How RWA Tokenization Is Bringing Trillions On-Chain in 2026

Trillions in traditional finance are shifting to blockchain in 2026, turning illiquid real world assets into highly tradable digital tokens. This is the power of RWA tokenization. With institutions leading the charge, tokenized assets are unlocking global liquidity like never before.

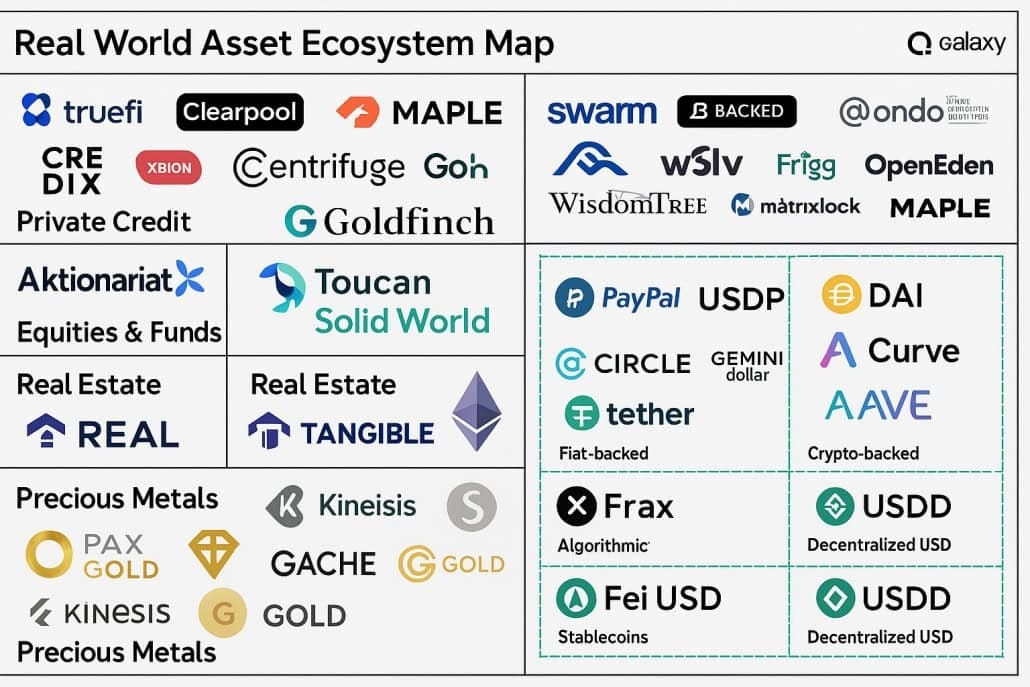

This is why tokenized RWAs are a growing market segment in the digital asset industry, with an increasing number of projects looking to tokenize a wide variety of assets, including cash, commodities, real estate, and much more.

Table of Content

- What is RWA Tokenization?

- Why RWA Tokenization Matters in 2026

- Use Cases of RWA Tokenization

- Top RWA Platforms and Projects in 2026

- How RWA Tokenization Works

- Common Questions about RWA Tokenization

- Final Thoughts

- About Onfinality

What is RWA Tokenization?

RWA tokenization is the process of representing real world assets, such as treasuries, real estate, private credit, or commodities, as digital tokens on a blockchain. These tokenized assets enable fractional ownership, instant transfers, and seamless DeFi integration while maintaining ties to off-chain legal frameworks.

In essence, on-chain tokenization bridges traditional finance with blockchain, making high-value assets accessible to a global audience without intermediaries.

Source: https://www.adventuresincre.com/real-estate-tokenization-part-ii-from-concept-to-execution/

Source: https://www.adventuresincre.com/real-estate-tokenization-part-ii-from-concept-to-execution/

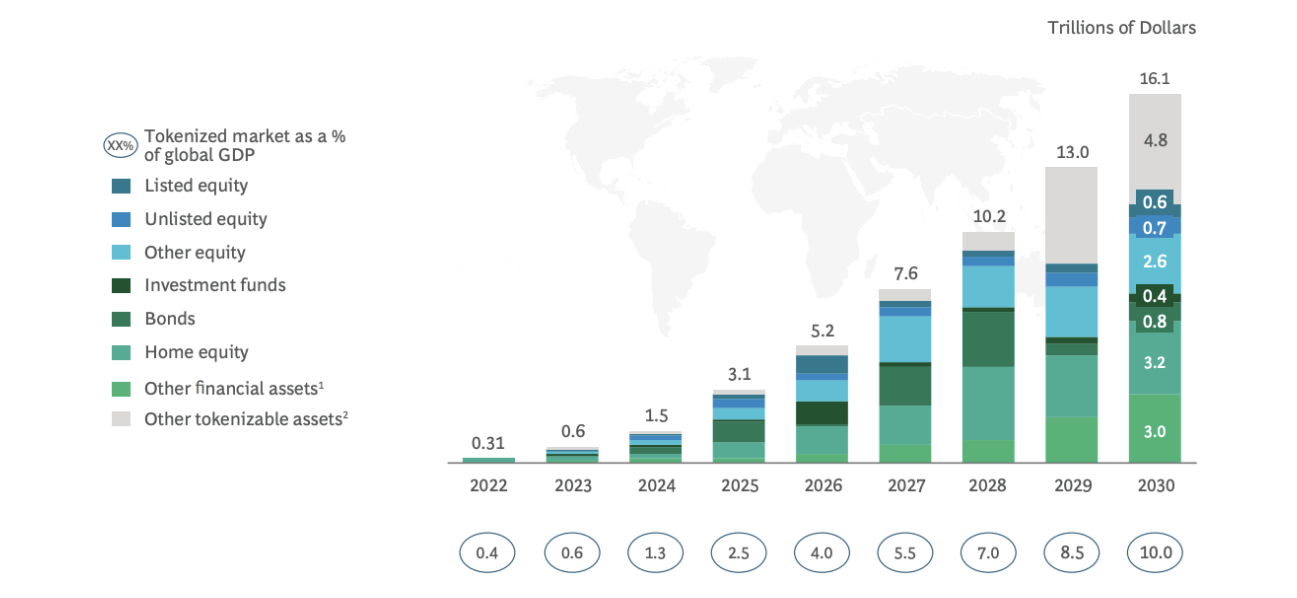

Why RWA Tokenization Matters in 2026

The market for tokenized assets is rapidly expanding. According to Binance Research, RWAs constitute the eighth-largest sector in decentralized finance (DeFi), with a Total Value Locked (TVL) of $1.3 billion as of September 2023. Moreover, the Boston Consulting Group projects that tokenized assets could represent a US$18.9 trillion market by 2033. Despite this promising growth, tokenized assets will still be a small fraction of the current global asset value, estimated at US$900 trillion. This projection underscores the immense potential for growth in the tokenization of RWAs, highlighting the importance of addressing existing challenges to fully capitalize on this emerging market. Despite their significant value globally, RWAs face challenges such as liquidity fragmentation, regulatory complexity, interoperability issues, and security concerns within traditional financial systems.

Source: https://mantrachain.io/resources/learn/rwa-tokenization-explained-why-it-matters-and-mantras-essential-role

Source: https://mantrachain.io/resources/learn/rwa-tokenization-explained-why-it-matters-and-mantras-essential-role

Use Cases of RWA Tokenization

RWA tokenization transforms real world assets with:

- Global Liquidity: 24/7 trading for traditionally locked assets.

- Fractional Ownership: Invest in premium tokenized assets with minimal capital.

- Transparency & Efficiency: Blockchain immutability plus DeFi yields.

- Risk Mitigation: Enhanced by ratings from providers like Particula.

Popular use cases:

- Tokenized U.S. Treasuries (e.g., BlackRock's BUIDL, Ondo Finance).

- Private credit and invoices (Centrifuge).

- Emerging programs like Solana-based tokenization with risk ratings from Particula.

- Fractional ownership of properties

Top RWA Platforms and Projects in 2026

The RWA market growth is powered by innovative platforms tokenizing diverse assets. Here are leading players:

- Six network: Focuses on regulated asset tokenization infrastructure, particularly for compliant issuance and lifecycle management of RWAs.

- Xcavate: Enables tokenized real estate and infrastructure assets, making traditionally illiquid property investments accessible on chain.

- BlackRock's BUIDL: Dominant in tokenized Treasuries, with over $2 billion in AUM for institutional yields.

- Ondo Finance: Leader in yield-bearing tokenized assets like U.S. Treasuries and bonds.

- Centrifuge: Specializes in private credit and real-world invoices for DeFi lending.

- Securitize: Institutional-grade tokenization for funds and equities.

- Maple Finance: Undercollateralized lending with tokenized real-world credit.

- Mantra: Compliant platform for tokenized securities and RWAs.

- RealT: Focuses on tokenized real estate for fractional property ownership.

- Particula: Provides independent risk ratings and monitoring, partnering on major initiatives like Solana tokenization programs.

These projects drive on-chain tokenization across treasuries, credit, real estate, and more. Track live data at RWA.xyz.

How RWA Tokenization Works

On-chain tokenization typically follows these steps:

- Asset Origination: Identify and legally structure the real world asset (e.g., via SPV).

- Token Minting: Issue blockchain tokens representing shares.

- Oracle & Data Integration: Use providers like Chainlink for pricing.

- Compliance & Rating: Add KYC and risk assessments (e.g., Particula's framework).

- Distribution: Launch on platforms for trading and DeFi use.

Examples: BlackRock's BUIDL tokenizes Treasuries for institutional yields; Centrifuge brings SME credit on-chain; RealT enables fractional real estate investment. Scalable networks are crucial.

Common Questions about RWA Tokenization

What Are the Biggest Risks in Tokenized Assets?

Regulatory shifts, oracle failures, and counterparty risks. Platforms mitigate this with audited code and tools like Particula's real-time monitoring.

Where can I buy RWA tokens?

Some of the top Institutional Platforms for RWA Tokenization are Securitize, , RealT., Ondo, Centrifuge, Maple Finance, Franklin Templeton Benji Investments.

Always do your own research and due diligence before investing in any RWA assets.

Are tokenized assets legal and regulated?

The legality depends heavily on the jurisdiction and the nature of the underlying asset.

Final Thoughts

RWA tokenization is fueling trillions on-chain through tokenized assets, with explosive RWA market growth and adoption of it by big institutions. 2026 is going to be a pivotal for RWA tokenization with regulations becoming clear across different geographies.

About Onfinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future