Metaplanet Buys The Bitcoin Dip With $93 Million Purchase

Japan-based Bitcoin treasury firm Metaplanet has announced another $93 million BTC buy as the crypto market leader trades in the $115K range after a 24-hour pullback.

The Bitcoin price slid 2% in the past 24 hours trade at $115,593.74 as of 12:50 a.m. EST, data from CoinMarketCap shows. The decrease nudged BTC’s weekly performance deeper into the red zone, with the crypto now down around 5% in the past seven days.

Bitcoin price chart (Source: CoinMarketCap)

Bitcoin maxi and Strategy Executive Chairman Michael Saylor has also hinted that his firm will announce another BTC purchase later today.

Metaplanet And Strategy Continue Bitcoin Accumulation

Metaplanet CEO Simon Gerovich took to X today to announce his company’s latest Bitcoin buy of 775 BTC.

According to Gerovich, the BTC was acquired at an average purchase price of $120,006 per Bitcoin. The firm now holds a total of 18,888 BTC that was acquired for $1.94 billion at $102,653 per Bitcoin, the CEO added. The company has also achieved a year-to-date (YTD) gain of 480.2% with its BTC holdings.

Strategy could soon announce a Bitcoin buy later today as well.

That’s after Saylor posted a screenshot of the Saylor Tracker chart on X yesterday. In the past, posts like these have always been followed by an announcement of another Bitcoin buy.

If Strategy does announce another BTC buy today, it will be the second consecutive week that the firm has purchased the crypto. The most recent acquisition was announced on Aug. 11, and saw the company buy 155 BTC for $18 million at an average price of $116,401.

Both Metaplanet and Strategy are among the largest corporate Bitcoin holders globally.

Strategy, which started its aggressive accumulation of the crypto market leader back in 2020, is currently the largest Bitcoin holder with its holdings of 628,946 BTC, according to data from Bitcointreasuries.

That ranks is far above the next biggest Bitcoin holder, MARA holdings, with its BTC stockpile standing at 50,639 coins.

Saylor Tracker data shows that Strategy is sitting on an unrealized profit of over $26.62 billion, which is around a 57% gain on its BTC position. Overall, the company’s holdings equate to over $72.73 billion at current prices.

Strategy Bitcoin holdings (Source: Saylor Tracker)

Meanwhile, Metaplanet, with its recent purchase, is the seventh largest BTC treasury company globally. It is also the biggest corporate Bitcoin holder in Asia.

With the latest purchase, the firm is now within striking distance of overtaking Riot Platforms, who has 19,239 BTC on its balance sheet, as the sixth largest Bitcoin holder in the world.

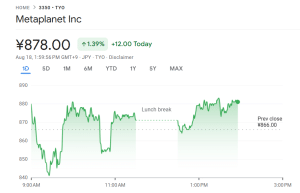

Metaplanet’s stock price jumped over 1% following the latest BTC buy.

Metaplanet price chart (Source: Google Finance)

The gain in the early hours of today’s trading session marked a slight reversal from the longer-term negative trend the company’s stock price has been in.

In the last week, Metaplanet shares slid over 15%, pushing the stock’s loss in the last month to more than 34% as well.

That’s even after the company posted strong earnings during the second quarter in its latest quarterly report last week, with total revenue reaching 1.2 billion yen ($8.4 million) – a 41% quarter-on-quarter gain.

Metaplanet also posted a net profit of 11.1 billion yen ($75.1 million), compared to a 5 billion yen (34.2 million) loss in the first quarter. The company also expects this stellar performance to continue.

“We continue to project full-year revenue of 3.4 billion yen and operating profit of 2.5 billion yen, supported by recurring cash-secured-put premiums and operational performance,” Metaplanet said in its report.

Despite the drop in share price over the past month, the company’s stocks remain over 44% up on the the 6-month time frame with a YTD gain exceeding 144%.

Metaplanet To Take On Japan’s Bond Market With Bitcoin-Backed Yield Curve

Metaplanet’s Bitcoin purchase announcement today follows the company’s Bitcoin-backed yield curve and a preferred share program the firm unveiled last week.

The aim behind those initiatives is to make BTC a credible form of collateral in Japan’s capital markets, while simultaneously challenging the dominance of traditional fixed income products.

With the Bitcoin-backed yield curve, the company would create a pricing framework for BTC-collateralized credit. This could then open the door for institutional investors to gain exposure to Bitcoin while also locking in predictable yields.

Meanwhile, the “Metaplanet Prefs” program will see the company issue BTC-backed instruments across multiple credit profiles and timelines in an effort to further weaponize the firm’s Bitcoin treasury.

Metaplanet’s head of Bitcoin strategy Dylan LeClair said in an X post that the initiatives are the next step in the company’s mission to “digitally transform Japan’s capital markets” and prepare for “hyperbitcoinization.”

You May Also Like

Woodway Assurance receives $1 million in funding for data privacy assurance solution EviData

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement