Solv and Chainlink integrate Proof of Reserve into SolvBTC: live on-chain anti-manipulation feed on Ethereum

Solv Protocol and Chainlink have launched a new feed that combines the market price with the on-chain verification of BTC reserves for SolvBTC, with a redemption rate anchored to the collateral and price limits designed to reduce manipulations.

According to data collected by Chainlink Data, the SolvBTC feeds show public timestamps and updates accessible from the mainnet since the announcement. Industry analysts note that the PoR+price model can directly impact over 2 billion dollars in tokenized BTC, reducing the likelihood of depeg during market stress. By monitoring the official pages (Solv and Chainlink Data), it is possible to verify the operational status of the feeds on Ethereum and BOB in real-time.

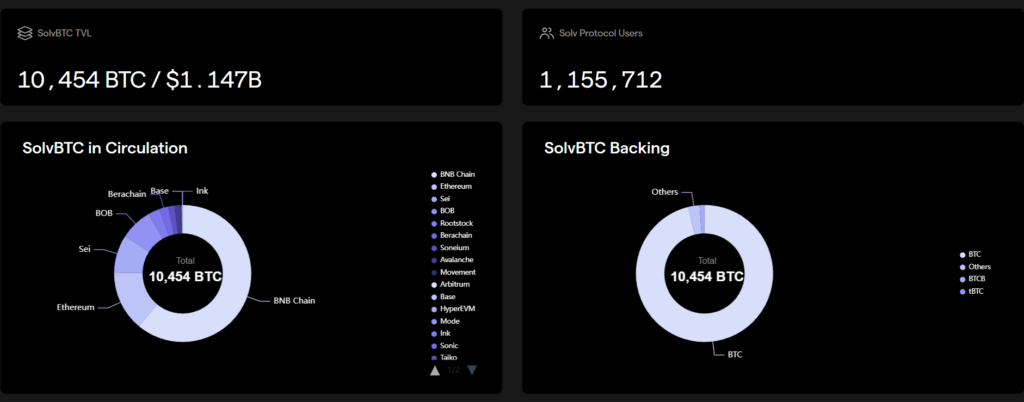

Solv Protocol shows data on its Bitcoin reserves collateralizing SolvBTC. Source: Solv Transparency

Solv Protocol shows data on its Bitcoin reserves collateralizing SolvBTC. Source: Solv Transparency

SolvBTC: what has been launched and where it is active

The new SolvBTC‑BTC feed combines the traditional exchange rate with the verification of reserves Bitcoin recorded on-chain. Unlike common price oracles, the value is anchored to the underlying collateral, enhancing transparency and consistency at the time of redemption. An interesting aspect is the immediate availability of data for public consultation.

- Ethereum mainnet: the Proof of Reserve (PoR) feed of SolvBTC is accessible with verifiable data and time-stamps.

- BOB network: the SolvBTC/BTC feed is operational for on‑chain pricing.

- Cross‑chain expansion: further integrations are in preparation, aiming to standardize the PoR + price model across multiple networks.

Why it impacts the price of SolvBTC

The feed directly integrates reserve coverage into the price calculation. This way, the redemption rate reflects not only the market spot price but also the actual availability of the BTC held, reducing possible misalignments between theoretical value and the value actually redeemable. It should be noted that the effect is particularly significant during times of volatility.

How the Protection Mechanism Works

The logic of the feed is structured to limit unjustified deviations, integrating multiple components into a single reference:

- Market Data: The BTC price is aggregated from Chainlink’s decentralized oracles, as indicated by Chainlink Data.

- Proof of Reserve: the feed includes the on-chain verification of SolvBTC’s BTC reserves, with public time-stamps ensuring transparency.

- Upper/lower limits: price bands derived from collateral coverage act to exclude outliers and mitigate manipulation attempts.

- Updates: the feed updates based on the frequency and thresholds configured on the oracle network; the related timestamps can be accessed via Chainlink Data.

Practical Examples (Simplified Scenarios)

- Full coverage (≈100%): the redemption rate remains close to the BTC spot price (except for fees or intra-chain slippage); in practice, 1 BTC remains equal to 1 BTC, meaning a redemption of ≈ 1:1.

- Coverage decreasing (e.g., 98%): with reduced coverage, the feed applies limits to reflect the lower collateral; for example, with 98% coverage, 1 BTC might be redeemable at ≈ 0.98 BTC until reserves are restored to 100%.

- Anomalous event: if the market rises while the reserve does not update in real-time, the upper band limits the deviation, helping to reduce the risk of spurious liquidations and possible depeg events.

Advantages for DeFi and lending protocols

For decentralized finance and lending protocols, pricing based on verified collateral helps reduce valuation errors and limit liquidations not backed by real resources, offering greater reliability even in highly volatile contexts. In summary, a more readable risk framework is obtained.

- Stronger prices for tokenized assets, with a reduced gap between NAV and market price.

- More readable collateral risk: creditors can assess exposure using verifiable and transparent data.

- Cross-chain integration: Consistent feeds across multiple networks reduce friction between protocols and vaults, facilitating wider adoption.

Limits and Risks Still Present

Despite the model increasing the resilience of the system, some risk factors remain. It must be said that no setup is free of dependencies.

- Smart contract risk: bugs or incorrect configurations can compromise the effectiveness of the PoR and the feed.

- Oracle dependencies: network congestion or outages can delay updates, affecting the timeliness of the data.

- Bridging and custody: if the custody of BTC or the bridges used do not ensure transparency, the effectiveness of PoR can be called into question.

- Partial coverage: in case of a decrease in reserves, the redemption rate immediately drops, protecting the system but penalizing the redeemable value; a factor that will need to be constantly monitored.

Implementation and Roadmap

- Status: the feed is active on the Ethereum mainnet and the SolvBTC/BTC feed is already available on the BOB network, according to the information provided by the teams and visible on the official data pages.

- Roadmap: further developments are planned towards other EVM networks and integrations with vaults, DEX, and lending protocols, with the idea of promoting a gradual adoption of the model.

- Operational transparency: the feed, both for the Proof of Reserve and the price feed, displays time-stamps and update statuses; further details (such as the exact frequency of updates and the total amount of verified reserves) are yet to be officially confirmed.

Key Terms (mini-glossary)

- Proof of Reserve (PoR): on-chain verification of the reserves that ensure the backing of a tokenized asset.

- Decentralized oracles: a network of independent nodes that publish data on the blockchain, helping to reduce single points of failure. Learn more about Decentralized oracles.

- Redemption rate: amount of collateral redeemable per unit of token, with a dynamic mechanism linked to the state of the collateral.

You May Also Like

Solana Price Plummets: SOL Crashes Below $90 in Stunning Market Reversal

New Developments Could Push Price Toward $0.40