Token’s 4,900% Surge Sparks ‘Bull Trap’ and Exit Scam Warnings

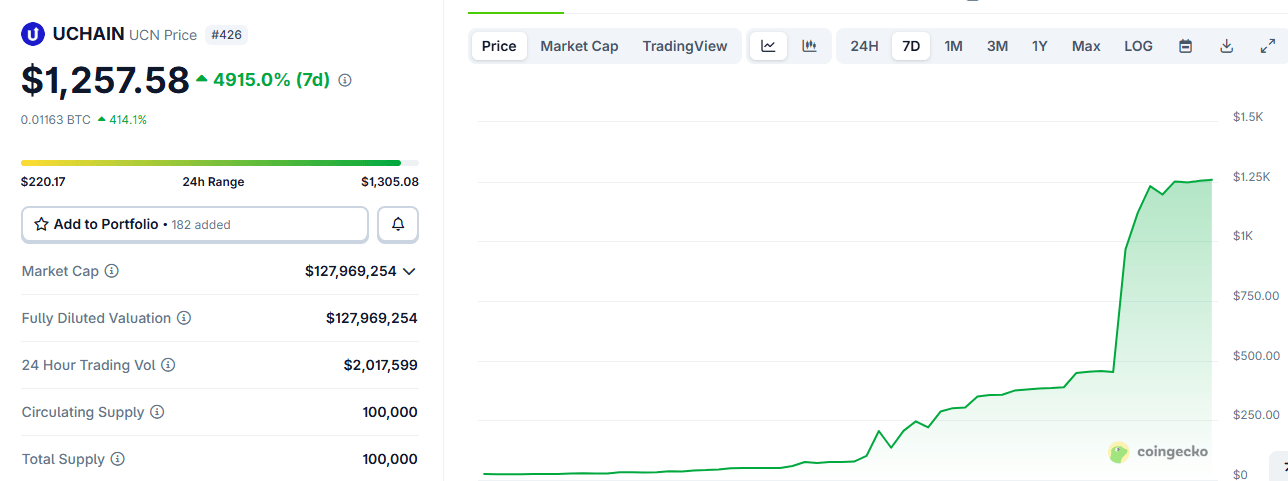

UCN has skyrocketed over 4,900% since August 27, with a 24-hour surge of more than 400% on August 29, climbing from $205 to $1,257. Despite the dramatic price jump, trading volume remained modest, under $2 million.

Mainnet Hype and Social Media Chatter

UCN, the native token of the Uchain project, has surged by more than 4,880% since Aug. 27. According to Coingecko data, the token was the top gainer on Aug. 29, rising by more than 400% in just 24 hours from $205 to $1,257. Despite this rapid appreciation, the token’s 24-hour trading volume remained largely under $2 million.

A report has linked UCN’s meteoric rise to user excitement surrounding the Uchain mainnet launch, which is scheduled for Sept. 1. A few social media accounts on X, some of which have since been deleted, fueled this excitement with teasing posts about the imminent launch, suggesting it could push the token’s price higher.

One account, Uchainupdates, posted on Aug. 28:

Another social media user, Blockchainoracle, whose account has also been deleted, cautioned that while UCN broke its 2025 resistance at $74, its “RSI at 89 screams overbought.” The user added that in such a scenario, the token is either “seeing a paradigm shift or classic bull trap.”

Despite UCN’s impressive market performance, social media chatter on the token remained surprisingly muted among major industry figures. Furthermore, the token’s thin liquidity has fueled fears that UCN could be yet another “pump and dump” scheme.

The lack of information or official updates on the imminent mainnet launch on the Uchain project’s official website and social media channels has also raised further questions about the project’s authenticity.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy