What Happens When You Sign a Crypto Transaction (And What Could Go Wrong)

\ If you’ve used a crypto wallet connected to networks with smart contract features, you’ve probably seen a button that says “Sign.” It might come up when you send tokens, log into a decentralized app (like an exchange), or try to claim an airdrop. It feels simple, like clicking “Accept” on a website. But in crypto, signing is much more than that. It’s a powerful action that tells the network, “I approve this.”

Understanding what happens when you sign can help you stay in control. It also helps you avoid common mistakes that could put your funds at risk. Let’s take a closer look at what signing means and how to stay safe.

You’re Proving Ownership, Not Just Clicking a Button

In crypto, signing means using your private key to approve a transaction. This is how a chain confirms that the person behind the wallet agrees to move funds or interact with code. Your private key stays hidden, but the signature you create shows that you are the owner of the wallet.

When you sign a transaction, you’re approving a message or action. Those might include the address you’re sending funds to, the amount being sent, and other data. If you’re using a decentralized app, that message might also include instructions for a smart contract.

Wallets like MetaMask or Phantom help create and sign these messages for you. They make it possible to interact with the network (Ethereum, Polygon, etc.) without ever showing your private key. The signature confirms that you approved the action.

This process is similar to signing a digital contract. You don’t need to understand all the math behind it, but it helps to know that your approval carries weight. The network takes your signature as proof that the transaction is valid and came from you.

What Could Go Wrong When You Sign

While signing is essential for using certain features in numerous crypto networks, it can also open the door to problems if you’re not paying attention. One common mistake is signing something you don’t understand. Some wallets show long strings of code or confusing prompts that make it hard to know what you’re agreeing to. This is often called blind signing.

Blind signing makes it easy for bad actors to trick users. You might think you're approving a harmless transaction, but you could be giving permission to move all the tokens in your wallet. Some scams involve fake versions of trusted websites that prompt you to sign in. Others involve smart contracts that request unlimited spending rights without clearly showing it.

There are also cases where you sign a message not to send funds, but to log into a platform or prove ownership of your address. That kind of signing is common and can be safe, but it still creates a link between your wallet and a specific action. If a site turns out to be dishonest or poorly designed, even those simple messages can expose you to tracking or phishing attempts.

Some wallets offer ways to view what you’re about to sign, but the information shown is often hard to understand. If the message is unreadable or looks suspicious, it’s always better to pause and investigate before moving forward.

How Obyte Helps You Avoid Signing Mistakes

Obyte is a crypto platform that takes a different approach. Instead of leaving users to guess what they’re signing, the Obyte wallet gives clear previews of what will happen. When you send funds to a smart contract or “Autonomous Agent” (like a DEX or bridge) on this ecosystem, the wallet shows you a full description of the expected outcome.

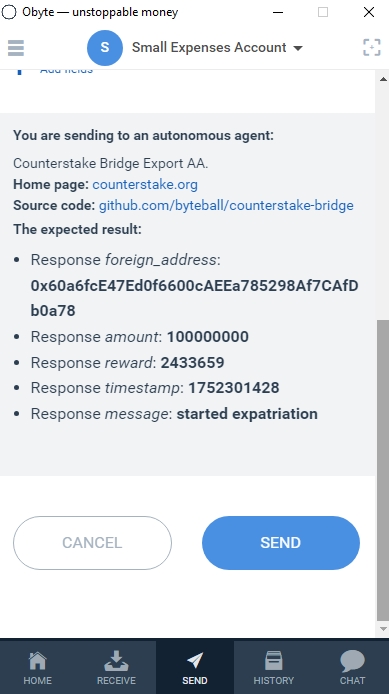

For example, if you use a bridge like Counterstake to send assets to another chain, the wallet will tell you the name of the agent you’re sending to, the address you’ll receive the funds on, the amount, fees, the reward you’re getting, and even a timestamp. It also shows you the website of the agent and a link to its source code. This makes it easier to confirm that you’re interacting with the right service, with predictable results.

\

This level of transparency helps users avoid blind signing. Instead of trusting a vague prompt, you see the details laid out in a way that makes sense. You can approve the transaction with more confidence because you know what’s going to happen next.

Why It Pays to Read Before You Sign

Remember: signing is how you approve actions on a chain or network, from sending funds to using apps. But mistakes often happen not from hacks, but from signing too fast without checking the details. If you’re unsure what a wallet is asking, it’s smart to pause and review. Ask around, make a Google or AI search, and you’ll find out.

Platforms like Obyte help make this safer. They show clear previews of what will happen before you sign, so you’re not left guessing. With simple tools and transparent design, they make it easier to understand what you’re agreeing to—no technical background needed.

\

Featured Vector Image by vectorjuice / Freepik

\n

You May Also Like

“Vibes Should Match Substance”: Vitalik on Fake Ethereum Connections

Why Bitcoin Crashed Below $69,000 — Causes & Outlook