BitMine, SharpLink command $7b ETH as corporate holdings eclipse $14b

BitMine and SharpLink are leading the ETH treasury movement, with their combined $8 billion stash driving sector-wide holdings to $14 billion. But with Vitalik Buterin’s cautious blessing, the market wonders: Is this sustainable adoption or a bubble in the making?

- BitMine and SharpLink’s combined ETH holdings have surged to $7b, pushing total corporate treasuries to $14b and fueling a 43% monthly price rally.

- Vitalik Buterin supports ETH treasury adoption but warns overleverage could trigger forced liquidations and damage market trust.

On August 11, BitMine Immersion Technologies, the American Bitcoin mining company that pivoted to an Ethereum (ETH) treasury strategy barely two months ago, announced its ETH holdings had surged to $4.96 billion, representing a $2 billion jump in just seven days.

The Las Vegas-based firm now controls 1.15 million ETH tokens, positioning itself as the largest Ether treasury company and vaulting to third place among all public crypto treasuries, behind Michael Saylor’s Strategy and Marathon Blockchain, which hold a combined $81 billion in Bitcoin, according to BitcoinTreasuries.net data.

Meanwhile, SharpLink Gaming revealed plans to push its own ETH reserves past the $3 billion mark following a $400 million institutional funding round, solidifying its position as another heavyweight in the burgeoning ETH treasury race.

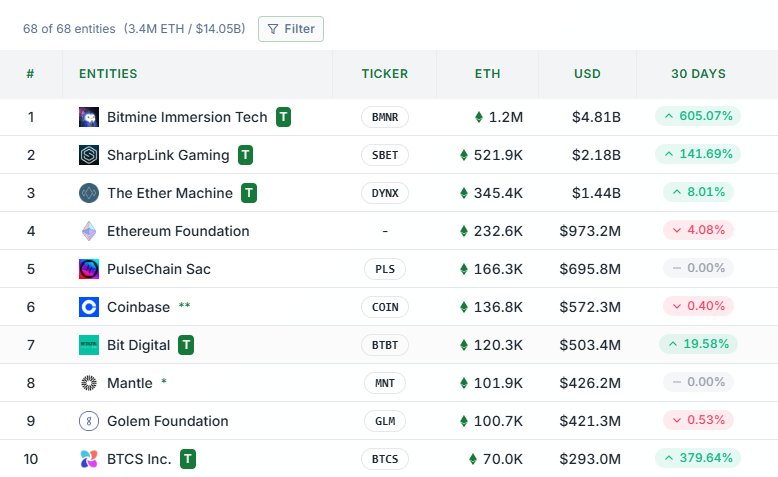

The aggressive moves by BitMine and SharpLink helped drive the sector’s total to $14 billion, StrategicETHReserve.xyz data shows.

Top 10 institutional ETH holders. Source: StrategicETHReserve.xyz

While this has injected fresh institutional momentum into Ethereum’s market performance, driving a 43% price surge over the past month, the breakneck pace of accumulation raises critical questions about long-term sustainability, particularly as Ethereum’s own co-founder warns of potential overleverage risks lurking beneath the euphoria.

How BitMine and SharpLink are shaping the ETH treasury race

For BitMine, the playbook has been clear from day one. Since unveiling its pivot to Ethereum on June 30, the company has repeated its ambition to acquire 5% of ETH’s total supply at nearly every turn.

With backing from institutional names like ARK’s Cathie Wood, Pantera, Galaxy Digital, and Founders Fund, BitMine has positioned itself not only as the largest ETH treasury in the world, but also as one of the most liquid U.S.-listed stocks, trading an average of $2.2 billion daily.

SharpLink’s strategy has been equally aggressive. The Minneapolis-based gaming company said it raised nearly $900 million in capital over the past week, a combination of a $400 million registered direct offering with global institutional investors and $200 million in at-the-market proceeds, all meant to accelerate its Ethereum accumulation.

Already holding roughly 598,800 ETH as of August 10, SharpLink expects its reserves to surpass the $3 billion mark once new purchases are complete. The company framed the speed and scale of its fundraising as a signal of market confidence in its treasury approach and of Ethereum’s “transformative potential.”

Vitalik Buterin’s take

Last week, Ethereum co-founder Vitalik Buterin offered what could be described as a cautious endorsement of this new corporate treasury wave. He said in a Bankless podcast episode that public companies buying and holding Ether can “provide valuable services” by exposing the asset to a broader range of investors, especially those who prefer not to hold it directly.

But his backing came with a warning: corporate ETH treasuries must avoid turning into an “overleveraged game.” He outlined a scenario in which excessive borrowing against ETH holdings could trigger forced liquidations in a market downturn, causing a cascading sell-off and eroding trust in the network.

Despite these warnings and other risks, such as macroeconomic shocks, neither BitMine nor SharpLink shows any sign of slowing their buying sprees. BitMine remains fixed on its 5 percent supply goal, while SharpLink is moving to deploy fresh capital at pace.

Whether this marks the beginning of a lasting institutional foothold for Ethereum or an overreach that could test the network’s resilience remains to be seen.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment