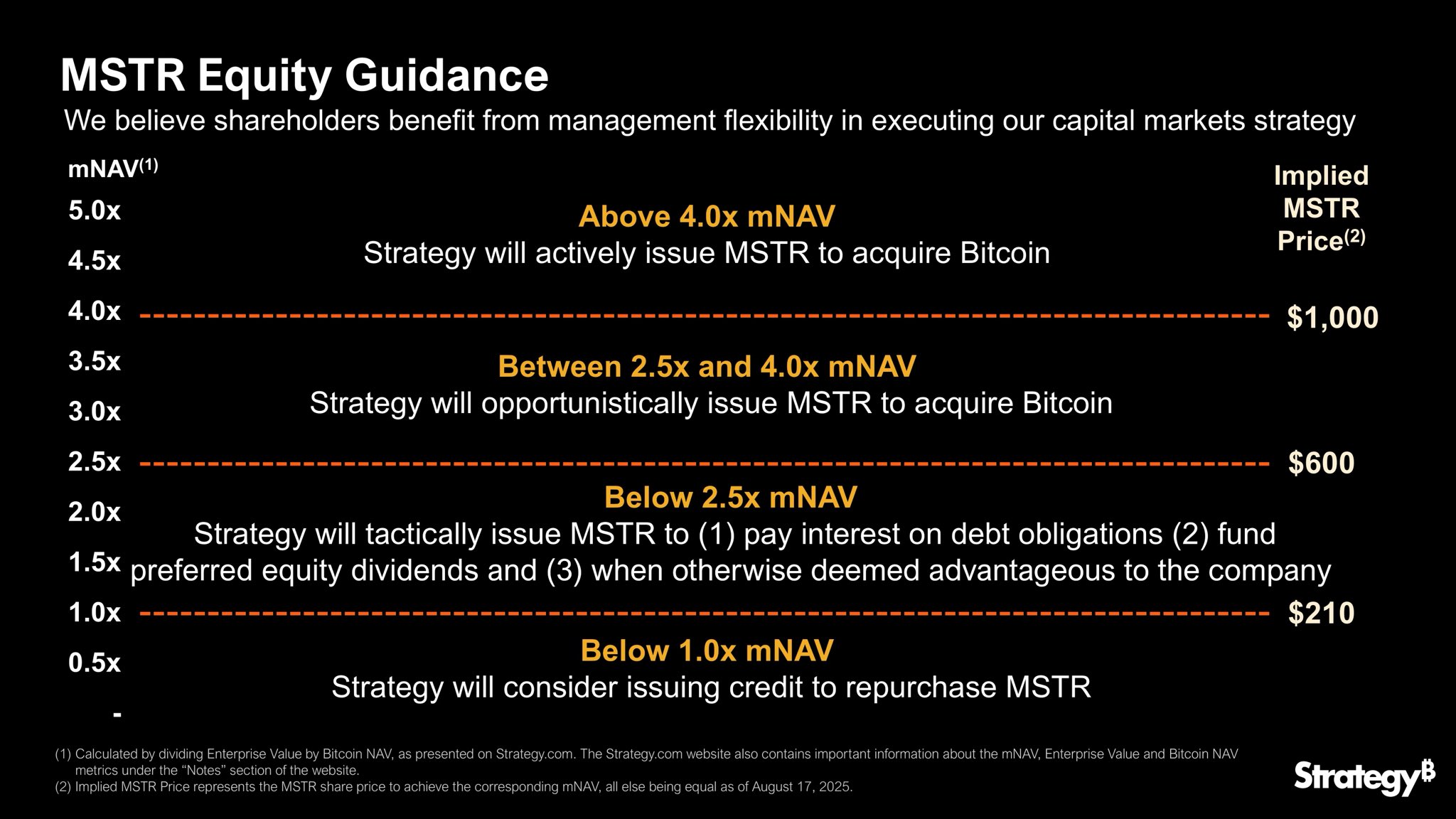

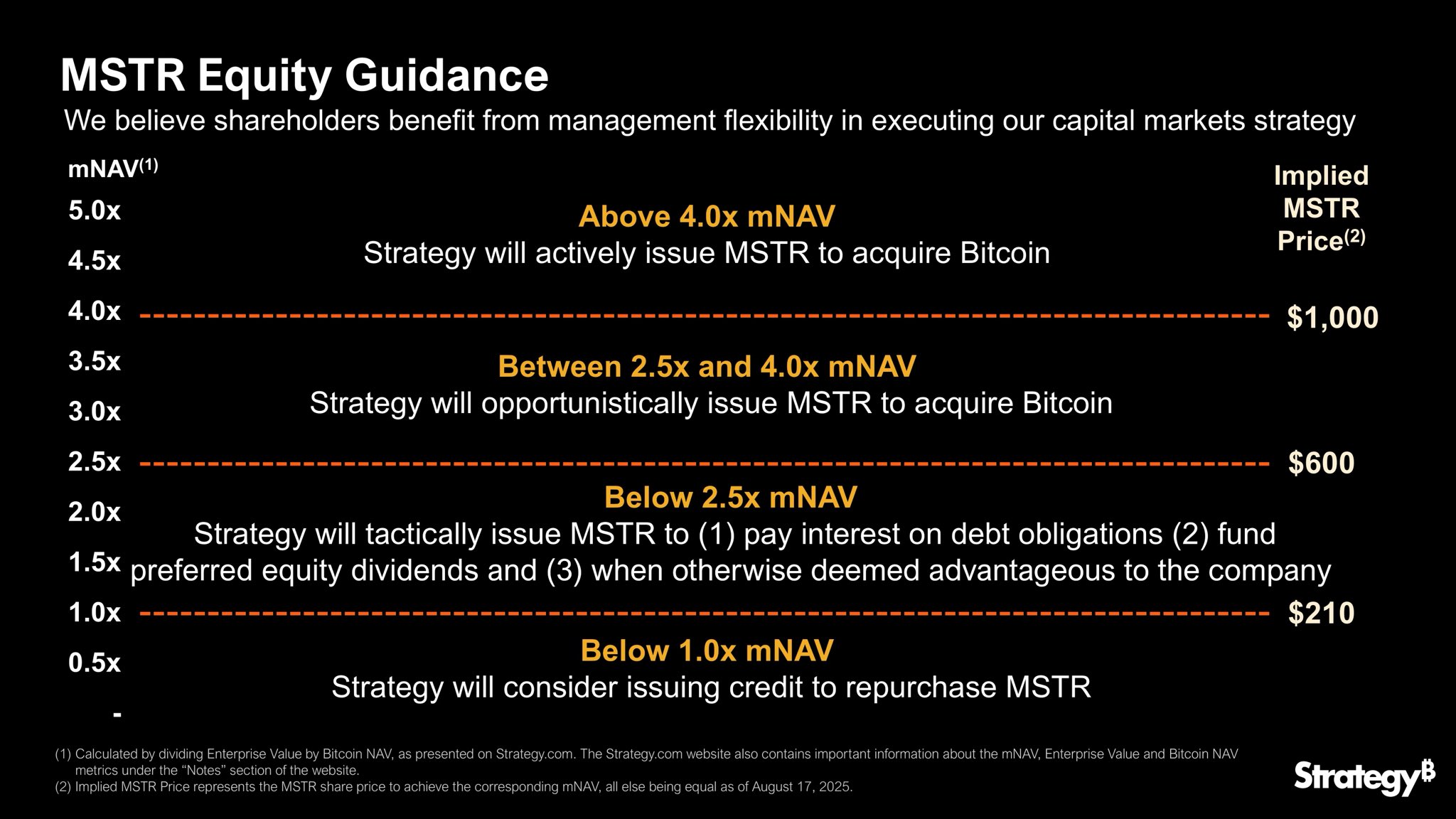

Strategy has again grown its already massive Bitcoin stash, but its latest financial update has triggered worries that the company's approach could eventually backfire. Notably, while Chairman Michael Saylor insists the plan gives the firm more flexibility, a prominent expert believes it could push the company into a dangerous cycle that hurts both shareholders and its Bitcoin strategy. For context, just yesterday, on Aug. 17, Strategy revealed it had purchased 430 more Bitcoin, spending about $51.4 million at an average price of roughly $119,666 per coin. This new purchase lifted the company's total holdings to 629,376 Bitcoin, worth about $46.15 billion in total. The company said its average purchase price sits at $73,320 per Bitcoin and that its Bitcoin investments have delivered a 25.1% return so far this year. Strategy Releases Equity Guidance After Latest Bitcoin Buy Following the announcement, Michael Saylor shared an update about how Strategy plans to manage its stock in relation to the value of its Bitcoin. Notably, he explained that the company uses a measure called mNAV, or market net asset value, which compares the company's share price to the value of the Bitcoin it owns. Depending on where the share price sits relative to that benchmark, Strategy will take different actions. Specifically, if MSTR trades at more than four times its mNAV, Strategy plans to sell new shares aggressively to buy more Bitcoin. If the stock trades between two-and-a-half and four times its mNAV, the company will still issue shares but only when it sees a good opportunity. Meanwhile, the approach changes once the stock drops below two-and-a-half times mNAV. In that range, Strategy would sell shares not just to buy Bitcoin but also to handle debt interest, pay preferred equity dividends, and cover other needs.  Strategy Equity Guidance in Relation to Bitcoin mNAV Further, should the shares crash to below 1x mNAV, the company confirmed it could borrow money so as to buy back its own stock. For perspective, at a four times mNAV, Strategy's implied price would sit at $1,000. Meanwhile, the price would hover around $600 for a 2.5x mNAV, and $210 at a 1.0x mNAV. Today, Strategy's stock trades at $344, carrying an mNAV of 1.58x. Experts Express Concerns Saylor presented this plan as a way to give management more options when dealing with the market, but not everyone feels confident about it. Dom Kwok, co-founder of the blockchain education company EasyA, warned that the strategy could trap Strategy in what he called a spiral of doom. https://twitter.com/dom_kwok/status/1957801027853324701 Kwok argued that if the company keeps selling new shares to pay off debt, shareholders will see their stakes diluted. Each round of dilution could pull the stock price lower, which would then force the company to sell even more shares to raise money. Over time, that cycle could snowball, with falling share prices and growing debt costs pushing the company into a position where it might need to sell some of its Bitcoin to stay afloat. In addition, speaking on the recent update, pseudonymous surgeon and market commentator Operation Danish claimed that the "Ponzi" is now starting to unravel. Crypto community pundit Based16z also suggested the Strategy Chairman was already "folding." Strategy still holds the largest corporate Bitcoin reserve in the world, and Saylor continues to promote Bitcoin as the best long-term store of value. However, the company's heavy reliance on issuing shares to fuel its Bitcoin buying has triggered criticism from analysts who question whether the model can hold up.

Strategy Equity Guidance in Relation to Bitcoin mNAV Further, should the shares crash to below 1x mNAV, the company confirmed it could borrow money so as to buy back its own stock. For perspective, at a four times mNAV, Strategy's implied price would sit at $1,000. Meanwhile, the price would hover around $600 for a 2.5x mNAV, and $210 at a 1.0x mNAV. Today, Strategy's stock trades at $344, carrying an mNAV of 1.58x. Experts Express Concerns Saylor presented this plan as a way to give management more options when dealing with the market, but not everyone feels confident about it. Dom Kwok, co-founder of the blockchain education company EasyA, warned that the strategy could trap Strategy in what he called a spiral of doom. https://twitter.com/dom_kwok/status/1957801027853324701 Kwok argued that if the company keeps selling new shares to pay off debt, shareholders will see their stakes diluted. Each round of dilution could pull the stock price lower, which would then force the company to sell even more shares to raise money. Over time, that cycle could snowball, with falling share prices and growing debt costs pushing the company into a position where it might need to sell some of its Bitcoin to stay afloat. In addition, speaking on the recent update, pseudonymous surgeon and market commentator Operation Danish claimed that the "Ponzi" is now starting to unravel. Crypto community pundit Based16z also suggested the Strategy Chairman was already "folding." Strategy still holds the largest corporate Bitcoin reserve in the world, and Saylor continues to promote Bitcoin as the best long-term store of value. However, the company's heavy reliance on issuing shares to fuel its Bitcoin buying has triggered criticism from analysts who question whether the model can hold up.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.