US Shutdown Odds at 75% — How Hard Will Bitcoin Be Hit?

The US federal government is heading toward a partial shutdown, putting bitcoin markets on alert. However, unlike last year’s 43-day full shutdown, the smaller scale of this potential closure suggests price impact may be contained.

With six of twelve spending bills already passed and historical data showing 60% of shutdown crises end in last-minute deals, markets appear to be pricing in a limited disruption scenario.

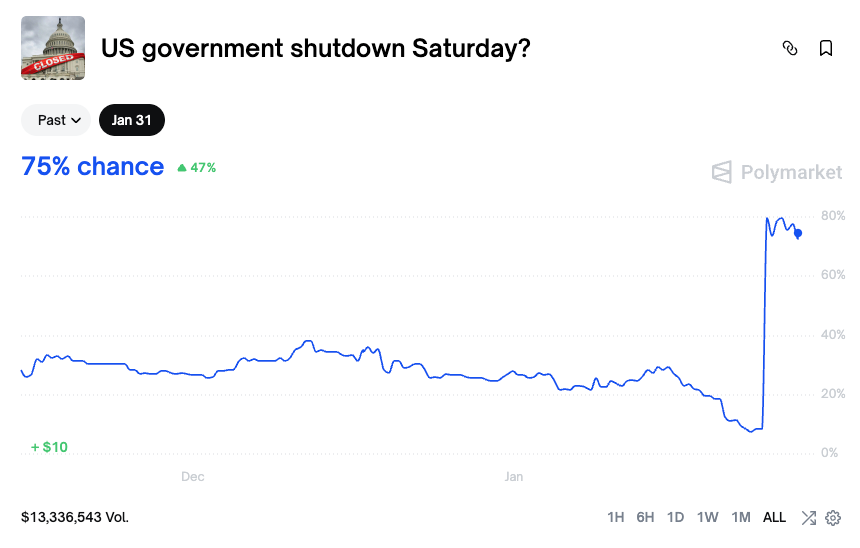

Shutdown Odds at 75% with $13.3 Million Wagered

According to the prediction market platform Polymarket, the probability of a shutdown on January 31 is 75% in the Asian morning hours. Total betting volume has exceeded $13.3 million. The impasse stems from Democrats’ opposition to the Department of Homeland Security (DHS) funding bill.

Senate Minority Leader Chuck Schumer stated, “I will vote no on any legislation that funds ICE until it is reined in and overhauled.” If no agreement is reached by midnight on January 30, some federal agencies will cease operations.

Partial Shutdown: A Different Scenario from Last Year

This potential shutdown differs significantly from the one in October 2025. Back then, all 12 appropriations bills were blocked, triggering a record 43-day full government shutdown. This time, six spending bills have already been signed into law.

According to the Committee for a Responsible Federal Budget, the departments of Agriculture, Veterans Affairs, Commerce, and Energy have secured full fiscal-year funding. DHS also holds approximately $178 billion from the “One Big Beautiful Bill Act” passed last year. This allows the agency to continue operations largely uninterrupted.

A pseudonymous market analyst known as “CryptoOracle,” who correctly predicted last October’s shutdown days before it began, had warned that a full shutdown would send shockwaves through both traditional and digital markets. “The shutdown will break liquidity first, then fix it later,” he wrote at the time. “Expect a 30–40% Bitcoin correction — and then the rally of the decade.” His downside target was $65,000–$75,000, a zone he called the “fear range.”

However, CryptoOracle’s prediction was based on the full shutdown scenario from last October. A partial shutdown may not drain liquidity from markets as much as a full shutdown.

During last October’s full shutdown, the Treasury General Account swelled to $1 trillion. This drained approximately $700 billion in liquidity from markets. BitMEX analysts described it as “starving risk assets of capital.”

This time, half of the appropriations bills are already signed into law. DHS also holds $178 billion in reserve funding. The TGA buildup — and the resulting liquidity squeeze — would be significantly smaller.

Last-Minute Deal Remains Possible

Historically, shutdown crises have often been resolved at the eleventh hour. According to analyst SGX on X, between 2013 and 2023, only three of five shutdown crises actually materialized — a 60% rate of last-minute deals.

SGX outlined several reasons why this shutdown might be averted: Republicans could separate DHS funding and pass remaining bills with a 60-vote threshold; some Democrats are privately willing to compromise if the harshest border provisions are removed; and a one-week shutdown costs the economy $4–6 billion with 2–3% market drops — political liability neither party wants.

Bitcoin Holds Steady Despite Uncertainty

Bitcoin spot ETFs recorded $1.33 billion in net outflows for the week ending January 23. However, analysts attribute this to multiple factors, including the Federal Reserve rate decision and Big Tech earnings, rather than shutdown fears alone.

Bitcoin is currently trading at $89,177 at press time, up 0.9% over the past 24 hours. The price remains approximately 29% below its October all-time high of $126,000.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy