Is the Ethereum price crash over as network metrics surge?

Ethereum’s price crash continued its strong downward trend this week, reaching its lowest level since June 23 as the crypto market dive accelerated.

- Ethereum price continued its strong downward trend this week.

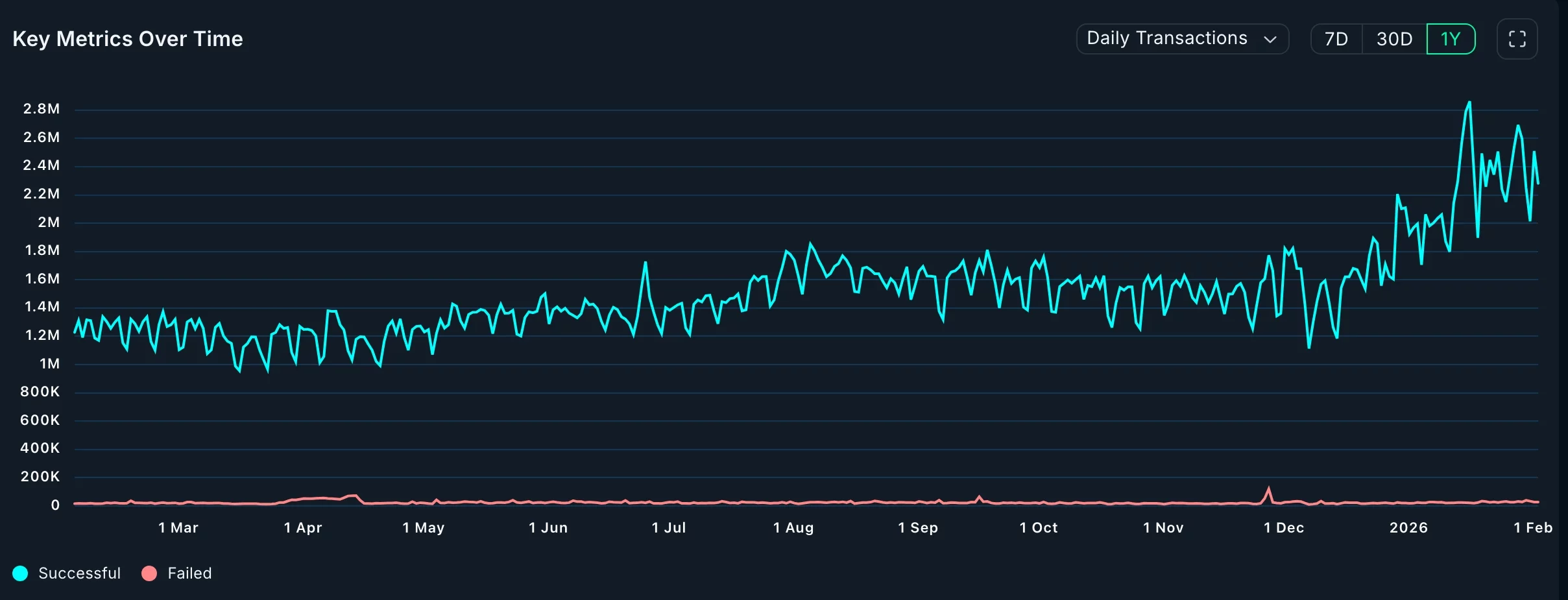

- The network’s transactions and active users have soared in the last 30 days.

- Technical analysis suggests that ETH price has more downside to go in the near term.

Ethereum (ETH) token dropped to a low of $2,180, down by over 54% from its highest level since August last year. This retreat has brought its market value to over $274 billion.

Ethereum has crashed despite the ongoing network and ecosystem boom as companies like Fidelity, JPMorgan, and Janus Henderson embrace its network for their tokenized assets.

Data compiled by Nansen shows that Ethereum’s network is firing on all cylinders. For example, the number of active addresses jumped by 45% in the last 30 days to over 15 million.

Another metric shows that the number of transactions jumped by 40% in the last 30 days to over 68 million, the highest level in years.

This growth has pushed its chain fees to over $15 million, up by 40% in the last 30 days. This growth occurred even as Ethereum transaction fees have continued to fall over the past few months.

More data show that Ethereum’s decentralized exchange network continued to rise in January, a trend that will likely continue in the coming weeks. Its DEX networks rose to over $52.8 billion in January from $49 billion in December last year. The most notable DEX networks are Uniswap, Curve Finance, Fluid, and Balancer.

Most importantly, Ethereum has become a major player in the real-world asset tokenization industry, with its distributed asset value rising by 15% over the last 30 days to over $14.4 billion. Its stablecoin market capitalization rose to over $165 billion.

Ethereum price technical analysis

The daily timeframe chart shows that the ETH price has been in a strong downward trend in the past few weeks. It crashed recently after forming a bearish flag pattern, which consists of a vertical line and an ascending channel.

Ethereum price has dropped below the 61.8% Fibonacci Retracement level at $2,753. It moved below the 50-day moving average and Supertrend indicator.

ETH is forming a bearish pennant pattern, a common continuation pattern in technical analysis. It has also moved below the Supertrend indicator.

Therefore, the most likely Ethereum price prediction is bearish, with the next key support level being at $2,000.

You May Also Like

XRPR and DOJE ETFs debut on American Cboe exchange

Over 60% of crypto press releases linked to high-risk or scam projects: Report