Bitcoin Breakdown Continues: 14-Month Low Sparks Fears of a Deeper Fall Below $60K

Bitcoin (BTC) has experienced a steep decline over the past weeks, mirroring the broader crypto market crash.

According to some analysts and experts, the situation could worsen for bulls in the short term, with the price at risk of falling below $60,000.

Fasten Your Belts

Just recently, the leading cryptocurrency tumbled below $70,000 for the first time since November 2024. As of press time, it trades at around $69,300, down 21% over the past week alone.

The renowned analyst Ali Martinez suggested that the bears might be just stepping in. He reminded that since 2015, every time BTC has lost the 100-week simple moving average (SMA), it has failed to reclaim it in time and continued toward the 200-week SMA. According to his chart, the price could drop to as low as $57,600. Prior to that, Martinez claimed that the next key support levels for BTC after the drop under $77,086 are $60,176 and $47,824.

The trader, using the X handle Hardy, also recently made a pessimistic prediction. They envisioned a massive decline in the coming months, with the bottom set at roughly $30,000.

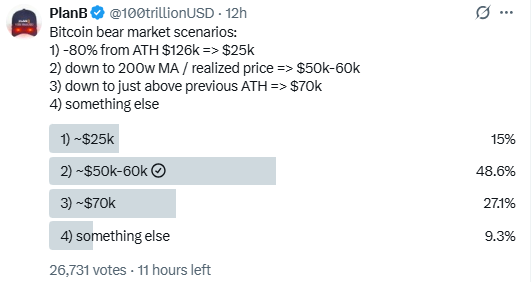

Meanwhile, PlanB (the anonymous creator of the Stock-to-Flow (S2F) model) believes several scenarios are possible, including a collapse to $25,000 and a retreat to $50,000- $60,000. The analyst took it to X to ask the followers for their take on the matter. Nearly half of the participants think a plunge to $50K-$60K is the most plausible option, while only 15% see the valuation nosediving to $25K.

PlanB Survey, Source: X

PlanB Survey, Source: X

Recent investor behavior supports the bearish thesis. According to data from CryptoQuant, the amount of BTC held on exchanges has been rising over the past few weeks. This suggests that many market participants have moved their holdings from self-custody to centralized platforms, typically interpreted as a pre-sale step.

BTC Exchange Reserves, Source: CryptoQuant

BTC Exchange Reserves, Source: CryptoQuant

Is It Really Over?

While BTC’s current condition may appear weak, several indicators suggest a potential rebound ahead. The Relative Strength Index (RSI) measures the speed and magnitude of recent price changes.

It ranges from 0 to 100, and anything below 30 means that the asset is oversold and due for a potential resurgence. On the contrary, ratios above 70 are considered bearish territory. As of this writing, the RSI stands at roughly 19.

BTC RSI, Source: CryptoWaves

BTC RSI, Source: CryptoWaves

The post Bitcoin Breakdown Continues: 14-Month Low Sparks Fears of a Deeper Fall Below $60K appeared first on CryptoPotato.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

TON Technical Analysis Feb 14