XRP’s ‘Golden Ticket’ Might Not Be What You Think, Expert Says

A fresh debate in the XRP Ledger (XRPL) community is converging on a specific “golden ticket” thesis: XRP’s breakout utility case won’t come from narratives, but from plumbing: Ripple’s regulated payments stack sourcing liquidity directly from the on-chain XRPL DEX, and Ripple Prime settling institutional flow on-ledger.

The XRP Golden Ticket Theory

The idea surfaced in an exchange on X after one user, Alex Cobb, a well-known commentator within the XRP community, argued that US market-structure legislation, the CLARITY Act, is “XRPs golden ticket.” Another renowned community member, Krippenreiter, pushed the focus back on product rails rather than policy catalysts: “Personally I think Ripple Payments sourcing liquidity from the onchain XRPL DEX and Ripple Prime settling post trade on the XRP Ledger are XRPs golden tickets.”

Krippenreiter clarified that the phrasing tracks what Ripple has previously messaged about how it intends to use the XRPL in institutional contexts. “The ideal is to do everything on-chain, so yes. Anything happening on-chain settles on XRPL,” they wrote, adding: “I said ‘post-trade settlement’ because that’s what Ripple initially publicly stated for what they plan on using XRPL for.”

That distinction matters because routing liquidity through a public DEX, especially for regulated entities, creates a different compliance surface than using a ledger as a settlement layer after execution happens elsewhere. In the thread, attorney Bill Morgan framed the gating issue bluntly: “Eventually, once it can source liquidity from the XRPL DEX without risk of regulatory non-compliance.”

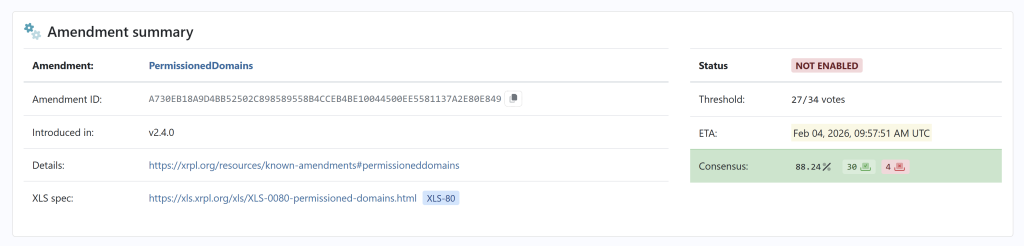

Others pointed to Permissioned Domains and a permissioned DEX construct as the major blocker for regulated liquidity sourcing, with Krippenreiter describing “credentials,” “permissioned domain,” and “permissioned dex” as the solution set. Morgan noted the implication extends beyond Ripple: if that’s a blocker for Ripple, “it will be a block for any other institution that may wish to use the XRPL DEX.”

Notably, the Permissioned Domains amendment is on track to go live next week, XRPScan shows 27 of 34 validator votes (88.24% consensus) and an estimated activation time of Feb. 4, 2026 at 09:57:51 UTC, provided it remains above the required threshold through the enablement window.

The same thread pulled Ripple Prime into the picture. Luke Judges (middle management at Ripple) said, “Prime underrated, we need more CEXs to support XRPL inventory. Working on it.”

Krippenreiter suggested that, beyond exchange inventory, privacy could be the other hard prerequisite for Prime’s deeper XRPL integration, calling it “the blocker” in circulating rumors.

That maps onto Ripple’s own public framing: in an October 2 post, Ripple engineering leader J. Ayo Akinyele argued that “finance cannot function without confidentiality, yet blockchains are built on transparency,” and that institutional-grade adoption requires privacy that still supports compliance.

Akinyele put the institutional constraint in plain terms: “Without privacy, financial institutions cannot safely use public ledgers for core workflows. Without accountability, regulators cannot sign off. With programmable privacy, we can have both.”

The discussion landed just as Ripple and GTreasury rolled out “Ripple Treasury,” positioning it as enterprise treasury infrastructure that blends traditional cash operations with digital-asset rails.

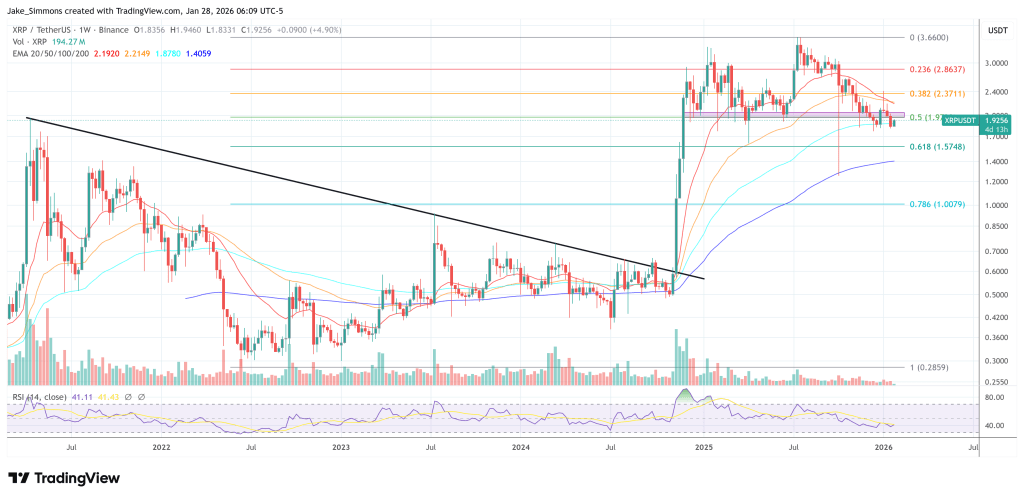

At press time, XRP traded at $1.9256.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator