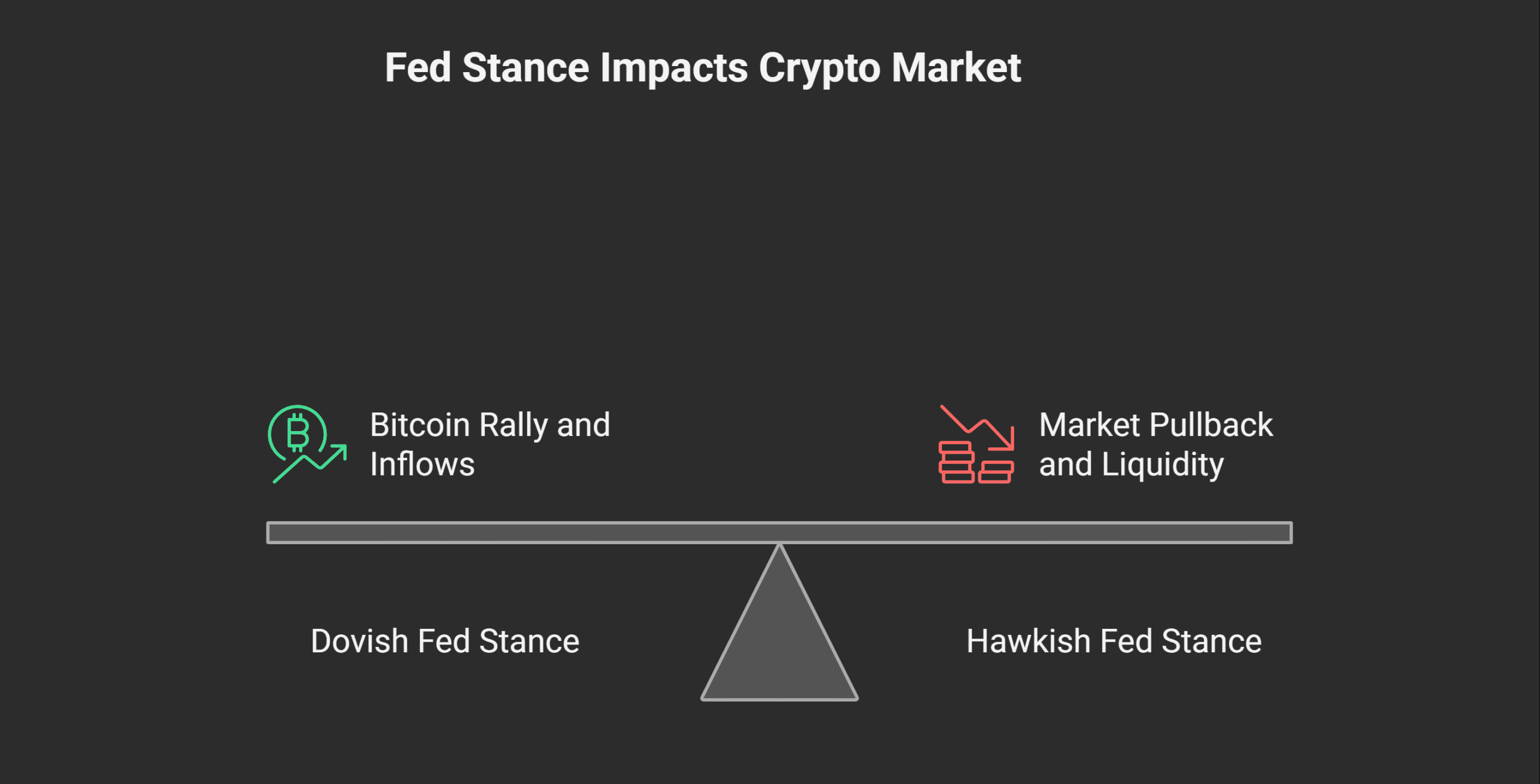

Price Impact Scenarios

| Fed Message | Market Tone | Possible Crypto Reaction |

|---|---|---|

| Dovish | Strong hints at near-term cuts | Bitcoin rally and higher inflows |

| Neutral | Wait-and-see approach | Mild volatility or sideways trade |

| Hawkish | Focus on inflation control | Market pullback and reduced liquidity |

Analysts believe the crypto market’s reaction to the Fed FOMC meeting will likely be swift once Powell speaks, with volatility expected across Bitcoin and major altcoins.

Conclusion

Based on the latest research, crypto traders attending the Fed FOMC meeting are approaching a decisive moment. The market is torn between optimism and caution. Every word from Powell could shift liquidity, investor sentiment, and direction. Whether the Fed confirms a softer stance or sticks to tight policy, this meeting could shape the next phase of the crypto market’s evolution.

For expert insights and the latest crypto news, visit our platform.

Summary

The link between the Fed FOMC meeting and crypto has become stronger as traders await Powell’s remarks. With Bitcoin at $125,245 and yields falling to 4.1%, every signal from the Fed could move markets. A dovish message might lift digital assets further, while hesitation could cause quick sell-offs. This meeting is more than a rate decision. It is a defining moment for the crypto market.

Glossary of Key Terms

- FOMC: Federal Open Market Committee, the Fed’s policy-making body.

- Dovish: Indicates support for rate cuts or easier policy.

- Hawkish: Indicates preference for tightening or higher rates.

- Dot Plot: Chart showing Fed officials’ rate forecasts.

FAQs About Fed FOMC Meeting Crypto

Q: Why does the Fed FOMC meeting affect crypto?

Because rate decisions and Powell’s tone affect global liquidity and investor sentiment, [main clause needed].

Q: What is the main Focus this time?

Markets are watching for clarity on rate cuts following weaker jobs data and low inflation.

Q: How did Bitcoin react after the last meeting?

Bitcoin jumped more than 7% following dovish comments from the Fed in September.

Q: When is the next FOMC meeting?

It is expected to take place in about three weeks, according to the Fed’s official calendar.

Read More: Fed Rate Uncertainty Grips Crypto Market Ahead of Powell’s Speech">Fed Rate Uncertainty Grips Crypto Market Ahead of Powell’s Speech

You May Also Like

The Channel Factories We’ve Been Waiting For

Ethereum Name Service price prediction 2025-2031: Is ENS a good investment?