BREAKING: Pepe (PEPE) Surges 24% to $0.00000472 on Valentine’s Day

Pepe (PEPE), the frog-themed meme coin, has surged 24.2% in the past 24 hours to reach $0.00000472, marking one of the strongest single-day performances among major cryptocurrencies on Valentine’s Day 2026.

The rally pushed PEPE’s market capitalization to $1.98 billion, representing a $382.6 million increase and securing its position as the 41st largest cryptocurrency by market cap. Trading volume spiked to $636.7 million, indicating strong trader interest in the meme coin’s latest move.

Key Price Metrics

PEPE climbed from a 24-hour low of $0.00000377 to a high of $0.00000470, representing a 24.6% intraday range. The token has gained 22.7% over the past week, suggesting sustained bullish momentum after a period of consolidation.

However, the token remains down 20.1% over the past 30 days and sits 83.2% below its all-time high of $0.00002803, reached on December 9, 2024. The current price represents an 8,455% gain from its all-time low of $0.000000055142 set in April 2023.

Market Performance

The market cap change of nearly 24% matches the price performance, with the fully diluted valuation also reaching $1.98 billion. PEPE’s entire supply of 420.69 trillion tokens is currently in circulation, meaning there is no additional supply pressure from unlocks.

Short-term momentum indicators show strength, with PEPE gaining 2.98% in just the past hour, suggesting the rally may have further room to run if buying pressure continues.

Trading Implications

The $636.7 million in 24-hour volume represents approximately 32% of PEPE’s market cap, indicating highly active trading. This volume-to-market-cap ratio suggests strong liquidity for traders looking to enter or exit positions.

The breakout above the 24-hour range high of $0.00000470 could signal a test of higher resistance levels if the momentum sustains. However, traders should note the significant distance to the December 2024 all-time high, which stands as major overhead resistance.

The Valentine’s Day surge aligns with broader meme coin interest, though PEPE’s outperformance suggests token-specific catalysts may be at play. Volume and volatility are expected to remain elevated as traders react to the rapid price movement.

You May Also Like

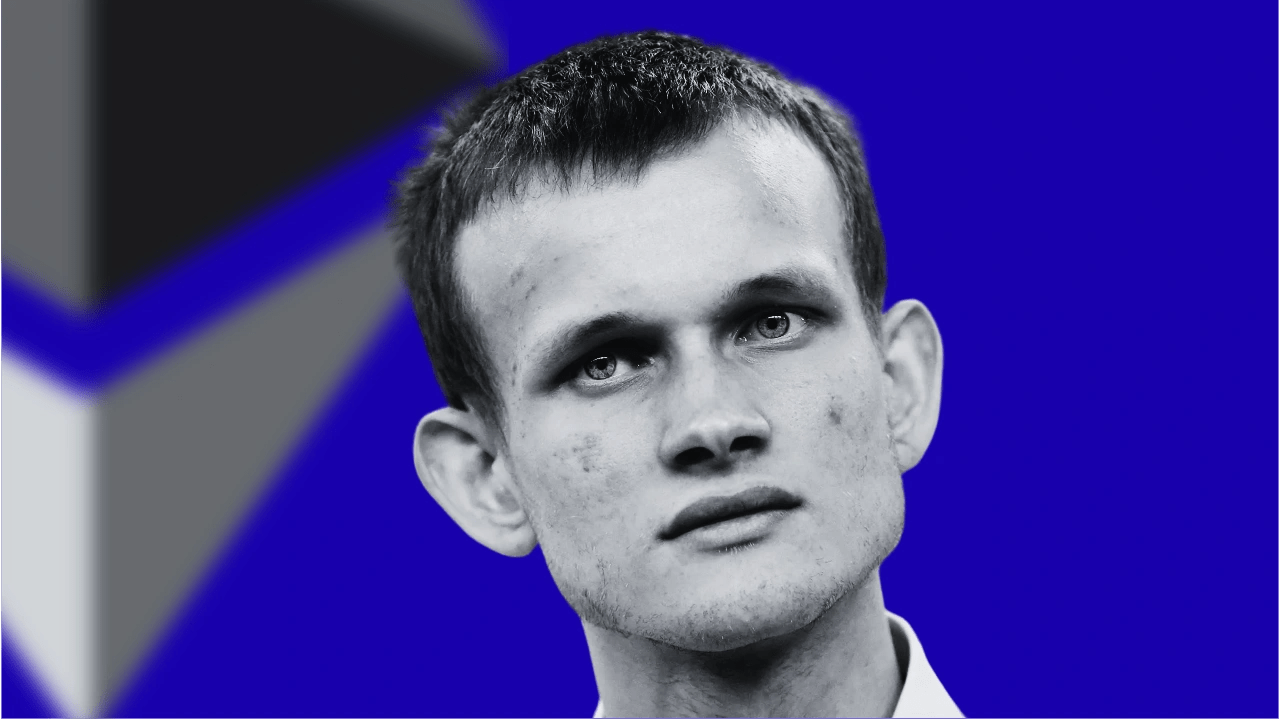

Vitalik Buterin is not happy about the current trajectory of prediction markets

River (RIVER) Plunges 19.4% as Post-ATH Correction Deepens to 83.6%