Cronos, Pyth, and Ethena Drive Altcoin Season Madness – Trump Media Bet Sends CRO Exploding

Altcoin season continues to show rotation into select assets rather than across the full market. This week, Cronos again takes the lead after a sharp rally tied to new corporate structures and improved on-chain activity. Pyth and Ethena also remain in view, each supported by utility within their ecosystems.

Traders describe altseason phases as periods when capital moves into non-Bitcoin assets. These phases often begin with tokens that already have liquidity and identifiable drivers.

Cronos, through its surge, illustrates how exchange-linked assets can draw flows when paired with broader market events. Pyth provides a case study in oracle infrastructure, gaining adoption. Ethena continues to show how synthetic stablecoins adjust to regulatory conditions.

Cronos (CRO): Treasury Structure and Upgrades Push Price Higher

Cronos is trading near $0.3393, representing a gain of about 28% in the past 24 hours. Market capitalization is about $11.3 billion, with supply around 33.6 billion tokens out of a possible 100 billion, according to CoinMarketCap.

The most direct driver came from a new treasury arrangement involving Trump Media, Crypto.com, and Yorkville Acquisition. The agreement created a corporate vehicle designed to hold and deploy billions in CRO.

Trump Media committed over $100 million in direct purchases, while Crypto.com added equity and liquidity support. Plans call for a Nasdaq listing under the ticker MCGA, placing CRO into a high-profile structure that has drawn traders and institutional observers alike.

This development arrived alongside technical and on-chain improvements. A July upgrade expanded interoperability through the Cosmos SDK and IBC, while also introducing a network safety circuit breaker.

Activity on the network has since risen, with gas consumption and contract deployment both showing double-digit growth. New perpetual contracts for CRO also expanded access for leveraged traders, creating an additional channel of demand.

Together, these elements explain why CRO has outperformed other exchange tokens during this stage of altcoin season. The token’s movement reflects both corporate linkage and measurable network progress, which has created depth across trading venues.

Pyth Network (PYTH): Oracle Feeds Gain Reach

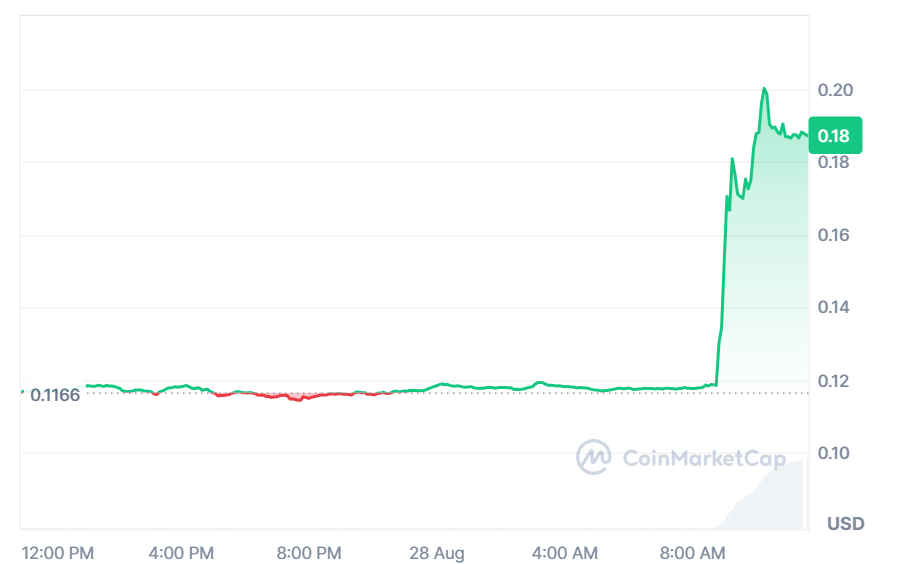

Pyth is trading at $0.1743, with a market capitalization near $1 billion and daily turnover above $300 million. The circulating supply stands at about 5.75 billion tokens out of a total of 10 billion.

PYTH Price (Source: CoinMarketCap)

The protocol provides pricing data for over 100 blockchains, sourced from institutional firms. Unlike push-based oracles, Pyth uses a pull model that allows applications to query pricing in real time. This structure has made it a preferred feed for derivatives protocols and decentralized exchanges.

Its presence across multiple ecosystems helps it retain steady trading interest during altcoin season, even without sharp speculative swings.

Ethena (ENA): Synthetic Dollar Protocol Adjusts to Regulation

Ethena is trading near $0.66, with a market capitalization of about $4.4 billion and a supply of around 6.6 billion out of 15 billion. Daily trading volume exceeds $700 million.

The project issues USDe, a synthetic stablecoin designed to maintain value through hedging positions rather than reserves. Regulatory shifts in the United States earlier this summer, particularly under the GENIUS Act, restricted interest-bearing stablecoins.

That outcome pushed demand toward alternatives like USDe, which nearly doubled its supply over July. Ethena governance has also approved regular buybacks to stabilize value, currently averaging several million dollars per day.

This design links ENA’s performance to policy and to the growth of its synthetic dollar. While less volatile than CRO, ENA remains active in altseason rotation as a proxy for stablecoin adoption.

Altcoin Season Outlook

Cronos provides the clearest example of how strong narratives combined with on-chain growth can lead to an altcoin season phase. Pyth adds a case where technical infrastructure sustains steady activity. Ethena demonstrates how regulatory changes can shape demand for synthetic assets.

Altseason is rarely uniform. Instead, specific drivers create movement in a handful of assets while others stay quiet. Cronos, Pyth, and Ethena together show how this selective rotation functions in the current market.

You May Also Like

‘One Battle After Another’ Becomes One Of This Decade’s Best-Reviewed Movies

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council