Breaking XRP News Today: 20% Yields Through Dual-Chain Staking from XRP Tundra

Average DeFi returns have stagnated across most major networks, but XRP Tundra has introduced something different. The cross-chain protocol built on the XRP Ledger and Solana has launched its Cryo Vaults, a staking framework delivering verifiable on-chain yields of up to 20% APY.

For XRP holders, it’s the first audited system offering native yield without relying on exchange custody or centralized loan programs. The launch expands XRP’s utility far beyond payments and transfers. Instead of operating purely as liquidity infrastructure, the network now supports direct, non-custodial income generation through dual-chain smart-contract staking — connecting Solana’s speed with XRPL’s traceability in one verified system.

Cryo Vaults Bring Real Yield to XRP Holders

The Cryo Vaults function as self-contained smart-contract pools that calculate and distribute rewards based on defined lock durations. Users can stake TUNDRA-S, the Solana-based utility token, or pair their XRP for joint staking positions. Four timeframes — 7, 30, 60, and 90 days — determine the reward rate, with higher yields for longer commitments.

Each vault’s contract logic has been published for independent verification. Instead of the opaque interest models used by custodial services, Cryo Vault payouts are determined by open formulas that calculate participation ratios and time-based multipliers.

The Cryo Vault activation follows the project’s ongoing presale. In its current phase, TUNDRA-S is priced at $0.158 with a 10% token bonus and paired TUNDRA-X allocations issued free at a $0.079 reference value. Those who join during the presale gain priority access to early staking tiers and higher yield multipliers once vaults go live.

Frost Keys: On-Chain Boosters for Smarter Yield

Adding to the staking model’s flexibility are Frost Key NFTs, which function as programmable yield enhancers within the Cryo Vault ecosystem. These NFTs directly modify staking parameters such as lock duration or APY percentage, letting users optimize their returns without manually altering their deposits.

For example, a Frost Key can add a 5% bonus to a standard 60-day lock, or shorten a 90-day lock to 60 days while maintaining the same APY. Each NFT interacts directly with the staking contract, ensuring that boosts are calculated and enforced on-chain.

This approach introduces something new to DeFi yield systems: personalization. Instead of offering flat rates, XRP Tundra turns staking into an adaptive experience powered by auditable smart contracts.

How It Works: Verified Dual-Chain Architecture

XRP Tundra’s multi-layer staking system operates under two complementary tokens.

- TUNDRA-S (Solana): The performance token that powers staking and vault participation.

- TUNDRA-X (XRP Ledger): The governance and reserve token that anchors cross-chain accountability.

When a user stakes assets in a Cryo Vault, Solana executes the reward logic instantly, while XRPL records the proof of participation. The result is a unified yield platform where speed and auditability coexist — a rarity in DeFi.

Behind this dual-chain coordination is a secure bridge infrastructure that ensures staking data cannot be manipulated between networks. The configuration not only supports XRP and TUNDRA-S, but also lays the groundwork for future integrations with other Layer-1 assets, extending Tundra’s reach beyond its current scope.

Security Validation and Institutional-Grade Transparency

Yield products succeed only if they are trusted, and XRP Tundra has made transparency central to its architecture. The project underwent three independent audits by Cyberscope, Solidproof, and FreshCoins, confirming the integrity and immutability of its contracts. Solidproof’s assessment awarded a 95% security rating with zero critical issues.

Corporate verification adds another layer. Through Vital Block, the development entity completed full KYC documentation, validating team accountability while preserving operational security.

For investors asking is XRP Tundra legit, these records present clear evidence. Every contract hash, audit report, and identity certificate is publicly accessible — allowing participants to verify the system’s legitimacy rather than taking claims at face value.

Demand for Secure Yield Surges Among XRP Users

XRP Tundra’s staking platform arrives at a time when market confidence is shifting from speculative trading to yield-based sustainability. Major exchanges currently offer XRP “earn” programs capped between 1% and 3.5%, but those rely on custodial wallets and non-transparent loan desks. Cryo Vaults, by contrast, use verifiable smart contracts that execute payouts without intermediaries.

More than $2 million has already been raised through Tundra’s presale, and the community surrounding the project continues to expand — over 6,800 followers on X and 6,400 members on Telegram. The Arctic Spinner rewards campaign has distributed $32,000 to date, reinforcing user participation ahead of the full Cryo Vault rollout.

A New Staking Standard for XRP and Solana Ecosystems

The launch of dual-chain staking marks a clear expansion of XRP’s utility within decentralized finance. The system connects Solana’s performance layer with the XRP Ledger’s transparent accounting to create a single, audited environment for yield generation.

In an industry where unverified promises often end in disappointment, XRP Tundra’s audited, documented, and publicly verifiable model sets a new reference point for what yield platforms can achieve.

Stake across two chains, earn up to 20% APY, and verify every result on-chain — XRP Tundra has made it possible.

Buy Tundra Now: official XRP Tundra website

How To Buy Tundra: step-by-step guide

Security and Trust: Cyberscope audit

Join The Community: Telegram

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

Tech Influence on Markets: A Deeper Impact Than the Dot-Com Era

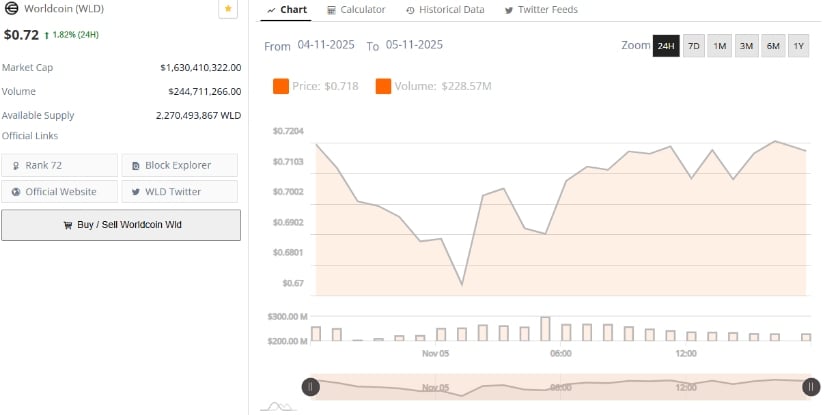

Worldcoin Price Prediction: WLD Tests $0.70 Support as Downtrend Extends