Senate Shakes Up Crypto With Major New Market Structure Draft

The U.S. Senate Banking Committee has introduced a long-awaited draft bill to reshape how digital assets are classified and regulated in the United States.

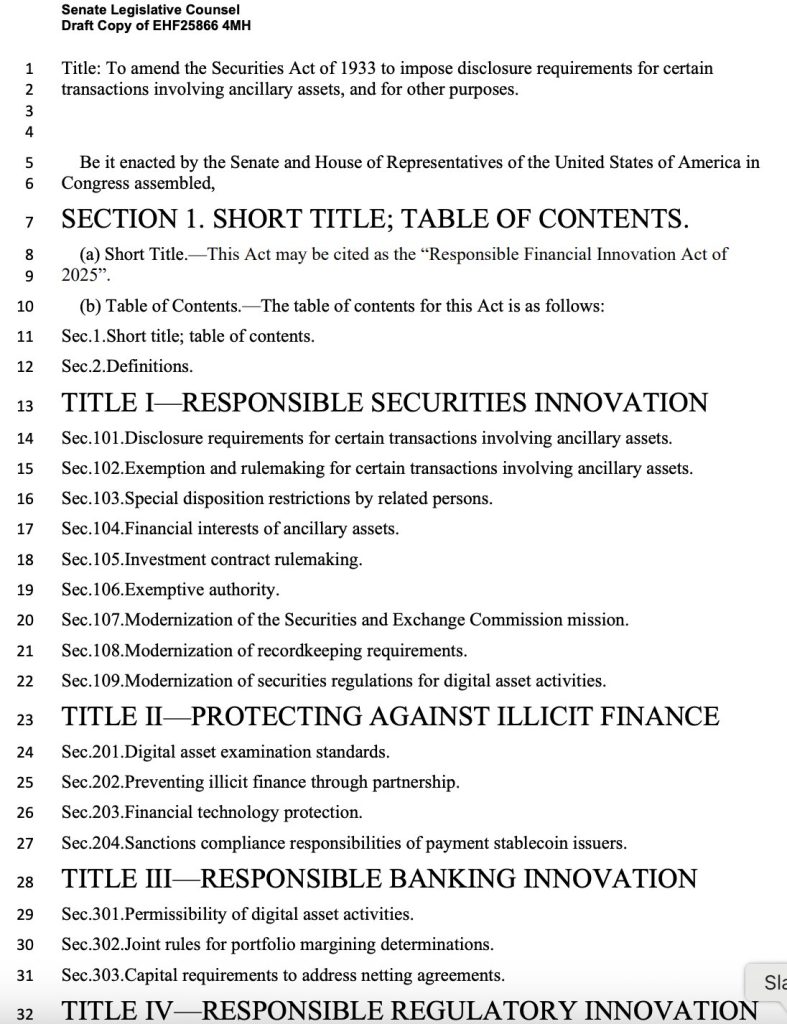

Titled the Responsible Financial Innovation Act of 2025, the draft introduced by Senate Banking Chair Tim Scott (R-SC), alongside Senators Cynthia Lummis (R-WY), Bill Hagerty (R-TN), and Bernie Moreno (R-OH), seeks to create a comprehensive legal framework for digital assets, addressing long-standing regulatory uncertainty in the crypto space.

New Senate Crypto Bill Proposes Clear Framework for Token Classification and Oversight

The legislation, released just days after the GENIUS Act was signed into law, builds on momentum from the House-passed CLARITY Act and incorporates key elements from the bipartisan Lummis-Gillibrand initiative.

Source: Responsible Financial Innovation Act of 2025

Source: Responsible Financial Innovation Act of 2025

One of the bill’s most consequential provisions is the explicit recognition that digital assets, referred to as “ancillary assets,” are not inherently securities. It clarifies that secondary market transactions involving these tokens should not automatically fall under securities laws.

However, exceptions apply: if a token’s value is closely tied to promises of profit through managerial efforts, securities laws could still be triggered.

In addition, the draft legislation attempts to resolve the persistent jurisdictional tension between the SEC and CFTC. Under the proposed framework, most digital assets would be regulated as commodities, falling primarily under the Commodity Futures Trading Commission (CFTC), while the SEC would retain oversight of investment contracts and investor protection matters.

The bill instructs the SEC to modernize disclosure rules and adapt its record-keeping systems to account for blockchain-based financial activity, ensuring compatibility with Web3 ecosystems.

Beyond token classification, the legislation spans more than 35 areas of focus. It includes requests for public feedback on topics such as stablecoin regulation, custody frameworks, DeFi exemptions, and illicit finance concerns, including tactics like “pig butchering” scams.

The draft also proposes a “safe harbor” for forward-looking statements, shielding developers from premature enforcement actions, provided their projects meet certain transparency and decentralization standards.

Additionally, developers who do not custody user funds could be exempt from some registration requirements, an important provision for open-source innovators.

Senator Tim Scott emphasized the bill’s collaborative approach, saying, “This bill gives Congress the opportunity to hear from industry and regulators alike before finalizing a legal framework that protects consumers and encourages responsible innovation.”

Stakeholder input is now being solicited, particularly on areas where the SEC and CFTC’s jurisdiction may overlap, with Senate Banking Committee hearings expected in the coming weeks as lawmakers move toward introducing a finalized version.

Senate Push for Market Structure Reform Gains Momentum After GENIUS Act Signing

Momentum for U.S. crypto legislation continued to build this week with the new draft legislation after President Donald Trump signed the GENIUS Act into law, marking a landmark moment in federal regulation.

The GENIUS Act, passed with broad bipartisan support, provides the first federal framework for stablecoin issuers and will take effect 18 months after signing or 120 days after federal regulators, including the Treasury and the Federal Reserve, issue final rules.

Alongside the GENIUS Act, two other major proposals, the CLARITY Act and the Anti-CBDC Surveillance State Act, are advancing in Congress. The CLARITY Act was recently approved by the House Agriculture Committee. Meanwhile, the Anti-CBDC Act seeks to block any retail digital dollar issued by the Federal Reserve.

Industry executives are watching closely. Ian De Bode of Ondo Finance described the new legislation as “the beginning of a new regulatory era,” pointing to bipartisan cooperation and the role of key figures like Patrick McHenry.

Senator Tim Scott said lawmakers are planning to finalize crypto market structure legislation by September 30.

With the GENIUS Act now law and several other bills in motion, the U.S. digital asset space is edging closer to a defined regulatory framework, one that could reshape the crypto sector heading into 2026.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment