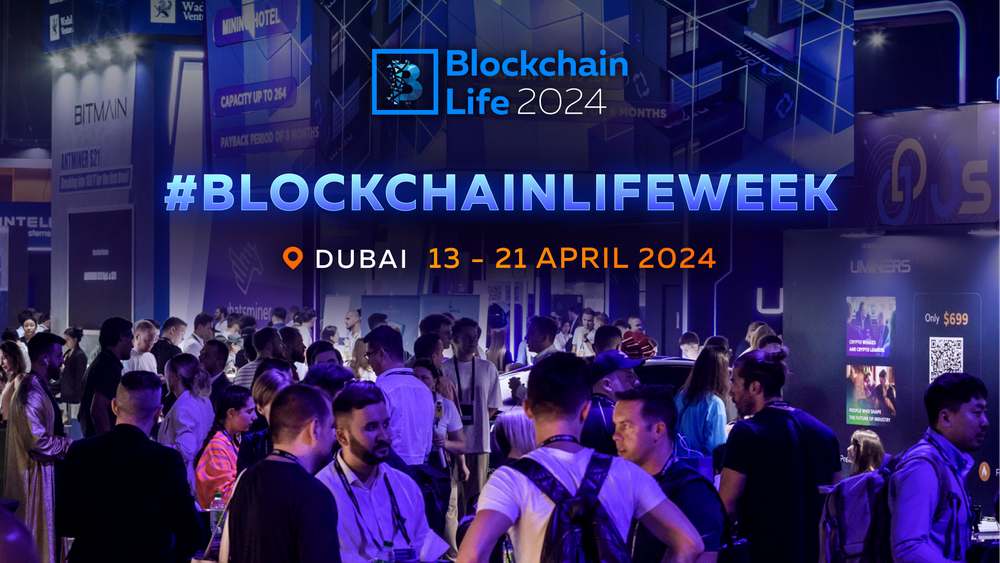

Blockchain Life Week in Dubai: we have never seen this before

The upcoming Blockchain Life 2024 Forum is set to be a game-changer for industry professionals and crypto enthusiasts from all over the world. With a lineup of renowned speakers confirmed, including the Founder of Tron, CEO of Tether, and CEO of Ledger along with many other leaders of the global crypto market. Gatheringover 8000 attendees from 120 countries, this massive Forum has to be considered as the main event of thefirst half of 2024.

But the excitement doesn't stop there. From April 13 to 21 crypto people will dive into an unbelievable Blockchain Life Week,filled with exciting side networking parties and events. It will enhance attendees' experiences and get everyone fully prepared to maximize earnings during the upcoming Bull Run.

A VIP ticket to Blockchain Life 2024 allows you to visit some side events for free.

The list is updated with new events every day.

Buy a ticket to Blockchain Life 2024:

https://blockchain-life.com/asia/en/

You May Also Like

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?

Fed rate decision September 2025