The Rise of Stablecoins in 2025: Adoption, Regulation, and Global Impact

Imagine sending money overseas in seconds for mere cents, or protecting your savings from inflation by holding digital USD on your phone. In 2025, such scenarios are becoming reality with new narratives like neobanks. Stablecoin growth has exploded, turning these dollar-pegged cryptocurrencies into a backbone of global finance. In this article, we explore what’s driving stablecoin adoption, the implications of the US “GENIUS Act” stablecoin bill, faster global settlements, use cases from low-income economies to institutional treasuries, and how infrastructure platforms like OnFinality are supporting this future. Let’s dive in.

Table of Content

- What is Stablecoin?

- Why stablecoins matter in 2025

- Key Benefits and Use Cases

- How OnFinality is supporting the stablecoin growth

- Common Questions about Stablecoins

- Final Thoughts

- About OnFinality

What is Stablecoin?

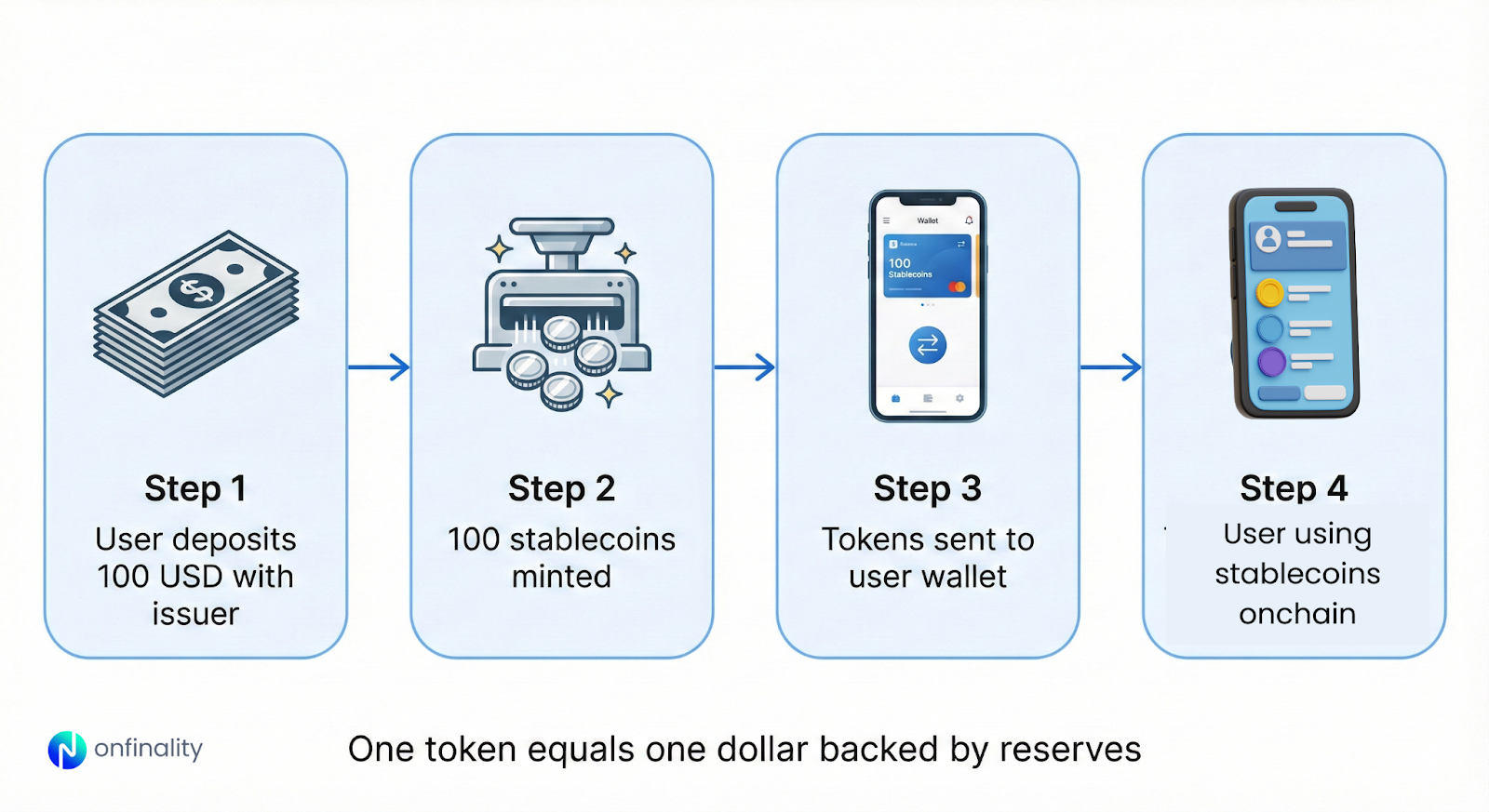

“Stablecoins” are cryptocurrencies whose values are pegged to a certain asset like USDT is pegged to US dollars, PAXG is pegged to gold and so on. The most popular stablecoins (like USDT or USDC) are fiat-backed: issuers hold traditional assets (cash, U.S. Treasury bills, etc.) in reserves equal to the stablecoins issued, maintaining a 1:1 peg to the dollar. For example, if a company issues 1 million stablecoin tokens pegged to USD, it should have $1 million in actual USD or equivalent safe assets in reserve. This backing and regular attestations give users confidence that they can redeem a stablecoin for real cash at any time. The new U.S. law now requires this full backing for payment stablecoins, which greatly reduces default risk. Other designs include crypto-collateralized stablecoins (over-collateralized by cryptocurrencies) and algorithmic ones, though the latter have proven fragile (e.g. the Terra collapse showed the dangers of an unbacked approach).

Why stablecoins matter in 2025

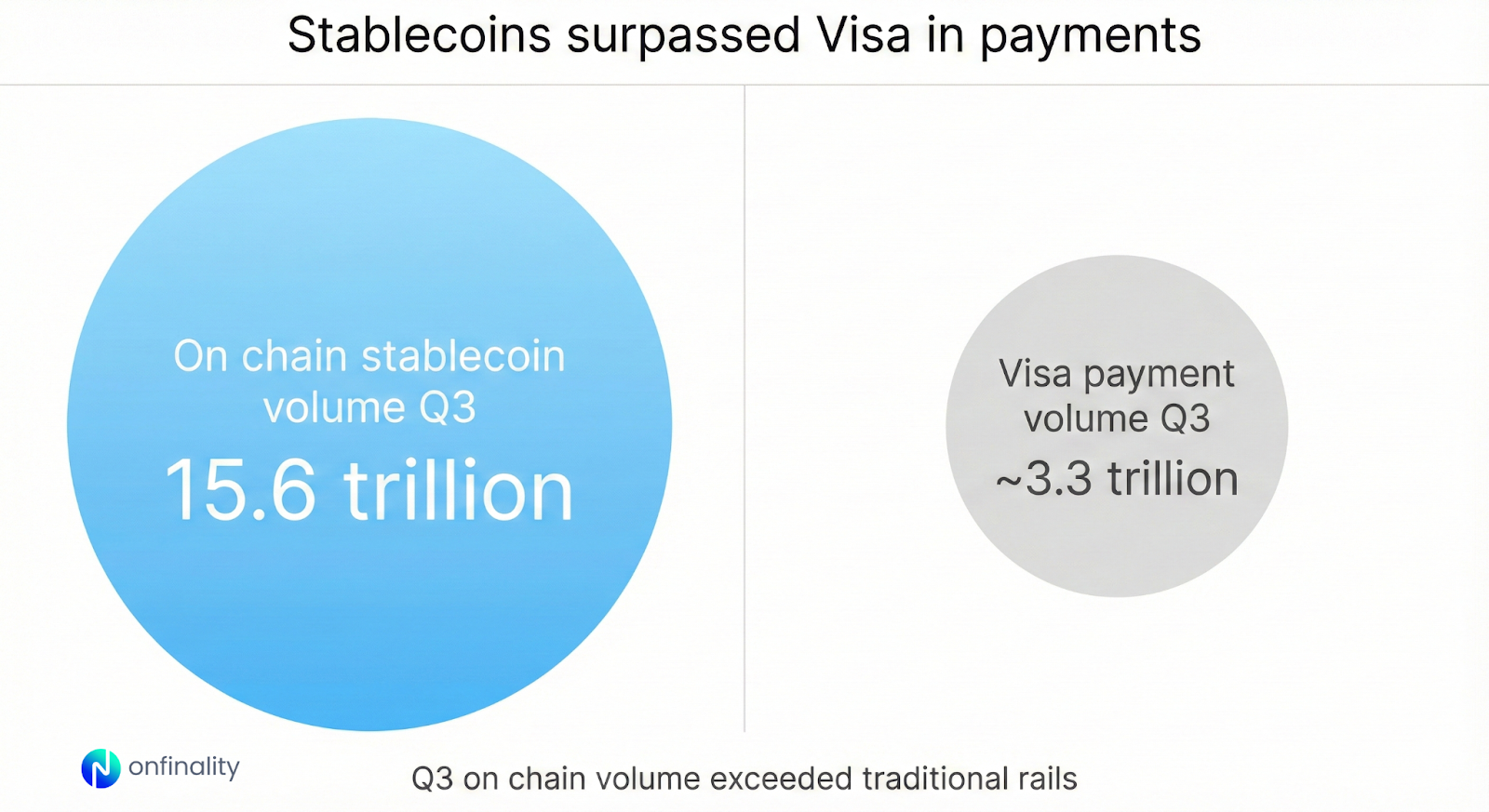

Today, over $300 billion in stablecoins circulate across public blockchains, up 75% from just a year earlier[1]. In fact, the total stablecoin supply has grown 30× in five years, an astonishing leap that underscores surging demand. For one, global adoption has reached critical mass! In Q3 2025 alone, on-chain stablecoin transfers topped $15.6 trillion, exceeding Visa’s quarterly payment volume. This signals that stablecoins are not just a crypto side-show; they’re becoming a major payments rail worldwide.

Regulatory clarity is also supercharging confidence. The United States passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) in mid-2025, creating the first federal framework for stablecoins. This “stablecoin bill” mandates that USD-backed stablecoins maintain 100% liquid reserves and regular audits, ensuring they truly hold a dollar for every token. By defining stablecoins as a new category of digital payment instrument (not quite securities or bank deposits), the law legitimized them and prioritizes consumer protection, even giving stablecoin holders first claim if an issuer goes bankrupt. The GENIUS Act’s implications are huge: it boosts trust (no more worrying if a stablecoin is fully backed), invites innovation under clear rules, and even ties stablecoins to national strategy (requiring reserves in U.S. Treasuries to uphold dollar dominance). In short, 2025’s regulatory green light means businesses and institutions can adopt stablecoins without as much legal uncertainty.

Equally important, stablecoin growth is reshaping finance for those who need it most. In economies with volatile local currencies or limited banking access, stablecoins offer an economic lifeline. They allow anyone with a smartphone to hold a digital dollar account cheaply and transact globally. This has expanded dollar access in high-inflation countries and emerging markets, empowering people to store value in USD stablecoins when their local money falters. Such grassroots adoption underscores a key point: stablecoins aren’t just a Silicon Valley craze; they’re meeting real-world needs from Argentina to Nigeria.

Key Benefits and Use Cases

Stablecoins rose in popularity by solving real problems. Here are some of the key benefits and use cases driving stablecoin adoption trends today:

- Faster Global Settlement: Sending money internationally via stablecoins is near-instant and low-cost, unlike traditional wire transfers that take days. Businesses and individuals can move funds 24/7, bypassing the delays, opaque fees, and forex frictions of legacy banking.

- Financial Inclusion & USD Access: Stablecoins allow people in high-inflation or underbanked regions to access a stable currency (often the US dollar) digitally. With just a mobile wallet, someone in a country with a volatile currency can hold value in USD stablecoins and transact globally. In non-U.S. dollar economies, stablecoins effectively let anyone hold a digital dollar account at low cost, without needing a U.S. bank.

- Institutional Adoption & Treasury Use: Companies are increasingly leveraging stablecoins for 24/7 liquidity and efficient treasury management. They use stablecoins to streamline cross-border payments, pay suppliers, manage payroll in crypto industries, and optimize cash across time zones. By transacting in stablecoins, firms can settle trades or transfers instantly without waiting for bank hours.

- Onchain Finance and Programmability: Another benefit is that stablecoins are programmable money on blockchain rails. This means they can integrate with smart contracts, opening up use cases like decentralized finance (DeFi) lending, yield farming, and micropayments. Users can park stablecoins in lending protocols to earn interest, or use them as stable collateral for borrowing other crypto assets.

How OnFinality is supporting the stablecoin growth

Under the hood, stablecoin transactions work like any blockchain transfer: if Alice sends Bob 100 USDC, that transaction is recorded on the relevant blockchain (Ethereum, for instance) and Bob’s address now has 100 more USDC while Alice’s has 100 less. The settlement is near-instant (just waiting for a block confirmation) and final. Because stablecoins live on public ledgers, they combine the transparency and security of blockchain with the familiarity of a dollar value. Every transfer is traceable on-chain, and the tokens can interoperate with other crypto applications seamlessly.

This is where infrastructure becomes critical and where OnFinality plays a key role. OnFinality is a multi-chain infrastructure platform that provides scalable nodes and API endpoints for blockchain projects. In essence, OnFinality ensures that the networks powering stablecoins stay performant and accessible, so that sending a stablecoin is always fast and reliable. For example, a stablecoin wallet or exchange can use OnFinality’s RPC nodes to read/write transactions to the blockchain without hosting their own nodes. Importantly, stablecoin issuers and dApp developers can leverage OnFinality to scale. Whether it’s a DeFi platform integrating a stablecoin or a payment app processing USDC transactions, they can rely on OnFinality’s infrastructure to handle surging demand. As highlighted in an OnFinality case study, the team behind the Acala USD stablecoin on Polkadot used OnFinality to deploy and manage the blockchain nodes that run their network.

Common Questions about Stablecoins

Why are stablecoins important?

Stablecoins are important because they combine the price stability of fiat currency with the transaction speed and flexibility of cryptocurrency.

How do stablecoins work?

Most stablecoins work by pegging their value to an asset. The common approach is fiat-backed: an issuer holds $1 in reserve for each $1 stablecoin in circulation, keeping the price stable at $1.

Are stablecoins safe to use?

Stablecoins can be very safe to use if you stick to well-regulated, fully backed ones – but like any financial product, there are risks to understand.

Final Thoughts

Stablecoin growth in 2025 showcases how far the crypto industry has come as digital dollars are now integral to global finance, from everyday users in unstable economies to Fortune 500 companies streamlining operations. Clear regulations and real-world utility are propelling stablecoins into the mainstream, cementing their role as a cornerstone of the digital economy. For crypto-savvy builders and businesses, the message is clear: stablecoins unlock speed, efficiency, and inclusion that legacy systems can’t match.

As this evolution continues, robust infrastructure will be key to supporting stablecoins at scale. That’s where platforms like OnFinality prove invaluable, by providing the reliable backend services needed to handle booming usage, they ensure that on-chain dollars “just work” when and where people need them. Stablecoins are here to stay, and they’re transforming how value moves across the world.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future