Solana Validator Count Drops 70%, Fueling Decentralisation Concerns

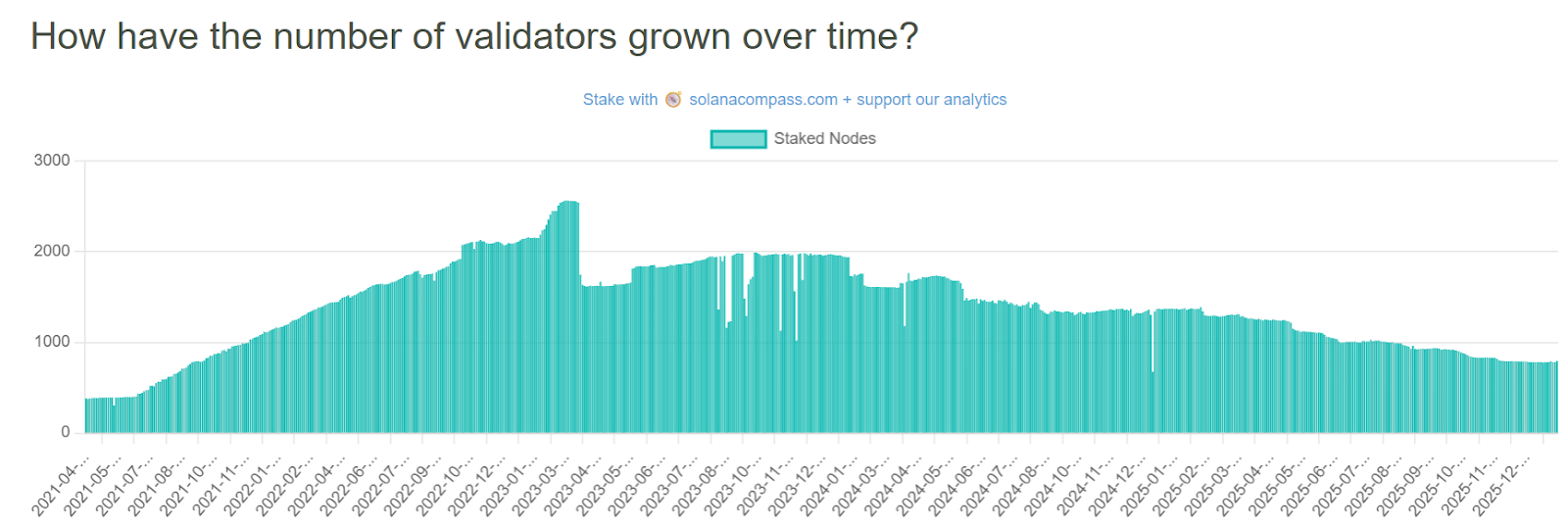

- Solana’s active validator count has plummeted 68%, dropping from over 2,500 in 2023 to roughly 795 in early 2026.

- Smaller operators are being priced out by intense competition from zero-fee institutional validators and annual voting costs that now exceed $49,000.

- Network decentralisation is weakening, as evidenced by the Nakamoto Coefficient falling from 31 to 20, signaling that control is concentrating among fewer large-scale entities.

Solana’s validator network is shrinking fast due to economic reasons.

According to data from Solana Compass, the number of active validators has fallen from about 2,560 in early 2023 to roughly 795 today, a 68% drop. Validators are the machines that vote on blocks and keep the chain running. Fewer validators means fewer independent actors securing the network.

Source: Solana Compass

Source: Solana Compass

Some of this decline is harmless cleanup of inactive nodes. But operators say the real problem is that running a validator no longer pays for smaller players.

Read more: Solana Mobile Launches SKR Token Airdrop for Seeker Smartphone Users

Low Fees Make Operations Less Viable

For instance, Moo, an independent Solana validator, said large validators now charge 0% fees to attract stake, leaving little revenue for independents. When rewards fall below costs, smaller validators shut down.

it is becoming increasingly impossible to operate a validator profitably (…) Many small validators are actively considering shutting down. Not due to lack of belief in Solana, but because the economics no longer work. At this point, the only justification left is altruism. Loving the network and caring about decentralization is not a sustainable business model.

That pressure also shows up clearly in decentralisation metrics, as the Solana Nakamoto Coefficient, or the minimum number of independent entities needed to control a critical share of the network, has dropped from 31 to 20. In simpler words, control over Solana’s stake is becoming more concentrated in fewer hands.

The cost structure goes something like this:

- A validator must stake SOL and continuously send vote transactions to participate in consensus.

- Voting alone can cost up to about 1.1 SOL per day. Over a year, that adds up to roughly 401 SOL just to stay online.

- At current prices, the first-year requirement excluding hardware and servers is around US$49,000 (AU$75,000). For many small operators, that math doesn’t work anymore.

This doesn’t mean Solana is failing or insecure today. Large validators are professional, well-capitalised, and technically capable, but it does mean decentralisation is drifting toward institutions and large staking providers rather than individuals.

Related: Analyst: Gold’s Surge Signals a Trust Crisis – and Crypto’s Moment

The post Solana Validator Count Drops 70%, Fueling Decentralisation Concerns appeared first on Crypto News Australia.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

SBF's X account showed unusual activity, and FTT subsequently surged.