Cardano Price Eyes $0.34 Following Its Integration with LayerZero

Highlights:

- The Cardano price has increased by 5% to trade at $0.267 today.

- This follows Cardano’s integration of LayerZero in its major multichain expansion.

- The technical outlook shows ADA’s potential short-term recovery towards $0.34.

At the time of writing, on Thursday, the price of Cardano (ADA) is at 0.267, increasing about 5% in the past 24 hours. The mood in the derivatives is also on the positive side as the funding rates of ADA become positive and long bets among traders increase. On the technical front, it indicates a short-term recovery as the momentum pointers are declining in bearish strength. Meanwhile, Cardano has integrated LayerZero in its major multichain expansion. This will enable connecting over 150 blockchains, 400+ tokens, and over $80B in omnichain assets, which increases cross-chain integration and liquidity by many folds.

The funding rates of Cardano help in a recovery thesis. According to the data provided by CoinGlass OI-Weighted Funding Rate, the number of traders who bet on the further decline of the price of ADA is less than the number of traders who expect the price to rise.

ADA OI-Weighted Funding Rate: CoinGlass

ADA OI-Weighted Funding Rate: CoinGlass

The metric has been inverted into a positive rate on Wednesday and takes the current value of 0.0043% on Thursday, which means that longs are paying shorts. Whenever there is a reversal of the funding rates, that is, when the rates are moving towards positive, the price of Cardano rebounds sharply.

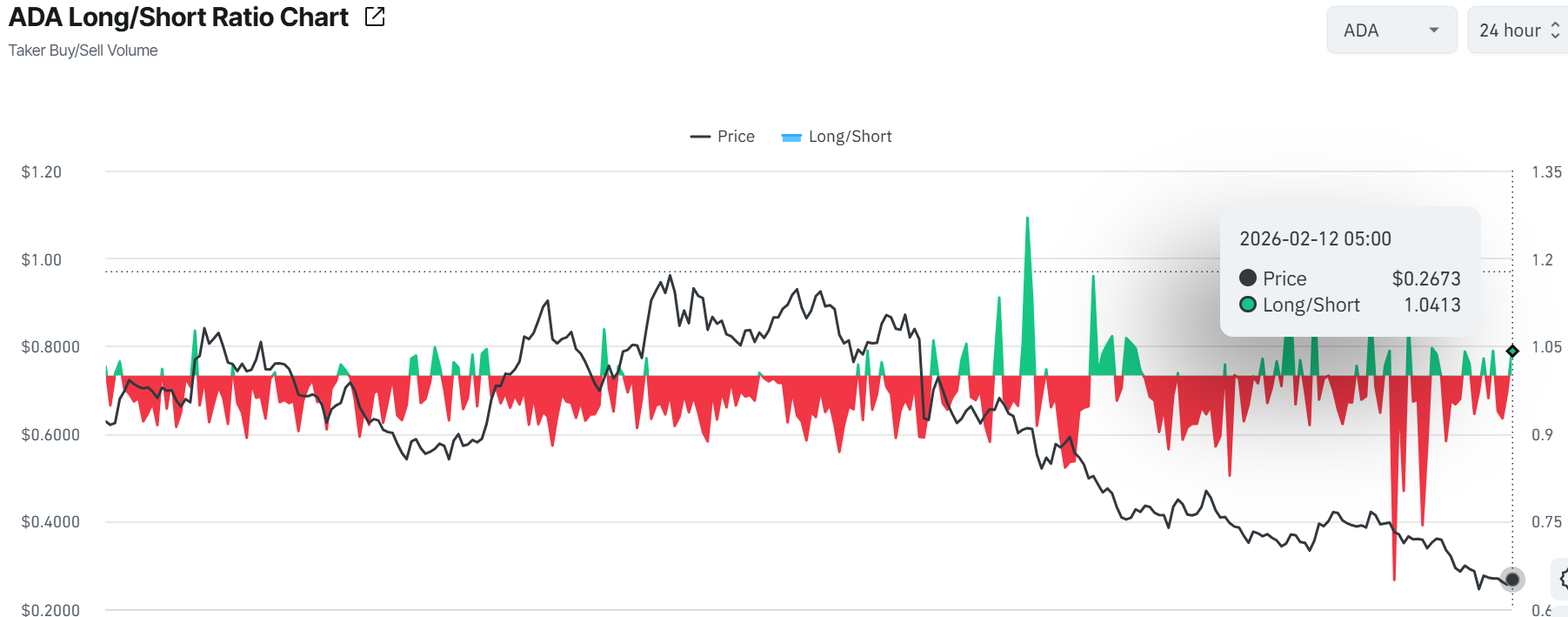

ADA Long/Short Ratio: CoinGlass

ADA Long/Short Ratio: CoinGlass

Moreover, CoinGlass has a long-to-short ratio of ADA of 1.04 on Thursday. The above ratio is higher than one, and this indicates that there are more traders who are placing bets on the price of Cardano to soar.

Cardano Price Eyes $0.34 Amid Fading Bearish Strength

The daily chart shows Cardano’s price action over the past few months, with a wild ride. Right now, it’s sitting at $0.267, from the recent lows of $0.221. The altcoin is trading well within a falling channel pattern, with a falling resistance currently at $0.34, which aligns with the 50-day SMA and support near $0.24.

Diving into the indicators, the Relative Strength Index (RSI) sits at 36.41, above the RSI-based MA, but still below the neutral territory. This means there’s room for Cardano price to run before the crypto hits exhaustion territory, potentially pushing toward that $0.59 barrier.

ADA/USD 1-day chart: TradingView

ADA/USD 1-day chart: TradingView

Looking at the bigger picture, if the recent recovery continues, Cardano could test the $0.34 resistance soon. If $0.24 support stays firm, Cardano might extend its short-term rebound. This could push gains to roughly 29% from current levels. However, there are risks. The recent spike is possibly fueled by the recent LayerZero integration, which unlocks the largest cross-chain connectivity expansion in Cardano’s history.

In the long term, if Cardano can break above $0.34 and hold, it might eye the long-term barrier at $0.59, which coincides with the 200-day SMA. On the downside, if the resistance zones prove too strong, ADA may plunge towards the $0.24 support, in which a deeper correction may open the door towards $0.221 lows. For now, the 5% pump is a green flag to ride the wave in the ADA market.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Rheem® and ecobee partner to launch the ecobee Smart Thermostat Lite | Works with EcoNet® Technology

Serrala Acquires e-invoicing and Accounts Payable Specialist Cevinio