Hyperliquid Revenue Beats Ethereum as HYPE Shows Strength

TLDR:

- Hyperliquid recorded over $5.5 million in daily fees, surpassing Ethereum and Tron in revenue generation.

- More than 2.32 million HYPE tokens were removed from supply through buybacks over the past 30 days.

- HIP-3 trading volume reached $5.21 billion daily, signaling rapid adoption of on-chain derivatives products.

- Hyperliquid’s perpetual DEX market share crossed 30% after five consecutive weeks of sustained growth.

Bitcoin and most major cryptocurrencies have faced sharp price swings over recent weeks. During the same period, Hyperliquid’s native token HYPE showed limited downside movement.

Trading data also points to growing activity on the protocol’s perpetual exchange. These shifts place Hyperliquid among the most closely watched on-chain derivatives platforms.

HYPE Shows Relative Price Strength Amid Crypto Volatility

Bitcoin moved from $90,000 to $60,000 before recovering toward $70,000. Over that period, HYPE remained near the $32 level, according to data shared by Wise Advice on X.

Since the recent market bottom, HYPE has gained about 60%. Meanwhile, open interest declined from $8.4 billion to $5.39 billion.

This combination shows price appreciation alongside falling leverage. Market data providers describe such patterns as a sign of spot-driven demand rather than speculative excess.

At the time of publication, CoinGecko data showed HYPE trading at $31.45 with a 24-hour volume of about $408 million. The token was down 5.25% daily and 2.48% weekly.

Hyperliquid’s revenue metrics have also moved higher. The protocol generated roughly $5.5 million in fees over the past 24 hours, exceeding Ethereum and Tron during the same window.

Buyback activity followed revenue growth. Platform data shows $5.25 million in buybacks in 24 hours, $25.9 million in seven days, and $62.9 million over 30 days.

Roughly 2.32 million HYPE tokens were removed from circulation during that period. This links protocol revenue directly to supply contraction.

HYPE price on CoinGecko

HYPE price on CoinGecko

Hyperliquid Expands On-chain Perps Share as Adoption and Volume Rise

HIP-3 trading activity reached a new all-time high with daily volume of $5.21 billion. Gold and silver contracts accounted for more than $20 billion over ten days.

That figure equals about 1% of daily COMEX volume. Two weeks earlier, HIP-3 accounted for less than 0.1% of comparable volume.

Cumulative HIP-3 statistics now show $55 billion in total volume, 39.9 million trades, and more than 103,000 users. Platform data attributes the growth to increased participation rather than trader rotation.

Perpetual decentralized exchange market share crossed 30% for the first time since September. The sector has recorded five consecutive weeks of growth.

Data shared by Wise Advice shows Hyperliquid expanding while rival venues remain stable or consolidate. Centralized exchange volumes continue to fluctuate with broader market conditions.

On-chain derivatives activity, however, has shown structural growth. Hyperliquid captured a growing portion of that flow.

The combination of stable pricing, rising revenue, expanding market share, and user growth places Hyperliquid among the strongest performers in the decentralized trading sector.

The post Hyperliquid Revenue Beats Ethereum as HYPE Shows Strength appeared first on Blockonomi.

You May Also Like

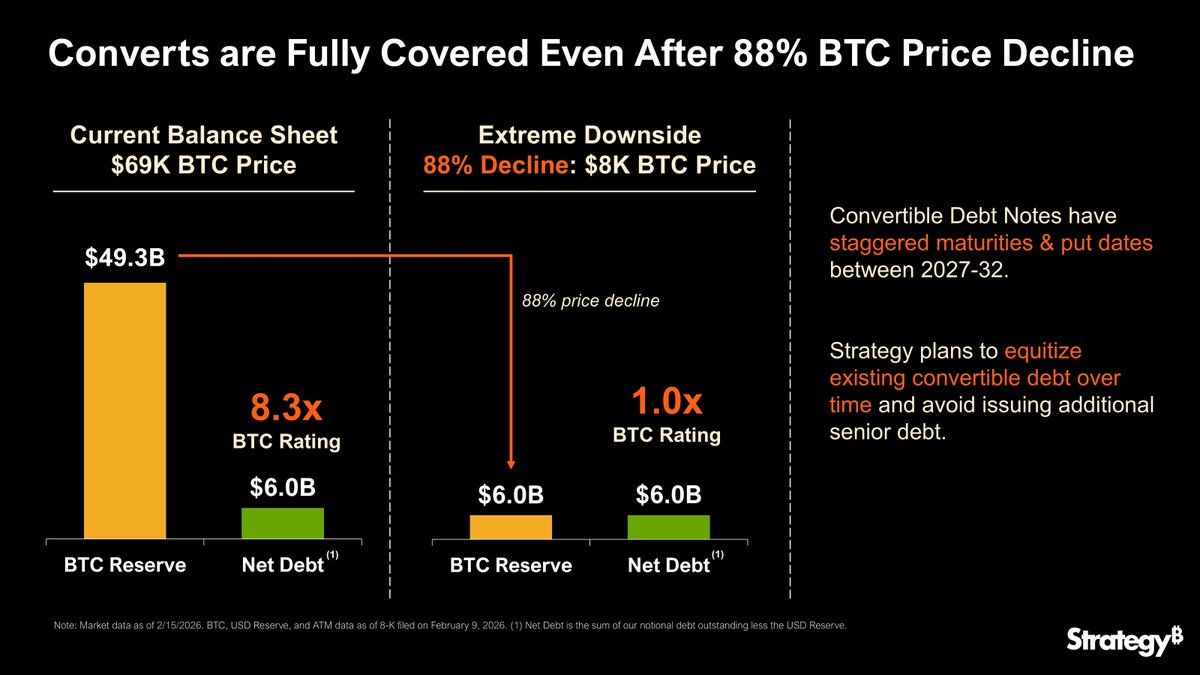

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more