BlackRock’s Bitcoin ETF Nears $100B, Becomes Firm’s Most Profitable Product

- BlackRock’s IBIT is making history as it nears $100 billion in Asset Under Management (AUM), becoming one of the few out of the over 4,500 ETFs to achieve this milestone.

- An analyst has labeled the 2025 Bitcoin rally as the most structured in its history and predicts a run to at least $130,000.

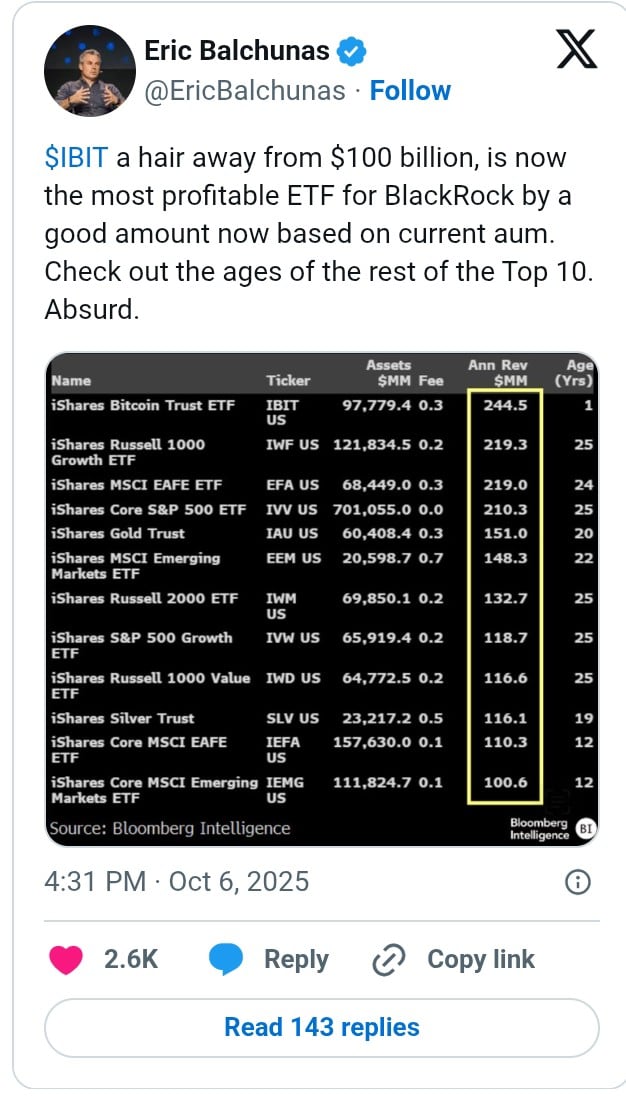

Bloomberg ETF analyst Eric Balchunas has hinted that the iShares Bitcoin Trust ETF (iBIT) has now become the most profitable ETF for BlackRock. According to the analyst, it is just some $2 billion away from becoming the fastest ETF to reach $100 billion in total Asset Under Management, as discussed in our previous news story.

Details of BlackRock’s IBIT Incredible Run

In a post, Balchunas lauded this impressive feat, highlighting that the Vanguard S&P 500 ETF needed 2,011 days to reach its current best. Meanwhile, IBIT is achieving this in just 435 days. As mentioned in our previous news brief, the IBIT’s AUM was around $70 billion in June, and had outpaced Gold’s ETF by 5 times.

Based on our research, BlackRock’s IBIT held about 783,767.84 BTC as of October 3. Days ago, 7,860 BTC was added, taking the total to 791,628 BTC. At Bitcoin’s daily high of $125k, its holding was worth almost $99 billion. According to Balchunas, IBIT also leads the company’s funds by annual revenue.

Overall, the US spot Bitcoin ETFs have had some impressive numbers since their inception in January 2024, recording a net inflow of around $61.5 billion. In total, the Asset Under Management is now around $170 billion. Fascinatingly, BlackRock’s performance so far has received applause from multiple experts.

According to NovaDius Wealth Management President Nate Geraci, only 18 out of the more than 4,500 ETFs have been able to achieve $100 billion AUM. To appreciate this even more, Geraci pointed out that the first ETF emerged in 1993, implying that BlackRock has attained a feat only a few could ever dream of in the industry’s 32-year history.

Bitcoin’s 2025 Performance

Commenting on the recent Bitcoin price, BRN Head of Research Timothy Misir has noted that the Bitcoin rally recorded this year is so far the most structured in its history.

While he confirms that there is a short-term overheating risk, he also admitted that the market has seen sustained real demand. In the meantime, he expects the price to hover within the $123,000 and $126,000 range before breaking out to between $130,000 and $135,000.

Our recent analysis also shows that Bitcoin has already entered a pre-euphoria phase. Meanwhile, 63% of analyst Plan B’s followers believe that Bitcoin could fall to below $100k at some point, as noted in our recent publication.

You May Also Like

What Web3 Means for the Future of Digital Fun — Beyond Finance

Russia's ruble becomes the world’s best-performing currency, up 40% against the dollar