DASH Surge 54%, Leads Privacy Coin Rally Ahead of Monero, Zcash

DASH posted a 54% gain over 24 hours, reaching $85.96 as trading volume climbed to $1.29 billion across exchanges.

The token’s daily volume rose 72% from the previous session. Seven-day volume increased 525%, climbing from approximately $39 million on Jan. 10 to $1.29 billion on Jan. 14. Despite the rally, DASH DASH $85.41 24h volatility: 54.8% Market cap: $1.07 B Vol. 24h: $1.35 B remains approximately 94% below its December 2017 peak of $1,493.59. The move extends a seven-day rally that has seen the token gain 107% from its weekly low of $36.87.

DASH price 1D | Source: TradingView

DASH is classified as a privacy coin, a category of cryptocurrency that obscures transaction details using cryptographic features, distinguishing them from transparent blockchains like Bitcoin.

The token led all major privacy coins during the session. Horizen gained 23.1%, Decred added 19.3%, Zcash rose 9.3%, and Monero increased 8.6%, according to CoinGecko category data.

On Jan. 13, Alchemy Pay announced support for DASH, enabling users to purchase the token with credit cards, Apple Pay, and bank transfers across 173 countries, though it remains unclear whether this partnership was a significant driver of the price increase.

Analyst Commentary

Analyst @CryptoWinkle pointed to improved trading access after OKX, a major exchange, relisted the token. The analyst noted that the relisting “restored access and depth, driving participation” while accumulation patterns became visible as selling pressure faded. The move follows OKX’s Nov. 23 Zcash relisting, signaling renewed exchange appetite for privacy tokens.

Multiple traders on X observed a broader rotation into privacy-focused assets. Trader @rushicrypto characterized the environment as “privacy season,” while @KookCapitalLLC noted that “privacy betas are going crazy.”

Broader Market Conditions

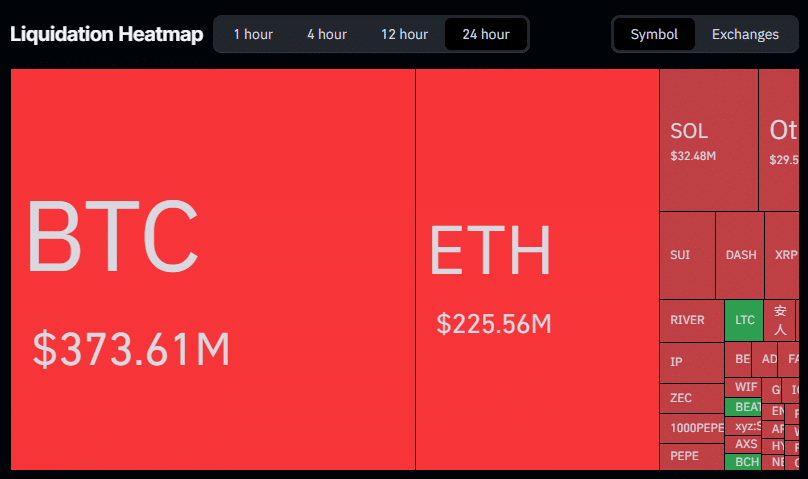

In the derivatives market, traders betting against rising prices were forced to close positions. Total forced closures reached $770.22 million over 24 hours, with short positions accounting for 86.8% of that figure.

Liquidation Heatmap | Source: Coinglass

The Fear & Greed Index, a market sentiment indicator ranging from 0 (extreme fear) to 100 (extreme greed), registered 48, indicating neutral sentiment. This marked a recovery from 26 the previous day. The broader market added 3.42% to total market capitalization, which reached $3.37 trillion.

The privacy coins category gained 13.1% overall, with a combined market cap of $24 billion. The category has added 24.6% over seven days. While DASH led daily gains, Monero holds the largest market cap in the sector at $13.4 billion. Zcash has struggled following the ECC team’s mass resignation on Jan. 7, which triggered a price drop amid governance disputes with the Bootstrap nonprofit board.

nextThe post DASH Surge 54%, Leads Privacy Coin Rally Ahead of Monero, Zcash appeared first on Coinspeaker.

You May Also Like

SEC Decision Sparks 12% Jump In ZEC Price

Zcash Foundation says SEC has closed the book on its years-long probe into the organization