Ethereum Slides Below $4300 As Whales Increase Positions In Pepe And Remittix

According to on-chain data, fresh inflows have been hitting PEPE and Remittix (RTX); a footprint signaling the whales’ choice.

Investors are betting heavily on PEPE and Remittix (RTX). What potentials are they seeing?

Ethereum Price Dips But The Macro Bull Holds

The current market play isn’t new; ETH corrects, then grinds back. Ethereum price pulled below $4,300 as funding cooled and majors caught a late-session sweep. Derivatives cleaned up. Spot buyers waited lower.

Ethereum price prediction still looks healthy and network demand still looks firm. Developers are entering and ETF inflows are intact.

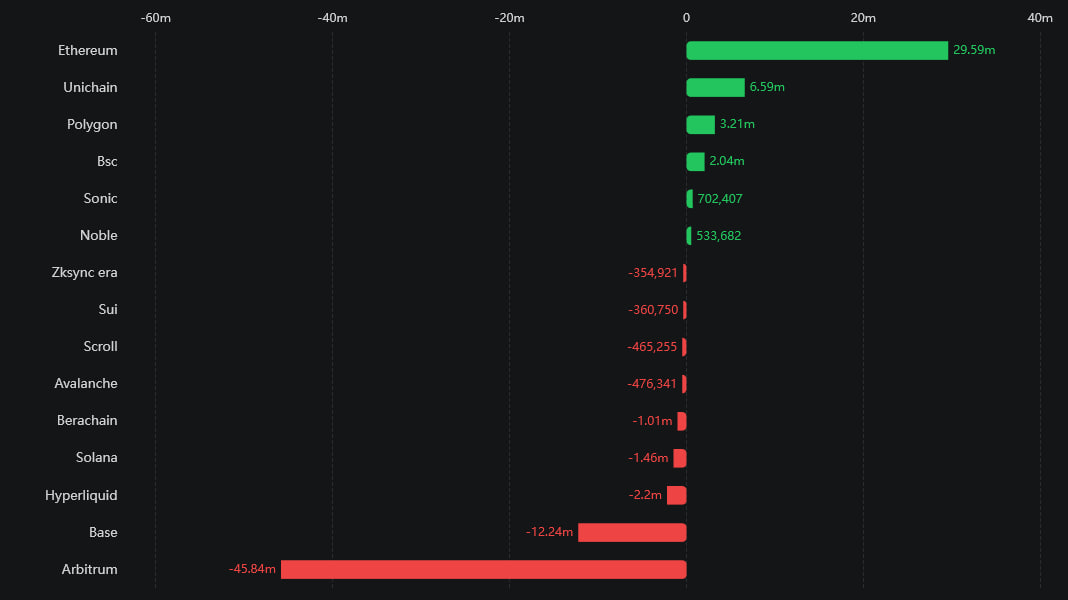

According to crypto news, $ETH led inflows with $29.59 million in the last 24 hours. Source: Crypto.News via X.

Source: Crypto.News via X.

Ethereum is in a rising trend channel, which signals increasing optimism among investors and indicates a continued rise. Ethereum price is approaching support at $4000, which may trigger a positive reaction. However, a break downwards through $4000 will be a negative signal.

If Ethereum’s price trades above key weekly support, analysts believe it should push toward $4,600–$5,000.

Why Whales Are Leaning Into Pepe

PEPE is a meme coin that thrives on momentum, social buzz, rapid liquidity and tight spreads on centralized exchanges. When the broader market moves, meme coins move faster.

Over the past few days, large wallets have been buying PEPE, a classic rotation move. Pepe fits the brief for traders scanning for short, sharp bursts and fast take-profit crypto to buy. It’s not the best long-term crypto investment, but it is a good bet for near-term gains.

If ETH stabilizes, meme liquidity usually spikes. This can extend Pepe’s trend.

Remittix (RTX): PayFi Utility With A Small-Cap And Explosive Potential

Investors are rotating into Remittix (RTX), a PayFi, with real-world utility and a small market, ready to explode, delivering over 100x.

Remittix (RTX) is an Ethereum-built platform on which users can send crypto converted on the app and deposit it as fiat directly into bank accounts in 30+ countries.

The PayFi project has a business API targeting freelancers, SMEs and marketplaces. And a full CertiK audit has been completed; liquidity and team tokens have been locked for three years.

Remittix Highlights:

- Users can earn up to 20% referral rewards by sharing the project

- Built for borderless payments with global reach.

- Designed for both crypto natives and non-crypto users, it can be used by business owners, freelancers and remitters.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Ethereum Slides Below $4300 As Whales Increase Positions In Pepe And Remittix appeared first on Coindoo.

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next