Allocating Just 10% to Solana Boosted Portfolio Returns by 44% — Study Finds

- The Solana price rally in the last five years has enticed investors, with Bitwise noting how investors have gained by adding SOL to their traditional portfolio.

- Crypto market analysts have shared mixed views of the next SOL price action as it bounces back from the crucial support at $180.

While the Solana blockchain network faces its own love-hate relationship within the crypto community, the SOL rally over the past few years has certainly attracted investors.

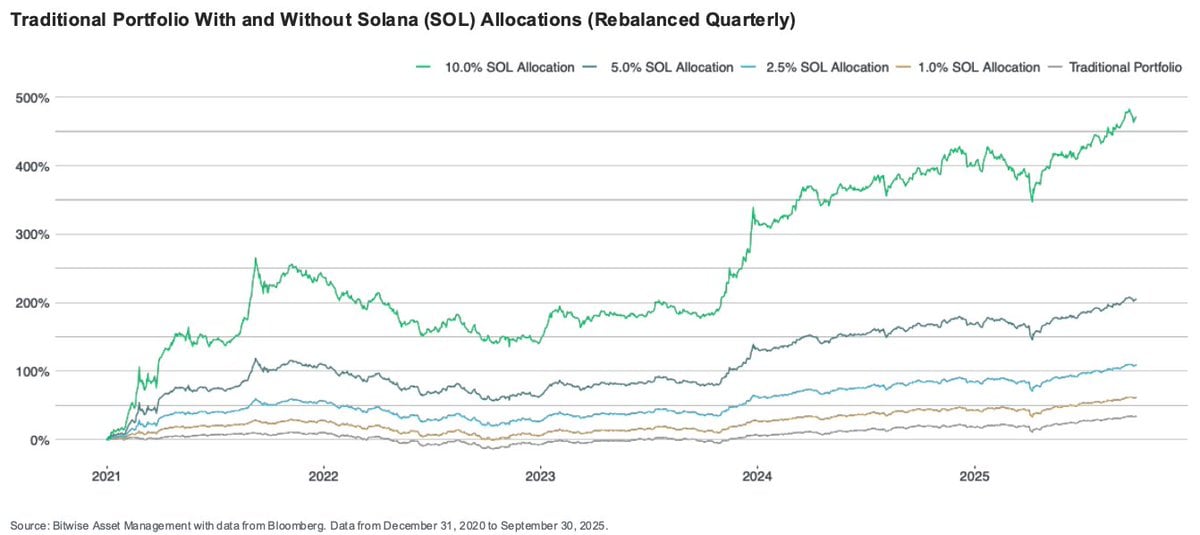

New analysis from Bitwise Asset Management shows that including even a small Solana allocation in a traditional 60/40 portfolio significantly enhanced performance over the past five years.

The study modeled a portfolio with 60% equities and 40% bonds, rebalanced quarterly.

How Adding Solana to a Traditional Portfolio Can Boost Returns

Market researchers at Bitwise Asset Management conducted a survey noting how adding Solana to a traditional investment portfolio could have boosted returns significantly.

According to the data, adding just 1% Solana (SOL) raised annualized returns to 10.54%. However, increasing allocations could have further enhanced the gains.

Source: Bitwise

Source: Bitwise

The study showed that a stepwise increase in allocations could have added further glitter to the portfolio. For e.g., 2.5% SOL delivered 16.64% (1.093), 5% SOL 26.22% (1.412), and 10% SOL 43.88% (1.687). Each step up showed stronger risk-adjusted performance versus the baseline. As reported by CNF, the institutional appetite for Solana has also been rising recently.

By comparison, diversified crypto allocations produced steadier but smaller returns. A 10% mixed allocation split evenly among Bitcoin, Ethereum, and Solana (33/33/33) returned 19.87% annualized, while a 50/30/20 BTC-ETH-SOL mix achieved 16.18% at 12.95% volatility.

Maximum drawdowns remained contained, suggesting that modest crypto exposure improved returns without severely increasing risk.

Overall, Bitwise’s findings indicate that adding small amounts of digital assets enhanced portfolio performance, raising annualized returns and Sharpe ratios while only modestly increasing volatility and drawdowns.

In addition to Bitwise, asset manager Grayscale also published a report identifying Solana as the leading smart contract network in terms of growth and real-world usage. The study ranks Solana ahead of most competitors across key metrics, including daily transactions, fee generation, and user engagement, supported by detailed on-chain data and ecosystem activity analysis.

Experts Share Mixed Views on SOL Price Action Ahead

Amid the broader crypto market correction, SOL price has tanked further and is currently found taking support at $180. As of press time, SOL price is trading 2.5% up at $185, with a market cap of $101 billion.

Thus, as SOL reverses its trajectory, crypto analyst Ali Martinez noted that the altcoin is ready to bounce back again and could reclaim the $210 levels from here onwards.

Crypto analyst Crypto Bullet has warned that Solana (SOL) may be approaching a major correction. In a post on X, the analyst noted that while the monthly candle still has two weeks left to close in green, Solana’s price action “looks cooked,” suggesting potential exhaustion in the current rally.

Source: TradingView

Source: TradingView

He added that if the market has entered Wave (C) of the Elliott Wave pattern, Solana holders should brace for significant downside volatility in the weeks ahead.

]]>You May Also Like

Cardano Price Outlook: Where Will ADA Be In 3 Years – Does It Have Higher 50x Potential Than RTX?

7 Best Crypto Presales This October for 100x ROI Potential