Analyst Warns of Deeper Correction—Ethereum (ETH) Price May Plunge Below $2000

The post Analyst Warns of Deeper Correction—Ethereum (ETH) Price May Plunge Below $2000 appeared first on Coinpedia Fintech News

The rejection of $3000 has pushed the Ethereum (ETH) price into a strong bearish trajectory. The price is failing to secure an important range of around $2300, which has become a major resistance to break. Meanwhile, the bulls have been defending the pivotal support at $2,150, keeping the bullish possibilities alive. This may point towards an upcoming trend reversal, but a popular analyst, Ali, suggests the bottom has not been reached yet.

Large Holders Remain in Disbelief

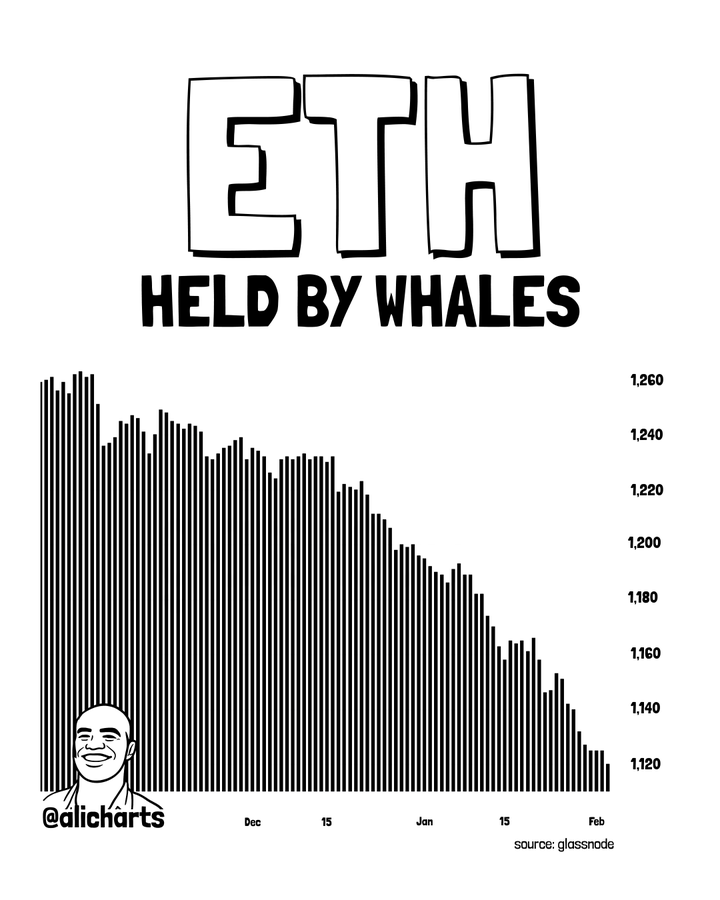

The big players seem to be not confident in the current price rebound, as they have been distributing instead of accumulating. The data from Glassnode shows that the Ethereum whales have been steadily reducing their holdings, possibly relocating them to other tokens.

The declining bars are the number of wallets holding more than 10,000, which has declined from 1,262 to 1,120. This validates the claim of a possible supply rotation, as they are not aggressively adding or holding at current levels. This points towards a weakening of upside momentum as buying pressure fades off. This may not follow a sudden crash but rather keep the price consolidated within a tight range.

Ethereum is Yet to Reach the Bottom

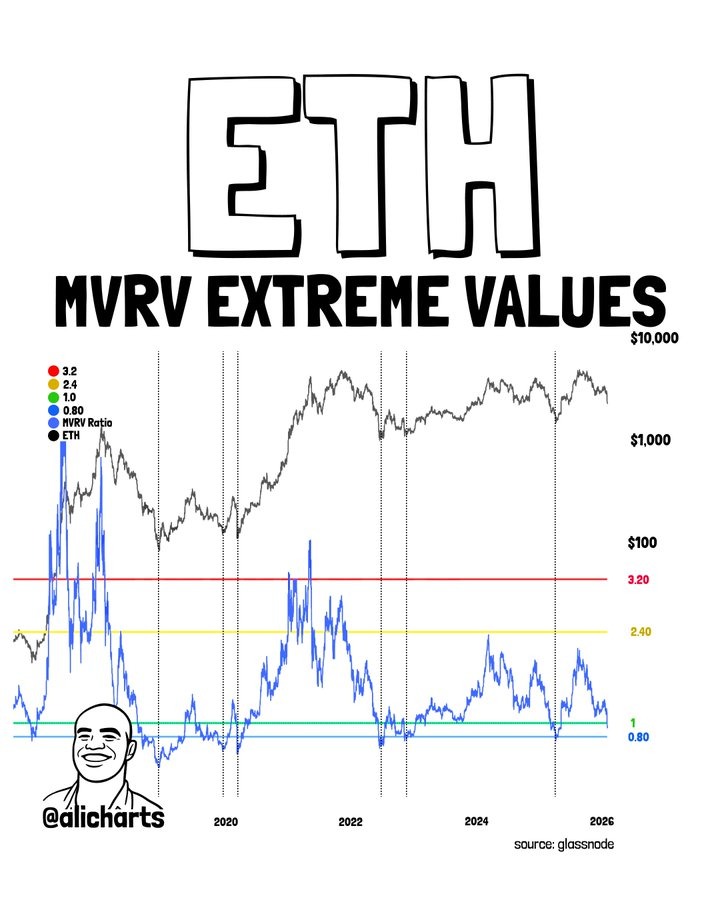

A better way to determine whether the ETH price is undervalued or overvalued is to analyse the MVRV values. The chart below shows the Ethereum MVRV ratio and how it behaves at the extreme levels over time. Historically, when ETH’s MVRV moves into the red zone above ~3.2, it has marked overheated conditions and major tops, where profit-taking tends to kick in. On the flip side, when MVRV drops toward the green zone around 0.8–1.0, it has often lined up with cycle bottoms, signaling that ETH is undervalued and long-term accumulation starts.

Right now, MVRV is sitting closer to the lower band, not in extreme greed territory. Historically, the Ethereum price bottoms when the MVRV ratio drops below 0.8. Currently, the ratio sits at 0.96, which suggests the typical bottom conditions haven’t fully formed yet.

ETH Price May Plunge Below $2000

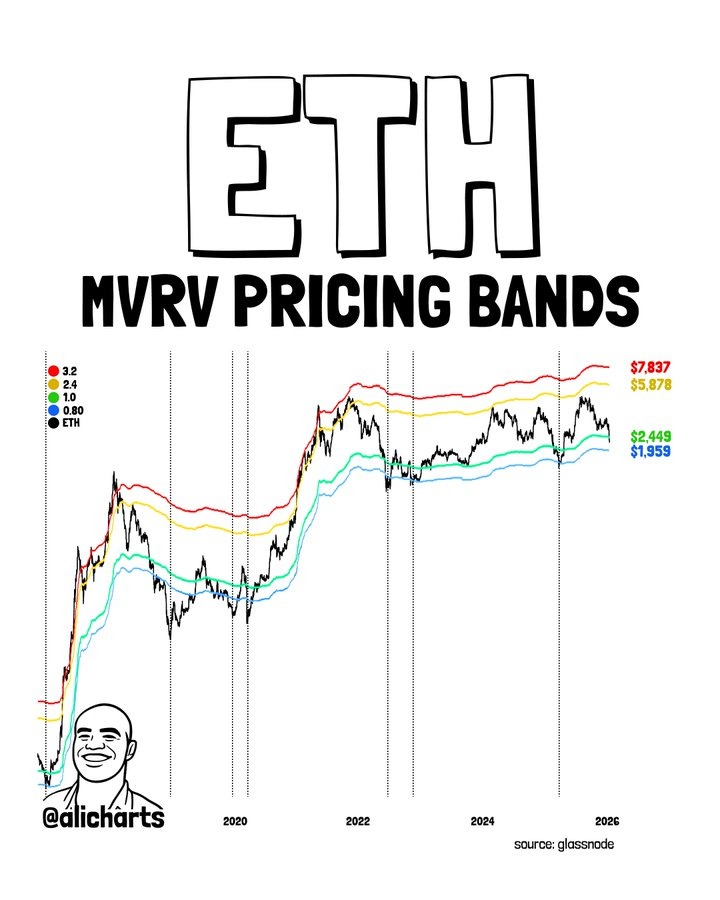

The second-largest token has been facing strong upward pressure over the past few days; still, the support at $2000 was held tight. However, the data revealed by the MVRV pricing bands suggests the ETH price may find its bottom below $2000. MVRV pricing bands are used to map out where ETH tends to be undervalued, fairly valued, or overheated based on on-chain data rather than pure price action.

Historically, when ETH trades near the lower blue/green bands (0.8–1.0 MVRV), it has marked strong accumulation zones and cycle lows. On the other hand, moves towards the yellow and red bands (2.4–3.2 MVRV) have aligned with market tops, where price becomes stretched and profit-taking increases. Right now, ETH is trading above the lower bands but well below the red zone, suggesting it’s no longer deeply undervalued, yet still far from euphoric territory. They hint that Ethereum has room to explore lower levels, and based on this model, a cycle bottom could form below $1,959.

Wrapping it Up

Ethereum has long been viewed as one of the more stable assets in the crypto market, yet even the strongest ETH bulls are now deep in the red. BitMine, led by Tom Lee, is currently sitting on an estimated loss of nearly $6.8 billion. Meanwhile, prominent crypto whale Garrett Jin has faced losses of around $770 million, including a $195 million ETH long liquidation. In another major hit, Jack Yi, founder of Capital Inc., has reportedly lost close to $680 million.

These losses reflect the broader market environment, where sentiment remains firmly fearful amid extreme volatility across major cryptocurrencies, including Bitcoin and Ethereum. At the same time, buying pressure remains negligible, keeping the probability of a near-term reversal low. Given the current structure, traders may prefer to stay cautious until market conditions stabilize and bulls show clear intent. A sustained move above $3,500 would be required to confirm that ETH is breaking out of bearish influence and regaining upside momentum. Until then, downside risk remains firmly in play.

You May Also Like

XRPR and DOJE ETFs debut on American Cboe exchange

Over 60% of crypto press releases linked to high-risk or scam projects: Report