CRO Jumps 5% Daily, BTC Price Calms After Post-CPI Volatility: Weekend Watch

The highly anticipated CPI numbers announced on Friday brought some volatility to the cryptocurrency markets, with BTC jumping to $112,000 only to slip below $110,000 before it recovered all losses.

Several altcoins have posted more impressive gains over the past days, including JUP, ZEC, CRO, BCH, and XRP.

BTC Recovers All Losses

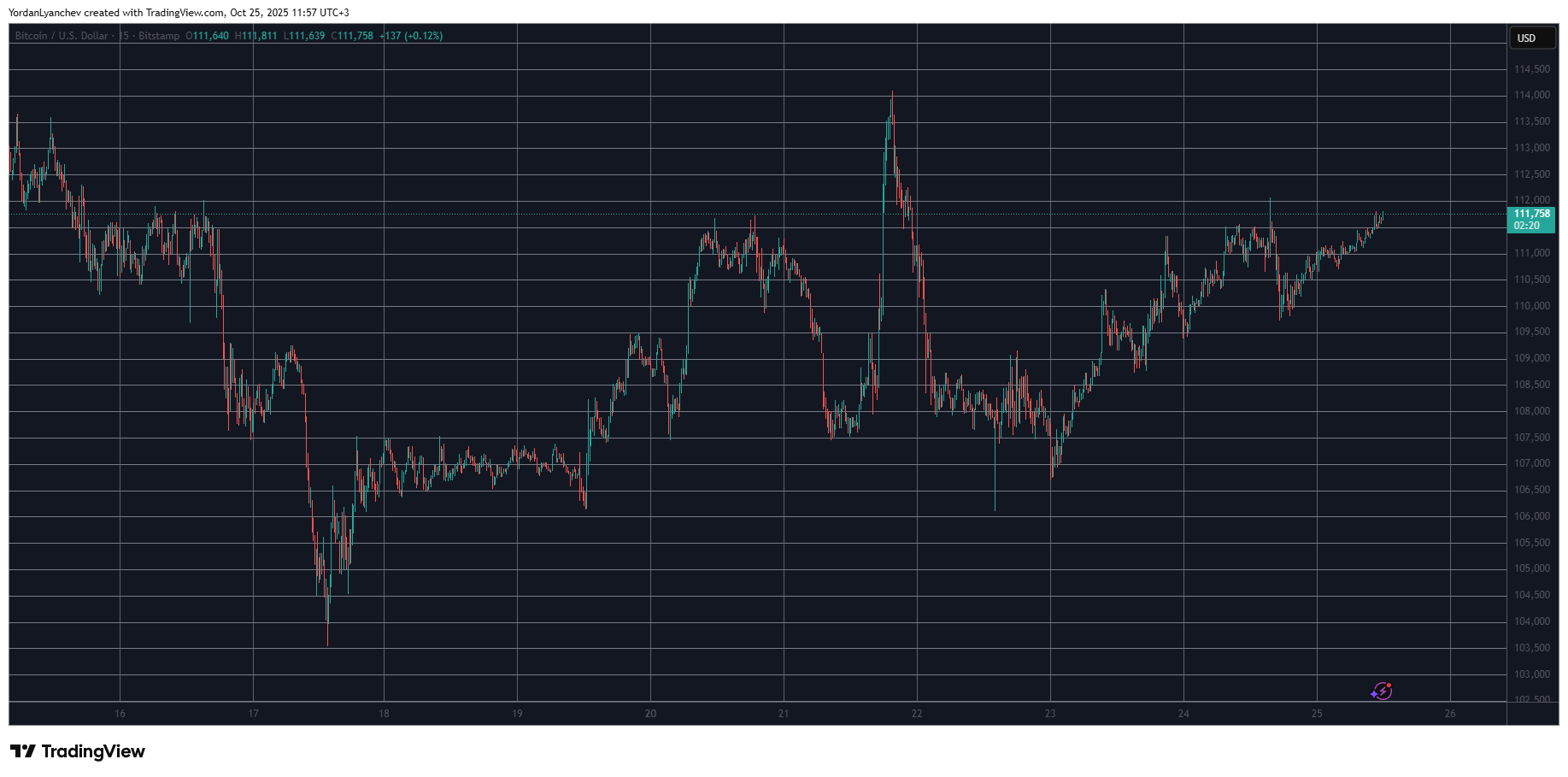

The primary cryptocurrency experienced massive turbulence at the end of the previous business week when it dumped from $112,000 to under $104,000 in the span of just a day. However, it bounced off during the weekend and went on the offensive at the beginning of the new business week.

The bulls initiated an impressive leg up on Tuesday that resulted in a $6,500 surge. It pushed BTC from $107,500 to a multi-day peak of $114,000. However, it turned out to be a fakeout, and bitcoin quickly lost all gains and dipped even further below $106,500.

The following few days were more positive but less eventful as the markets awaited the Friday release of the US CPI numbers. BTC had calmed at around $111,000 and surged immediately with a grand after the inflation for September turned out to be lower than expected.

However, its progress was quickly halted, and the bears drove it south by over two grand in the following hours to just under $110,000. Nevertheless, BTC has bounced off and now sits close to $112,000. Its market cap has risen to $2.230 trillion on CG, while its dominance over the alts is at 58%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

CRO, XRP on the Rise

Most larger-cap alts have failed to post any significant moves in the past 24 hours. ETH and BNB are slightly in the red, while SOL, ADA, DOGE, HYPE, LINK, and XLM have produced minor gains.

More volatility comes from the likes of XRP, CRO, BCH, and ZEC, all of which have increased by somewhere between 3.5% and 5.3%. In contrast, TRX has dumped by over 5% and now sits inches below $0.30.

The total crypto market cap has remained sideways since yesterday at around $3.850 trillion on CG.

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

The post CRO Jumps 5% Daily, BTC Price Calms After Post-CPI Volatility: Weekend Watch appeared first on CryptoPotato.

You May Also Like

Yicai Global: Futu Securities and Tiger Brokers Further Close Account Opening Channels for Mainland Chinese Residents

The 100% winning rate whale's BTC and ETH long positions have made a floating profit of over $7.67 million