Faraday Future Bets Billions on Crypto: Which Coins Could 100x Next?

This move comes as various corporations increasingly adopt crypto treasuries to diversify their revenue, attract Wall Street attention, and gain exposure to this expanding asset class.

Faraday Future’s timing is significant, too: the company is leaning into crypto just as optimism builds for an extended bull market cycle, with staking yields and blockchain integrations across the industry offering fresh revenue streams for firms that take the plunge.

While its troubled past raises eyebrows, this pivot could reshape its future. And, it could fuel a new wave of 100x altcoin opportunities for investors with their eyes on the ball.

Ethereum: The Core of the C10 Index

While Bitcoin sets the benchmark, Ethereum is the backbone of any top-10 crypto basket. Its smart contract infrastructure powers DeFi, NFTs, and a growing array of enterprise blockchain pilots.

This makes it the most versatile asset in the sector. For Faraday Future’s C10 Index, Ethereum‘s inclusion isn’t just expected; it’s essential, and likely the most heavily-weighted.

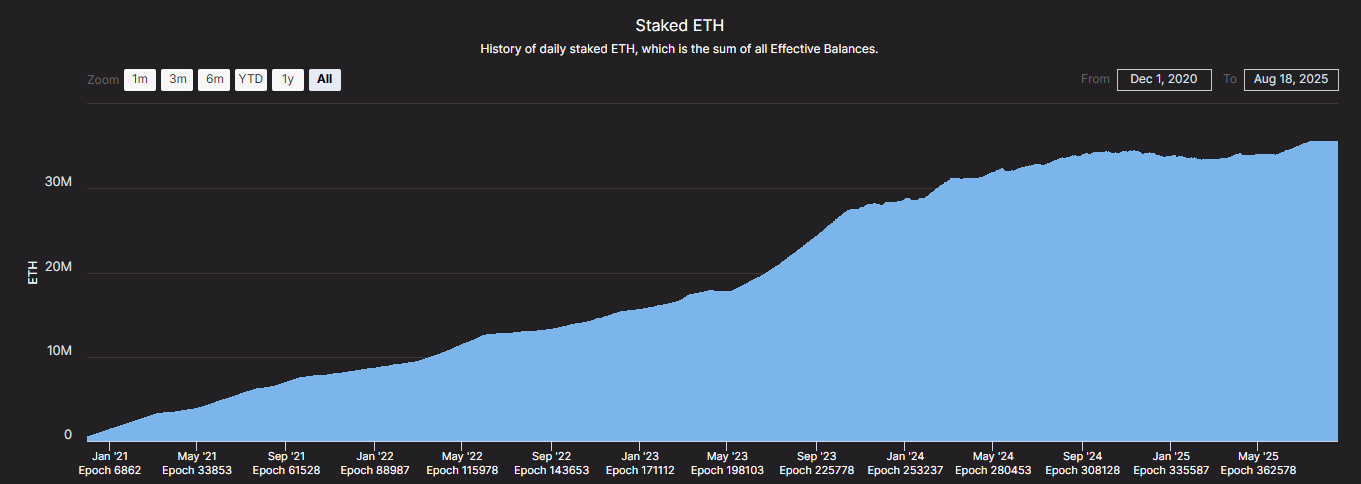

With staking yields available as of September 2022, $ETH offers a unique two-pronged appeal: price appreciation, alongside potential passive income. According to CoinDesk, Ethereum staking hit record highs this summer, reinforcing its draw for treasury managers.

Faraday’s decision to allocate into $ETH could amplify this trend, drive more institutional attention, and perhaps inspire other corporations to follow suit. Combined with regulatory clarity from the GENIUS Act in the US, $ETH‘s path for mainstream corporate adoption is clearer than ever before.

From the point of view of an individual investor, $ETH may not offer glamorous 100x gains. However, it’s as close to a sure thing as possible in crypto and will likely net you some respectable profits.

Bitcoin Hyper: The Layer-2 Leverage Play

We know that Faraday Future’s treasury is focusing on top-10 assets. However, both whales and retail traders alike often rotate into higher-beta Layerr-2 plays once sustained confidence returns to crypto majors.

That’s where Bitcoin Hyper ($HYPER) comes in. Still in its presale with just over $10.6M raised, $HYPER is a next-generation Layer-2 scaling token for Bitcoin, designed from the ground up with high-speed throughput, yield mechanics, and DeFi integration.

It’s likely only a matter of time before investors seek similar plays within Bitcoin’s ecosystem, and $HYPER‘s positioning will tap directly into this boom: it offers scalability, staking incentives, and speculative upside for early supporters.

For investors, the main appeal lies in its asymmetric profile: being still in its presale stage, the potential for exponential returns is far greater than any large-cap assets. With Layer-2s expected to dominate the next crypto infrastructure wave, $HYPER offers a leveraged way to ride that momentum.

Take advantage of this asymmetric opportunity by participating in the $HYPER presale today!

Maxi Doge: Meme Energy Meets Corporate Hype

When liquidity begins rotating from majors into smaller caps, memecoins are usually the first to erupt; and, typically, the most explosive. This dynamic puts Maxi Doge ($MAXI) in the spotlight, as Faraday Future and other corporate players draw new attention to altcoins.

Branded as a take on Dogecoin, but with “Proof-of-Workout” and GigaChad energy, $MAXI blends the virality of memecoins with a lifestyle identity that resonates among people far beyond just crypto circles.

Whatever $MAXI is doing, it seems to be working. Despite being early in its presale phase, it’s raised over $1.2M and has gained a large cult-like community following on social media.

Memecoins tend to outperform early into each altseason phase, when retail energy and whale positioning coincide. $MAXI’s presale momentum, staking rewards, and viral-friendly branding position it as a high-risk, high-reward play with potential to multiply quickly once fresh liquidity enters the market.

If Faraday’s C10 Index successfully onboards retail and institutional inflows, it could act as a catalyst that amplifies meme-driven rallies. Historically, whales have been early accumulators of memecoins before explosive runs; $MAXI fits right into that narrative.

Available at $0.000253 per token, you’ll be hard-pressed to find a better entry on a memecoin with 100x potential.

Join the $MAXI presale today before the chance passes you by!

A High-Risk Corporate Bet Meets Retail Opportunity?

Faraday Future’s pivot into crypto marks a bold attempt to reinvent itself with the launch of its C10 Index and treasury strategy. For corporations, it offers exposure to majors like Ethereum, reinforcing its role as the backbone of digital finance.

Join the $HYPER and $MAXI presales today, and fasten your seatbelts for the explosive moves ahead!

Disclaimer: This article is for informational and educational purposes only and should not be taken as financial or investment advice. Cryptocurrency markets are highly volatile, and you should always research and consult a licensed financial advisor before making any investment decisions.

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next