Bitcoin Rebounds from $60K Capitulation Low, Eyes $74,500 Resistance This Week

Bitcoin Magazine

Bitcoin Rebounds from $60K Capitulation Low, Eyes $74,500 Resistance This Week

Bitcoin Price Weekly Outlook

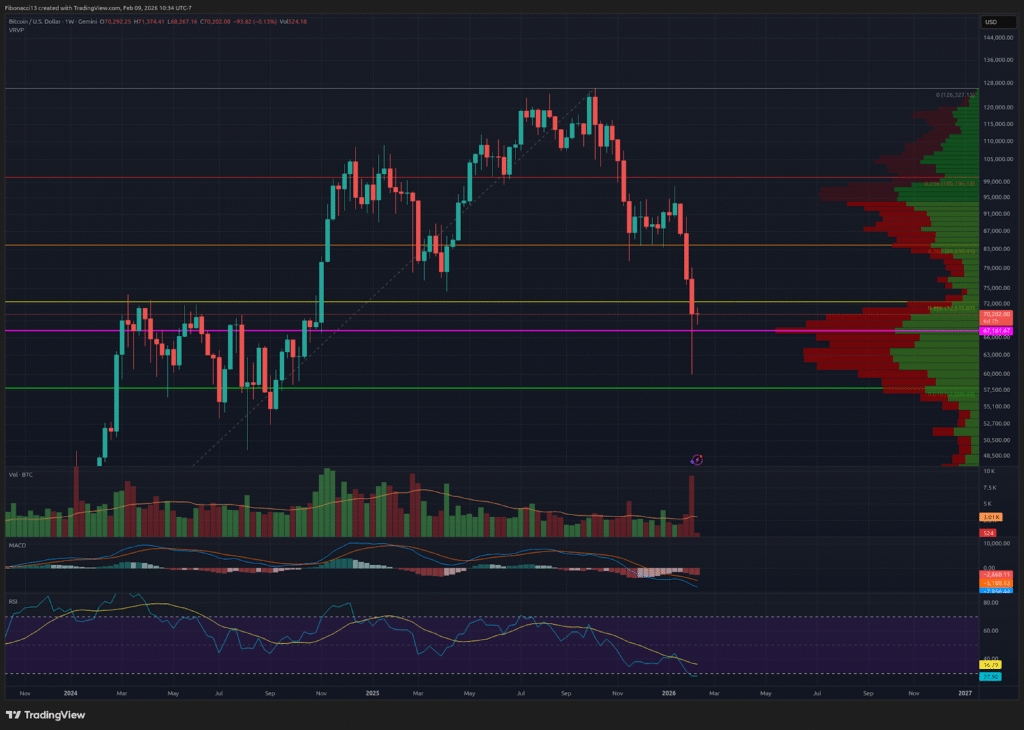

Well, that escalated quickly! The bitcoin price just melted all the way through the $70,000s and $60,000s last week, but finally found its footing at $60,000. The bulls battled back from down there to push the price back up to $71,700 before it moved back slightly to close the week out at $70,315. The bears covered a lot of ground to the downside last week, so the bulls will try to get back some ground this week. Expect $60,000 support to hold at least into this week.

Key Support and Resistance Levels Now

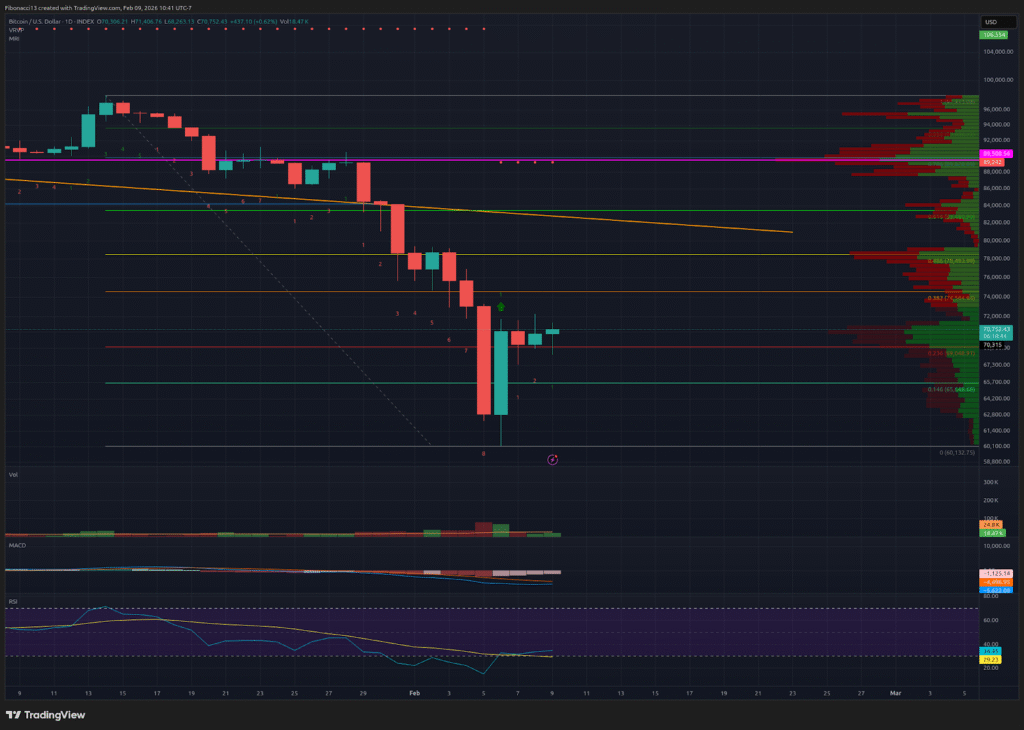

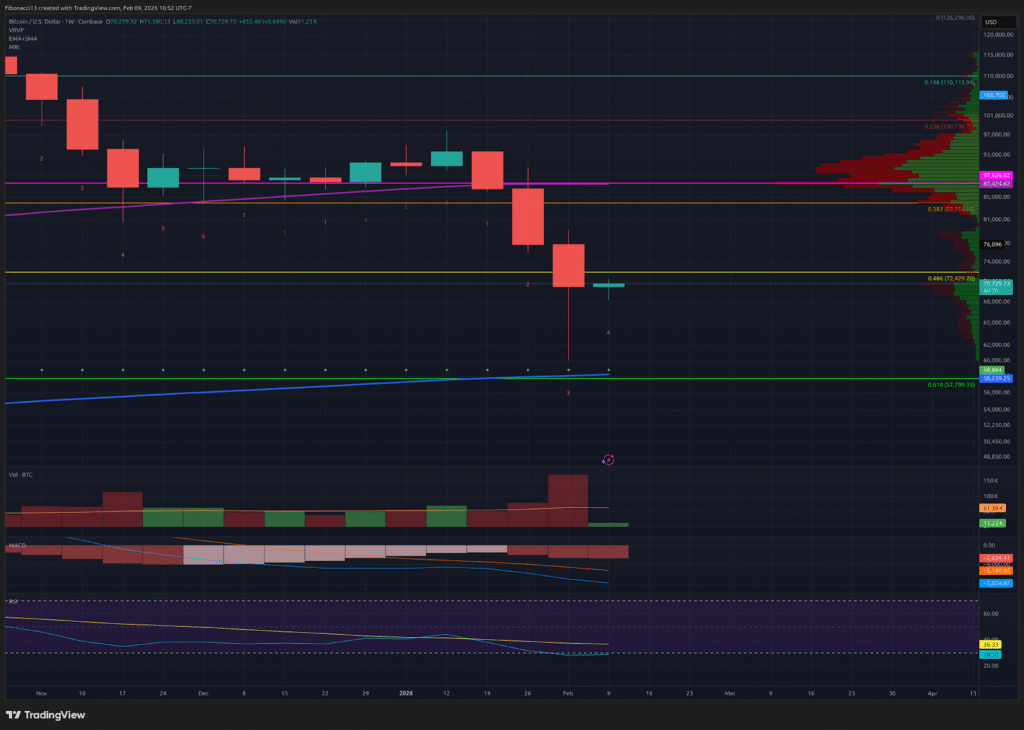

With such a big move down last Thursday, we will need to find new resistance levels to watch going forward. Over the short term, $71,800 is a level to watch after the price rejected there Friday into Saturday. Above here, we have the 0.382 Fibonacci retracement from the latest move down, sitting at $74,500. If the price can manage to climb above this level, $79,000 should be a strong resistance. $84,000 sits firmly above this level and should be very strong resistance going forward.

Looking below, the bulls will look to hold $65,650 in order to try to put in the reversal here. $63,000 sits just below here as support. Next, we have $60,000 as newfound support just above the 0.618 Fibonacci retracement at $57,800. Arguably, the true support sits at $57,800 here and was slightly front-run at that $60,000 low. If this level is lost, we will look all the way down to $44,000 for support, then $39,000 at the 0.786 Fibonacci retracement below here.

Outlook For This Week

The MRI Indicator gave us a buy signal on Friday last week on the daily chart off of the $60,000 low. The move was strong from that level, so the bulls will have to try to capitalize on this bounce to continue the momentum into this week. This signal can produce a full reversal, but often only results in a 1 to 4 candle correction of the trend. So if the bulls can keep the push higher going into Wednesday, we may be looking at a sustainable reversal on the daily chart, which could attempt to reclaim the $80,000 level.

Market mood: Bearish – The price lost a lot of ground last week. The bears are in control. Period.

The next few weeks

The bears took the price down another big leg last week. Weekly RSI hit oversold levels and produced a big bounce. After such a significant drop and such a big bounce back from $60,000, the price should remain constrained within a range here for at least the next few weeks. Do not expect to see any price action above $80,000 or below $60,000 for the next few weeks.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

Oscillators: Technical indicators that vary over time, but typically remain within a band between set levels. Thus, they oscillate between a low level (typically representing oversold conditions) and a high level (typically representing overbought conditions). E.G., Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD).

RSI Oscillator: The Relative Strength Index is a momentum oscillator that moves between 0 and 100. It measures the speed of the price and changes in the speed of the price movements. When RSI is over 70, it is considered to be overbought. When RSI is below 30, it is considered to be oversold.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

Momentum Reversal Indicator (MRI): A proprietary indicator created by Tone Vays. The MRI indicator tracks buyer and seller momentum and exhaustion, providing signals to indicate when to expect momentum to fade and accelerate.

This post Bitcoin Rebounds from $60K Capitulation Low, Eyes $74,500 Resistance This Week first appeared on Bitcoin Magazine and is written by Ethan Greene - Feral Analysis and Juan Galt.

You May Also Like

Hadron Labs Launches Bitcoin Summer on Neutron, Offering 5–10% BTC Yield

South Korea Launches First Won-Backed Stablecoin KRW1 on Avalanche