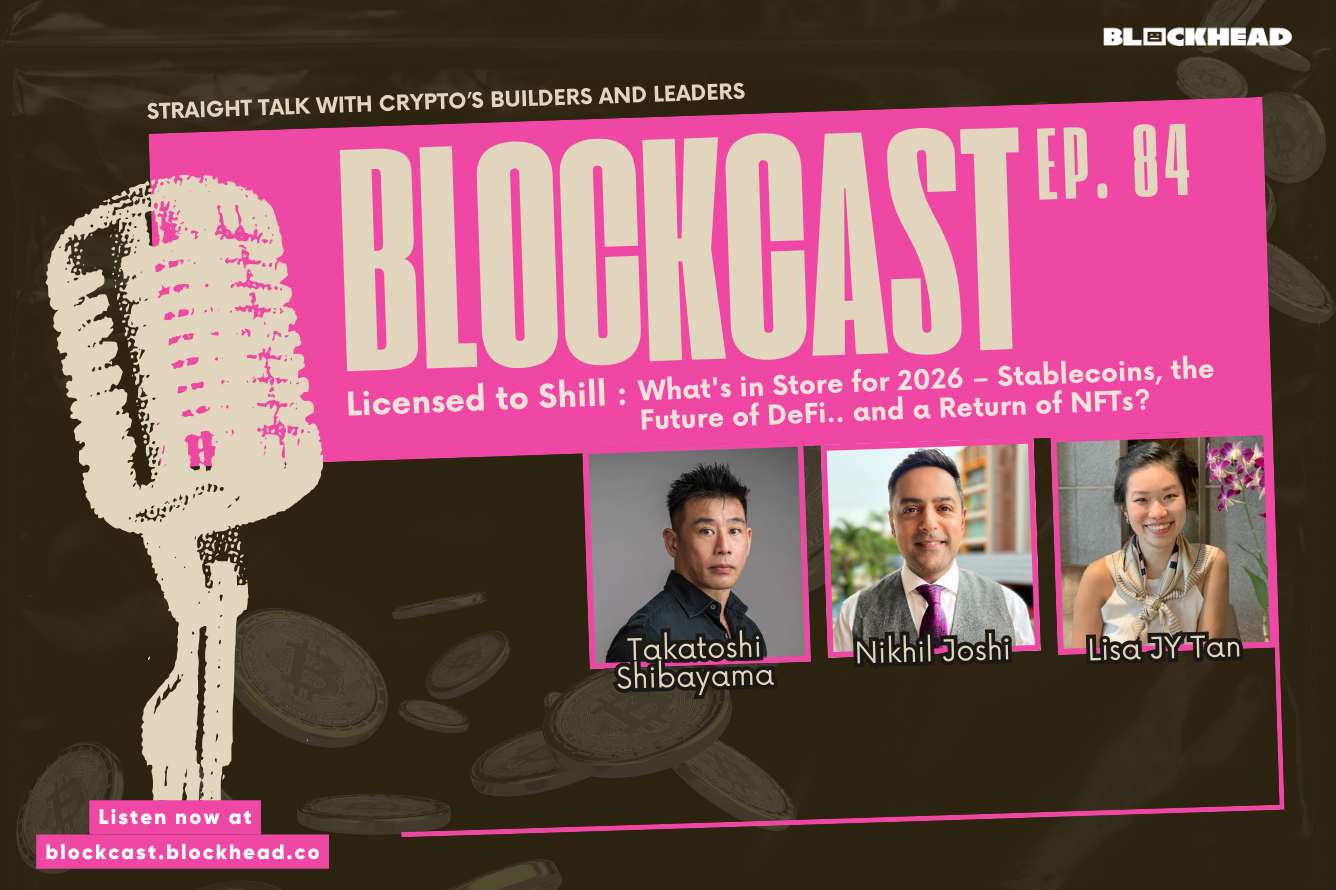

Blockcast 84 | Licensed to Shill: What's in Store for 2026 – Stablecoins, the Future of DeFi.. and a Return of NFTs?

Takatoshi Shibayama (Head of APAC, Ledger), Nikhil Joshi (COO, Emurgo), and Lisa JY Tan (Founder & Managing Director, Economics Design) share their expectations for the year ahead – where crypto infrastructure is maturing, where speculation is giving way to utility, and where new risks are emerging.

They dig into the rise of stablecoins, AI-driven payments and customer service, and how personalization is reshaping consumer expectations. The discussion moves through regulation and compliance across jurisdictions, the impact of US policy shifts, and the growing importance of financial literacy as financial services become increasingly retail and software-driven.

Real-world assets, prediction markets, NFTs beyond the hype cycle, and the role of SMEs in pushing practical adoption all feature as the panel weighs what’s likely to matter – and what’s likely to fade – in 2026.

Thanks for tuning in! If you enjoyed this episode, please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Fredrick Gregaard (Cardano Foundation), Daren Guo (Reap), Yat Siu (Animoca Brands), Kean Gilbert (Lido), Joey Isaacson (Nook), Kapil Dhiman (Quranium) Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Anastasia Plotnikova (Fideum), Jeremy Tan (Singapore parliament candidate), Hassan Ahmed (Coinbase) and more on our recent shows.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future