China mulls launch of first stablecoins in push to challenge US Dollar dominance

- China plans to allow the launch of its first stablecoins as part of a broader strategy and compete against the US Dollar, the FT reports.

- Hong Kong emerges as the testing ground, after the region passed a new law allowing licensed businesses to issue fiat-backed tokens.

- China still faces significant hurdles in catching up with the US dollar-backed stablecoin ecosystem.

China is preparing to launch its first stablecoins as part of a broader effort to reduce reliance on the US Dollar (USD), according to a Financial Times report on Wednesday. Hong Kong has emerged as China’s testing ground for cryptocurrency assets in the country, given that the industry is banned on the mainland, with the passing of a new stablecoin regulation recently. However, regulatory caution and limited licensing are expected to slow any rollout.

China’s interest in the stablecoin sector grows

The Financial Times report on Wednesday highlighted that China is planning to roll out its first stablecoins as part of a broader strategy to internationalize its currency, the Renminbi (CNY), and reduce reliance on the US Dollar in global payments.

Hong Kong emerges as the testing ground for China’s cryptocurrency bet, as the industry is banned on the mainland, said the report. Still, regulatory caution in the autonomous region remains high, with only a limited number of stablecoin licences to be issued starting next year.

“We have been quite concerned about market speculation and exuberance,” HKMA officials said, reports the Financial Times.

The stablecoin market in China is gaining traction following the introduction of the first regulatory framework for stablecoins (GENIUS Act). US Dollar-pegged cryptocurrency was signed into law by US President Donald Trump on July 18.

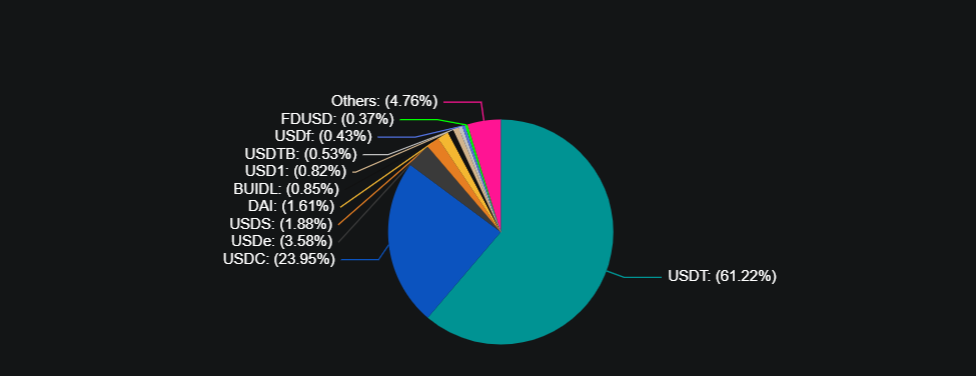

Currently, over 99% of stablecoins are tied to the US Dollar. Crypto intelligence tracker DeFiLlama data shows Tether’s USDT, which is tied to the US Dollar, holds a 61.22% market share.

Chinese exporters increasingly use USDT for international payments, bypassing currency risks and capital controls.

Despite these ongoing efforts, China still faces significant hurdles in catching up with the US Dollar-backed stablecoin ecosystem.

“It’s quite challenging to compete with the US dollar-backed stablecoin system, and certainly Hong Kong is making its own efforts, but there’s still a long way to go,” said Chen Lin, Director of the Centre for Financial Innovation at the University of Hong Kong, to the FT.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

Microsoft Corp. $MSFT blue box area offers a buying opportunity