Top Crypto Gainers Watch: ZKP’s $249 Proof Pods Spark 8000x Talk as Cardano News and Polkadot Crypto Stall

| Sponsored Post Disclaimer: This publication was produced under a paid arrangement with a third-party advertiser. It should not be relied upon as financial or investment counsel. |

Early 2026 saw crypto swing hard, with market value near two trillion dollars and volumes topping one hundred billion daily. Cardano news points to steady builds, while Polkadot crypto shows upgrades without fireworks. With returns cooling, can these leaders still deliver outsized profit?

That tension has pushed experts toward Zero Knowledge Proof. Analysts and researchers frame it as a privacy-first AI network and data marketplace using cryptographic proofs to verify value without exposure, rewarding real computation.

ZKP’s $249 Proof Pods anchor an 8000x forecast, experts say, generating daily proof income and urging reinvestment to climb tiers. At level 300, earnings may reach $300 daily, locking supply and buying pressure, making it a standout among top crypto gainers.

ZKP: Built for Relentless Upside

ZKP is built as a privacy-first AI network and data marketplace, designed on Substrate with zero-knowledge cryptography at its core. Researchers highlight its hybrid Proof-of-Intelligence and Proof-of-Space model, pairing computation, storage, and ownership into one coordinated incentive system.

Analysts tracking early activity already rank ZKP among the top crypto gainers to watch, pointing to fixed supply mechanics and real utility. The network processes proofs in milliseconds, consumes roughly ten watts per terabyte, and targets up to one thousand transactions per second over time.

Momentum sharpens with the project’s dedicated Proof Pods. Priced at $249, these low-power devices generate cryptographic proofs daily, translating network participation into consistent token rewards. Experts stress that accessibility matters, since thousands of users can join without technical barriers.

What excites analysts most is the upgrade ladder. Earnings can be recycled to unlock higher tiers, steadily increasing output. At the highest levels, projections reach $300 per day, while reinvestment quietly tightens circulating supply through constant demand.

This loop, experts argue, is why ZKP is again listed among the top crypto gainers. Locked supply, recurring buy pressure, and expanding utility align into a structure many believe could fuel extraordinary upside, positioning ZKP as a compelling high-growth investment for long-term believers worldwide across multiple market cycles and adoption phases.

Cardano News: Price Pressure Meets Long-Term Signals

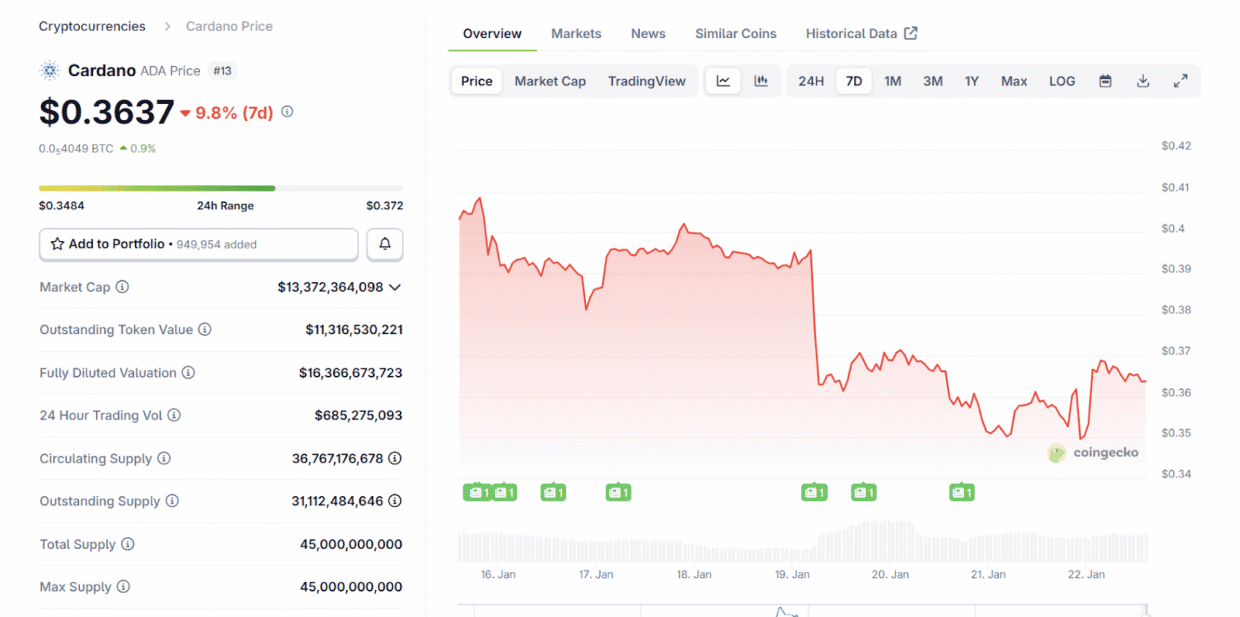

Recent Cardano news shows a network that is active but cautious. ADA traded near the $0.36 range after breaking short-term support, while overall sentiment stayed mixed. On-chain data shows large holders accumulated about 210 million ADA over three weeks, even as retail activity slowed.

Decentralized exchange volume dropped more than 95 percent, pointing to reduced short-term trading interest rather than a lack of conviction. Governance advanced with the validation of the Cardano 2030 direction.

Source- CoinGecko

Source- CoinGecko

From a market access view, Cardano news highlights growing institutional reach. CME Group announced plans to launch ADA futures, including micro contracts, expanding regulated exposure. Block times near six seconds and fast finality support steady network use. Short-term price structure remains weak, but whale accumulation and long-term governance plans keep attention on ADA. This balance of slow price action and deep infrastructure explains why Cardano remains watched, though upside expectations are more measured.

Polkadot Crypto: Network Upgrades and Market Reality

Recent Polkadot crypto updates show steady technical progress despite muted price action. DOT traded around the $1.9 to $2 range after short-term sell pressure, reflecting cautious sentiment.

A scheduled network upgrade on January 20 reduced execution latency and improved Ethereum compatibility, making Solidity deployments easier. Governance activity continued through on-chain referenda, while developer interest stayed visible across Substrate-based tooling.

From a market view, Polkadot crypto remains focused on structure rather than quick rallies. Analysts point to consistent block times near six seconds and shared security as long-term strengths. Comparisons with newer projects highlight slower upside expectations, even as hackathons and funding proposals support growth.

With upgrades in place but demand still forming, Polkadot holds relevance, though profit potential depends on future adoption rather than near-term momentum. This balance explains why traders watch development metrics closely while waiting for stronger volume signals in the market ahead.

Top Crypto Gainers: Where ZKP Fits in the Bigger Picture?

Recent Cardano news shows a network building through governance and institutional access, but price action remains slow and cautious. Polkadot crypto follows a similar path, with upgrades improving performance while DOT trades in a tight range and waits for stronger demand.

Together, these projects highlight strong technology and long-term planning, yet analysts see limited room for explosive upside in the near term. Steady progress has not translated into sharp gains, keeping expectations measured.

That contrast draws attention to ZKP, which experts describe as one of the top presale crypto gainers in the making. Analysts point to its reinvestment-driven design, constrained supply, and user-powered rewards as factors that could set ZKP apart over the coming market cycles, according to analysts.

Find Out More about Zero Knowledge Proof:

Website: https://zkp.com/

Auction: http://buy.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

| Disclaimer: The text above is an advertorial article that is not part of CoinLineup editorial content. |

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next