Coinbase Joins Ethereum Foundation to Back Open Intents Framework

Coinbase Payments has become a core contributor to the Open Intents Framework (OIF), a new initiative aimed at building open standards for secure asset movement across blockchain networks. The company announced its participation in a post on X on Sept. 17.

The project seeks to address the fragmented user experience within the current multi-chain environment, where users often manage assets across networks like Ethereum ETH $4 456 24h volatility: 0.3% Market cap: $538.40 B Vol. 24h: $33.31 B and Base. According to the official announcement, the OIF is a collaborative effort involving key players like the Ethereum Foundation, Hyperlane, Across Protocol, and OpenZeppelin.

An Open-Source Approach to Interoperability

The framework operates on the concept of “intents,” a paradigm shift in blockchain interactions. Instead of manually navigating complex steps, users can simply express a goal, such as swapping one token for another on a different network. A specialized agent, known as a solver, then finds the best route and executes the transaction on the user’s behalf.

The OIF provides a modular, open-source toolkit for developers. This includes a reference solver implementation and composable smart contracts built on the proposed ERC-7683 standard. By offering shared infrastructure, the framework allows developers to build and deploy intent-based systems more easily without being locked into a single provider.

Improving security is a key benefit of standardizing these complex interactions. The industry has seen how sophisticated attacks can exploit system vulnerabilities, such as the recent Coinbase data breach that was revealed to be an insider plot. In another instance, a hacker who allegedly exploited the exchange later lost nearly $1M by panic-selling tokens.

The OIF’s use of automated solvers also aligns with a growing industry trend toward blockchain-AI integration. The Ethereum Foundation launched an AI team to position its network as a settlement layer for a future machine economy. Similarly, other companies like Circle are developing solutions that enable AI agents to pay for online services autonomously using stablecoins, showing a clear path for such specialized agents.

Described as a “public good initiative,” the OIF project’s ultimate goal is to make cross-chain interactions feel as seamless as modern web experiences. This would allow for more intuitive applications in areas like e-commerce, while still benefiting from the security of the Ethereum network.

nextThe post Coinbase Joins Ethereum Foundation to Back Open Intents Framework appeared first on Coinspeaker.

You May Also Like

LG Electronics To Raise $1.3 Billion From Indian Unit’s IPO Amid Consumer Boom

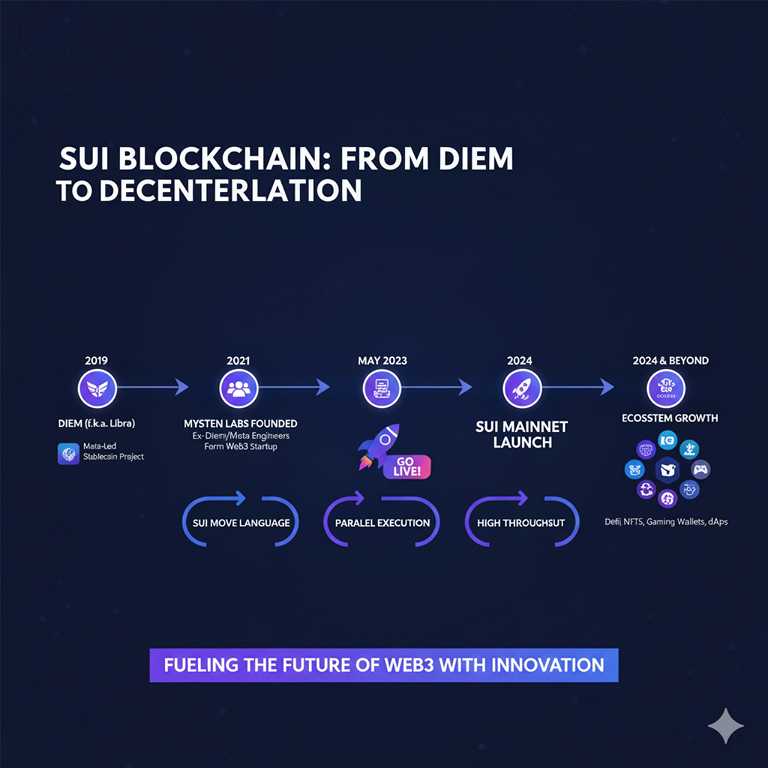

Sui Blockchain Explained (2025): Move Language, High-Speed Layer-1 & The Future of Web3