BTC Price Enters Fifth Month of Correction—Is Bitcoin Entering a Bear Phase?

The post BTC Price Enters Fifth Month of Correction—Is Bitcoin Entering a Bear Phase? appeared first on Coinpedia Fintech News

Despite the recent bounce, Bitcoin (BTC) price action continues to show clear signs of pressure as the correction stretches into its fifth straight month. Every recovery attempt has faced strong supply, with rallies repeatedly stalling below key resistance zones. This behavior points to ongoing distribution rather than a healthy consolidation phase. While buyers are stepping in near the lows, their lack of follow-through has allowed sellers to retain control of the broader trend.

As a result, BTC remains stuck in a corrective structure unless it can reclaim the critical $80,000 resistance with conviction. Until then, the market faces a near-term turning point. Traders are now watching closely to see whether Bitcoin can push above $80,000 this week—or if failure to do so leads to a breakdown below the $77,500 support zone.

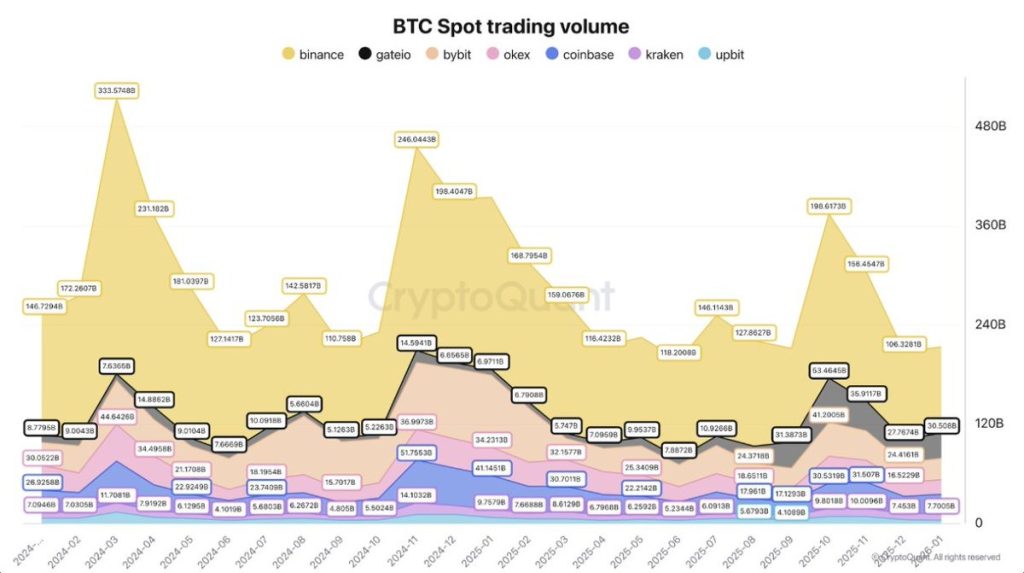

Bitcoin Spot Trading Volume Dries Up

Bitcoin’s spot demand drying up is a subtle but meaningful signal—and CryptoQuant’s exchange data makes this clear. When spot volumes fall, it means real buyers are stepping back even if the price hasn’t yet cracked key levels. Historically, strong rallies in BTC have been backed by expanding spot demand on exchanges; without it, upside attempts tend to lack follow-through, and the price becomes more sensitive to headline moves or liquidations.

The CryptoQuant data shows key cycle moments: after the 2019 peak near $14K, spot demand faded, and price entered a prolonged consolidation and pullback; in late 2021, spot volumes dropped sharply after the all-time high, signaling distribution before the broader downtrend; and again in mid-2023, muted spot activity coincided with choppy range-bound price action before volatility picked back up.

As seen in these historical snapshots, drying spot demand on CryptoQuant typically aligns with consolidation, shaky breakouts, or increased volatility rather than sustained trend extensions.

Bitcoin (BTC) Price Sits on the Edge

The BTC price has been largely volatile since the last few days of January, which appears to have restricted the rally below the key resistance zone. The buyers and sellers are actively contributing, and as a result, volume remains elevated with no major impact on the price. The strength of the rally has been decaying since the start of the month, keeping the rally capped below an important resistance zone between $78,900 and $79,235.

As reflected on the chart, there has been a clear lack of aggressive buying interest from market participants. Since facing rejection near the $126,219 highs, price action has consistently printed lower highs and lower lows, reinforcing the ongoing bearish structure. This sustained absence of demand supports the view that spot buying interest has largely dried up over the past five months. Meanwhile, the RSI has slipped into oversold territory and is attempting a rebound, hinting at short-term relief potential rather than a confirmed trend reversal.

As a result, the Bitcoin (BTC) price is likely to remain range-bound below the $80,000 mark unless a clear surge in buying pressure pushes the price back above this bearish zone. Until then, any upside moves are expected to face strong selling pressure, keeping the broader corrective phase intact.

You May Also Like

Solana Price Plummets: SOL Crashes Below $90 in Stunning Market Reversal

New Developments Could Push Price Toward $0.40