Solana (SOL) Recovery Reaches A Level That Changes Everything

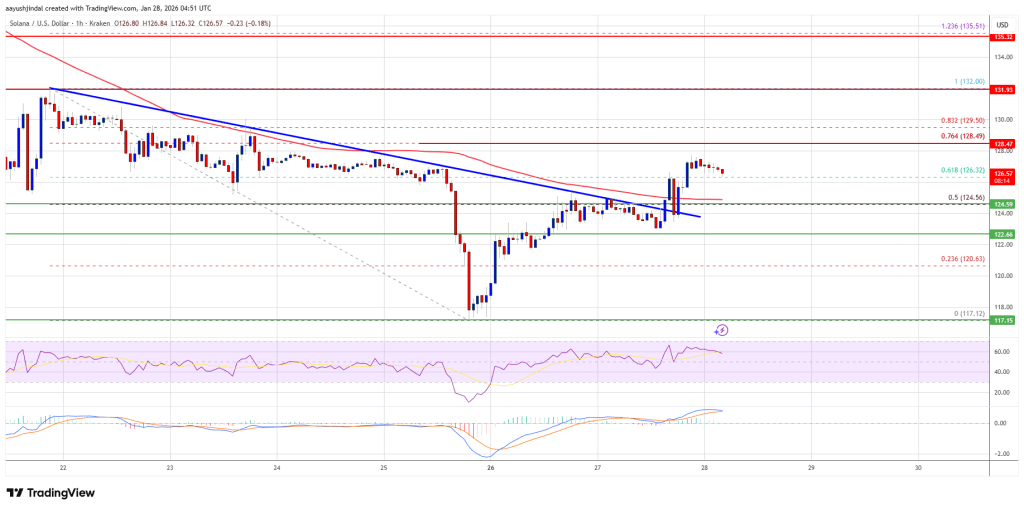

Solana started a recovery wave above the $125 zone. SOL price is now consolidating and faces hurdles near the $128 zone.

- SOL price started a decent recovery wave above $122 and $125 against the US Dollar.

- The price is now trading above $125 and the 100-hourly simple moving average.

- There was a break above a key bearish trend line with resistance at $124 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The price could continue to move up if it clears $128 and $130.

Solana Price Faces Resistance

Solana price remained stable and started a decent recovery wave from $118, like Bitcoin and Ethereum. SOL was able to climb above the $122 level.

There was a move above the 61.8% Fib retracement level of the downward move from the $132 swing high to the $117 low. Besides, there was a break above a key bearish trend line with resistance at $124 on the hourly chart of the SOL/USD pair.

The bulls even pushed the price above $125. However, the bears remained active near $128. Solana is now trading above $125 and the 100-hourly simple moving average. On the upside, immediate resistance is near the $128 level, and the 76.4% Fib retracement level of the downward move from the $132 swing high to the $117 low.

The next major resistance is near the $130 level. The main resistance could be $135. A successful close above the $135 resistance zone could set the pace for another steady increase. The next key resistance is $142. Any more gains might send the price toward the $145 level.

Another Decline In SOL?

If SOL fails to rise above the $128 resistance, it could continue to move down. Initial support on the downside is near the $124.50 zone. The first major support is near the $122 level.

A break below the $122 level might send the price toward the $117 support zone. If there is a close below the $117 support, the price could decline toward the $105 zone in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $125 and $122.

Major Resistance Levels – $128 and $130.

You May Also Like

Regulatory Clarity Relief, On-Chain Stress, Cautious Price Action

Vaadin Launches Swing Modernization Toolkit, Enabling Java Teams to Run Desktop Applications in the Browser