Zcash and Privacy Coins: The Future of Private Blockchains in 2025

Privacy is becoming one of the strongest comeback stories in crypto. As regulations tighten and transparency increases, users are turning back to Zcash and other privacy coins to regain control of their data.

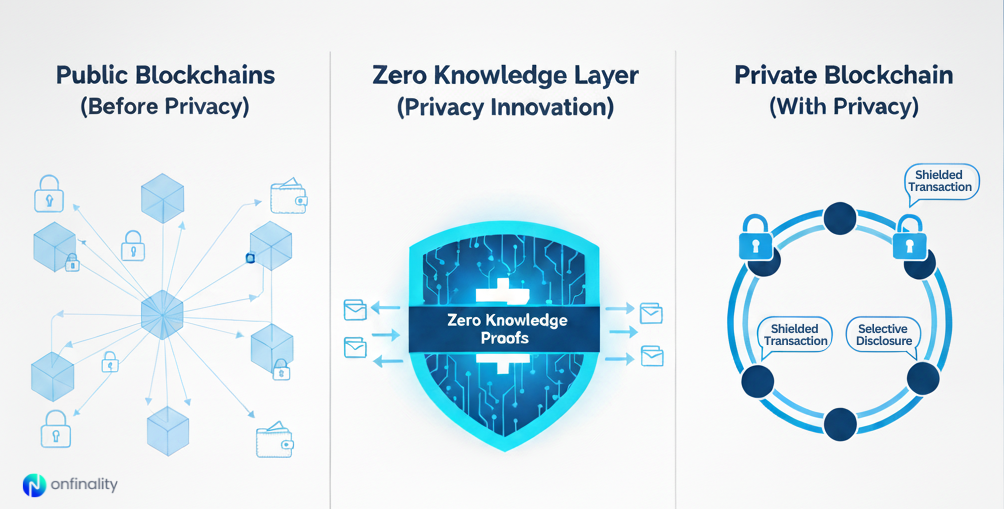

The renewed interest in Zcash, reflects a shift toward cryptographic innovation. Powered by zero knowledge proofs and private blockchain infrastructure, Zcash shows that decentralisation can protect both transparency and privacy in equal measure.

Table of Contents

<!doctype html>- How Transactions Happen Currently on Blockchains

- What Are Privacy Coins

- How Privacy Works in Blockchain

- Why Privacy Is Important

- Why Zcash and Privacy Coins Matter in 2025

- Key Benefits and Use Cases

- How Zcash Works

- Common Questions About Privacy Coins

- Final Thoughts on Privacy

- About OnFinality

How Transactions Happen Currently on Blockchains

In most public blockchains like Bitcoin and Ethereum, every wallet, transaction, and balance is visible to everyone. While this openness supports transparency, it also eliminates privacy. Anyone can trace payments, study wallet activity, or identify counterparties.

This structure reveals too much for users and businesses who value confidentiality. Imagine paying employees or making strategic transfers where anyone could track the amount or destination. Without private blockchain mechanisms, financial privacy is almost impossible in traditional networks.

What Are Privacy Coins

Privacy coins are digital currencies that protect user information while keeping the network secure and auditable. They rely on cryptography to validate transactions without revealing who sent or received them or how much was transferred.

Zcash was one of the first networks to implement zero knowledge technology through zk-SNARKs. These proofs let one party prove a transaction’s validity without showing any of the underlying data. Monero, another privacy coin, uses ring signatures and stealth addresses to achieve a similar result. Both represent major steps in blockchain’s evolution toward secure and private systems.

How Privacy Works in Blockchain

Zcash supports two kinds of addresses. Transparent addresses function like standard blockchain accounts, where transactions are public. Shielded addresses, on the other hand, use zero knowledge cryptography to hide all details from the public while still proving that the transfer occurred correctly.

Monero enforces full privacy by default, combining ring signatures with stealth addresses that generate new one-time keys for every transaction. Both Zcash and Monero prove that private blockchain architecture can maintain decentralisation while safeguarding user identity.

Why Privacy Is Important

Privacy in blockchain is about choice and safety, not secrecy. It ensures that individuals and organisations can control what data they share. In transparent systems, anyone can view your wallet balance or investment history, creating risks for both personal and business security.

Privacy protects users from financial profiling, targeted scams, or political exposure. It also shields companies from revealing internal transactions or supplier information. With tools like zero knowledge proofs and private blockchain systems, financial privacy becomes achievable without undermining trust or accountability.

Why Zcash and Privacy Coins Matter in 2025

In 2025, privacy is evolving from a niche requirement to a key feature of blockchain development. Developers are integrating zero knowledge proof systems that allow selective disclosure and verifiable privacy.

Zcash supports confidential payroll systems, where transactions are auditable by regulators but invisible to the public and indicates rising institutional adoption of privacy-preserving technologies across private blockchain environments.

Infrastructure platforms are enabling this transition with high-performance RPC and indexing solutions that support privacy-focused protocols. This ensures scalability and reliability for networks built on zero knowledge and modular blockchain frameworks.

Key Benefits and Use Cases

Financial Confidentiality

Private Blockchains like Monero, Zcash allow users to transact securely without revealing wallet data or transaction histories to the public ledger.

Enterprise Applications

Companies are increasingly adopting private blockchain systems for secure settlements, internal payments, and compliance-friendly data sharing.

Selective Transparency

Users can choose to disclose transaction data to auditors or partners when necessary while keeping sensitive details private.

DeFi Integration

Privacy layers using zero knowledge proofs are being embedded into decentralised finance protocols, enabling confidential lending and yield farming.

How Zcash Works

Zcash allows users to switch between transparent and shielded transactions depending on their privacy needs. Shielded transfers use zk-SNARK proofs to validate transactions without revealing sender, receiver, or amount.

Developers building in private blockchain environments can implement similar mechanisms through OnFinality, which provides high-availability RPC endpoints and indexing services optimised for privacy-heavy applications.

Common Questions About Privacy Coins

Is Zcash really anonymous?

Zcash is often described as anonymous, but technically, it provides selective privacy rather than full anonymity. Its zero knowledge proofs ensure that transactions are validated without exposing sensitive data. However, users can still choose between transparent and shielded addresses, allowing different privacy levels based on preference or regulatory need. This flexibility makes Zcash one of the most practical privacy coins for users who want both confidentiality and compliance.

How is Zcash different from Monero?

Monero enforces full privacy by default, while Zcash lets users decide between transparent or shielded transactions. This design makes Zcash adaptable for enterprises, regulators, and private blockchain ecosystems.

What is next for privacy coins in 2025?

The widespread adoption of zero knowledge technology and privacy protocols across major blockchains indicates that privacy will soon become a standard feature of digital finance rather than a niche experiment.

Final Thoughts on Privacy

Privacy is the foundation of freedom in the digital world. Zcash demonstrates how privacy coins can protect user autonomy while ensuring transparency when needed.

With the continued evolution of zero knowledge systems and private blockchain networks, privacy is becoming a default expectation, not an afterthought. Builders and enterprises exploring privacy-based solutions can use infrastructure from OnFinality to power scalable, secure, and privacy-enabled applications for the next generation of decentralised technology.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future