BNB Price Prediction – BNB Risks Further Downside to $574 as Bearish Sentiment Persists

Highlights:

- BNB price has slipped below $600, currently exchanging hands at $588 mark.

- The derivatives market shows a negative sentiment, as the open interest drops and the funding rate flips negative.

- The technical outlook shows an intense bearish grip, as BNB risks further downside to $574.

BNB price, previously Binance Coin, is down below $600 on Wednesday, marking a 6% drop to $588. An aggressive wobbling crypto market is also promoting the bearish price action as Bitcoin leads with a drop to the $66,000 mark. Moreover, the short bets are increasing together with negative funding rates in the derivatives market. In the meantime, the BNB price has a further correction implied by technical analysis since bears are still on a roll.

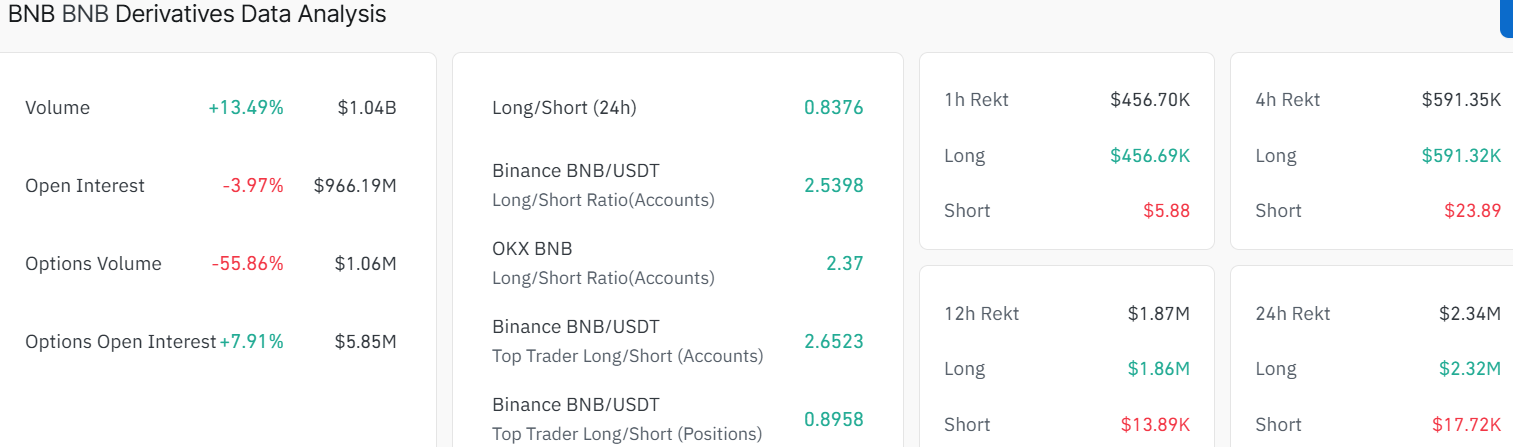

The derivatives data at BNB is bearish. BNB CoinGlass long-to-short ratio is 0.83 on Wednesday. This is a ratio which is lower than 1, and it means that the market is becoming less optimistic, where more traders are betting that the price of BNB will go down. Moreover, the open interest has plunged by 3.97% to $966.19 million, indicating that money is flowing out of the BNB market.

BNB Derivatives Data: CoinGlass

BNB Derivatives Data: CoinGlass

According to the data provided on CoinGlass regarding the OI-Weighted Funding Rate, there are more traders who bet that the price of BNB will fall even more than those who expect the price to rise.

BNB OI-Weigted Funding Rate: Coinglass

BNB OI-Weigted Funding Rate: Coinglass

As of today, the metric has flipped negative towards -0.0012%, showing that shorts are paying longs and that there is bearish sentiment in relation to BNB.

BNB Risks Further Downside to $574

The BNB/USD chart shows the token on a 1-day timeframe. Right now, it is hovering around $589, with a recent dip of 6% in the last 24 hours. The 50 Simple Moving Average (SMA) sits at $839, while the 200 SMA is at $917, which indicates the BNB token is riding a long-term bearish trend.

However, trouble is brewing as the Relative Strength Index (RSI) is plummeting and currently sits at 22.06, indicating intense oversold territory. The chart also shows a breakdown below the consolidation channel, as the bears show immense strength in the market.

BNB/USD 1-day chart: TradingView

BNB/USD 1-day chart: TradingView

Looking at the bigger picture, the 50-day SMA is sloping, as the blue 200-SMA is lagging, signaling a disconnect as momentum fades. However, BNB’s volume is currently up by 5.32% to $1.87 billion in the last day, which could mean fading bearish activity.

The MACD’s blue line dipping below the signal line is also a red flag, showing momentum is shifting, and fast. If BNB bursts below current price levels with conviction, the next stop could be $574 support. A worst-case scenario would be a crash toward $508 if panic sets in.

On the flip side, if bulls step in and initiate a buy-back campaign, a short-term rebound could be plausible. A push past $703 might dodge the bullet and aim for $793-$839 resistance zones. Meanwhile, the recent 6% drop is not a lock, but the chart is showing warning signs. Traders might want to keep an eye on the market and the RSI dip.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

The Italian banking giant held approximately $96 million worth of Bitcoin spot ETFs last December, hedged with Strategy put options.